- France

- /

- Diversified Financial

- /

- ENXTPA:ABCA

ABC arbitrage (EPA:ABCA) Is Increasing Its Dividend To €0.18

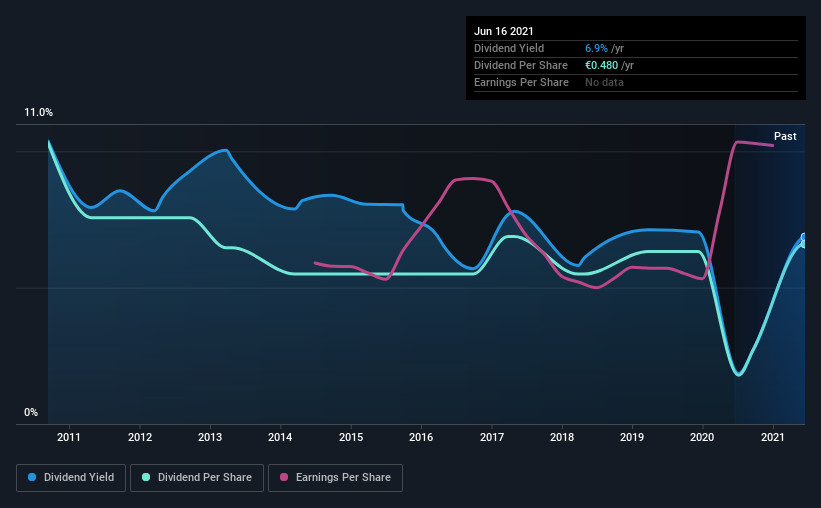

ABC arbitrage SA's (EPA:ABCA) dividend will be increasing to €0.18 on 3rd of August. This makes the dividend yield 6.9%, which is above the industry average.

Check out our latest analysis for ABC arbitrage

ABC arbitrage's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, ABC arbitrage was paying out quite a large proportion of both earnings and cash flow, with the dividend being 115% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Looking forward, earnings per share could rise by 7.2% over the next year if the trend from the last few years continues. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 67% which brings it into quite a comfortable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2011, the dividend has gone from €0.75 to €0.48. The dividend has shrunk at around 4.4% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. ABC arbitrage has seen EPS rising for the last five years, at 7.2% per annum. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think ABC arbitrage's payments are rock solid. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for ABC arbitrage that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade ABC arbitrage, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ABCA

ABC arbitrage

Develops arbitrage strategies for liquid assets in Europe, North America, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives