- France

- /

- Hospitality

- /

- ENXTPA:SW

How Sodexo’s Euronext 150 Inclusion Could Shape Its Investment Appeal (ENXTPA:SW)

Reviewed by Sasha Jovanovic

- Sodexo S.A. was recently added to the Euronext 150 Index, highlighting its expanding significance within the European equity landscape.

- This inclusion can lead to increased visibility among institutional investors and may prompt adjustments by funds tracking the index.

- We'll explore how Sodexo's addition to the Euronext 150 Index may influence its investment narrative and institutional demand.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sodexo Investment Narrative Recap

To be a shareholder in Sodexo today, you need to believe in the company’s ability to accelerate organic growth, particularly as it works through short-term challenges mainly in its North American operations. While inclusion in the Euronext 150 Index brings higher visibility, it is unlikely to directly change the key short-term catalyst: the timely ramp-up of new Healthcare contracts. However, this news does little to offset the most immediate risk, which remains execution and revenue growth in North America.

Among recent announcements, Sodexo’s proposed dividend increase to EUR 2.70 per share stands out, reinforcing the company’s commitment to rewarding shareholders even as execution risks persist. This move also signals management’s confidence in Sodexo’s long-term cash flow, providing some reassurance at a time when consistency in contract wins, especially in key growth sectors, remains a central catalyst for future performance.

By contrast, investors should be aware that despite these positive signals, the risk associated with delayed Healthcare contract ramp-ups remains...

Read the full narrative on Sodexo (it's free!)

Sodexo's outlook anticipates €25.9 billion in revenue and €831.3 million in earnings by 2028. This scenario requires a 2.3% annual revenue growth rate and a €155.3 million increase in earnings from the current level of €676.0 million.

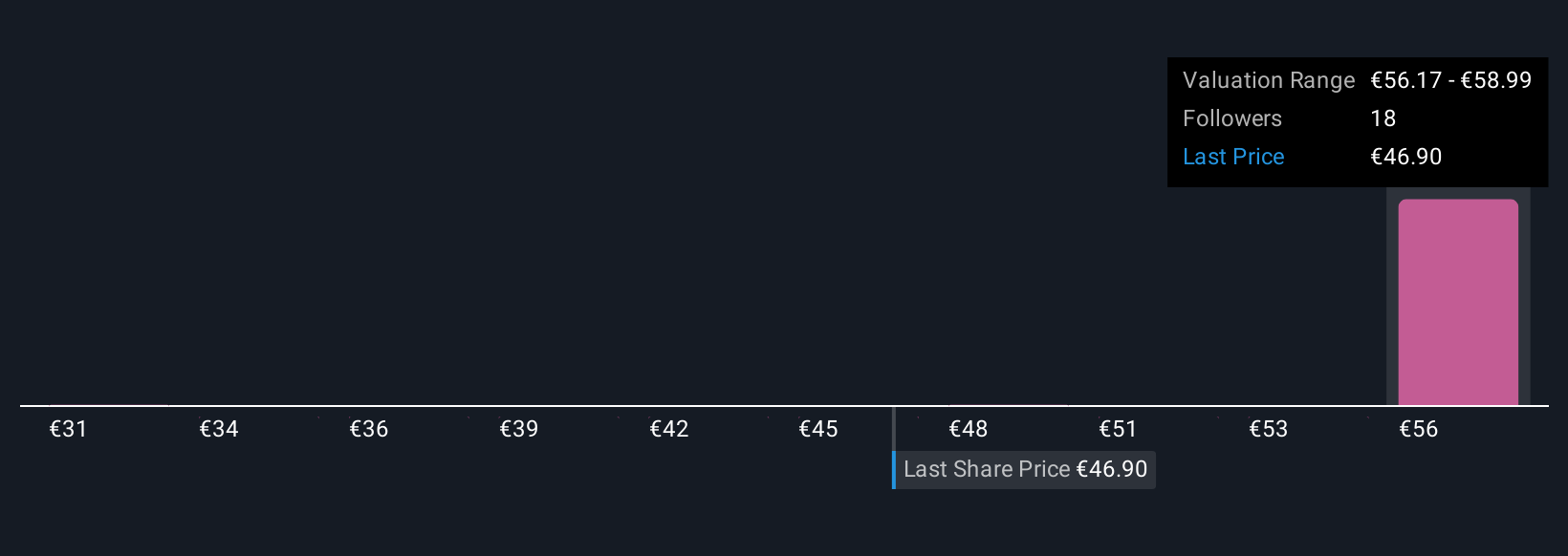

Uncover how Sodexo's forecasts yield a €58.99 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted 4 fair value estimates for Sodexo ranging from €30.81 to €58.99 per share. While these independent estimates point toward wide differences in opinion, it is clear that overcoming revenue growth risks in North America is top of mind for many as you consider the company’s current outlook.

Explore 4 other fair value estimates on Sodexo - why the stock might be worth as much as 26% more than the current price!

Build Your Own Sodexo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sodexo research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sodexo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sodexo's overall financial health at a glance.

No Opportunity In Sodexo?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SW

Sodexo

Provides food services and facilities management services in North America, Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives