- Taiwan

- /

- Personal Products

- /

- TWSE:1707

3 Dividend Stocks Yielding Up To 5.5% For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to recover, with U.S. indexes approaching record highs and broad-based gains observed across various sectors, investors are closely monitoring the Federal Reserve's upcoming decisions on interest rates amid positive economic indicators like falling jobless claims and rising home sales. In this environment of cautious optimism and geopolitical uncertainty, dividend stocks offering yields up to 5.5% can provide a stable income stream while potentially benefiting from market growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

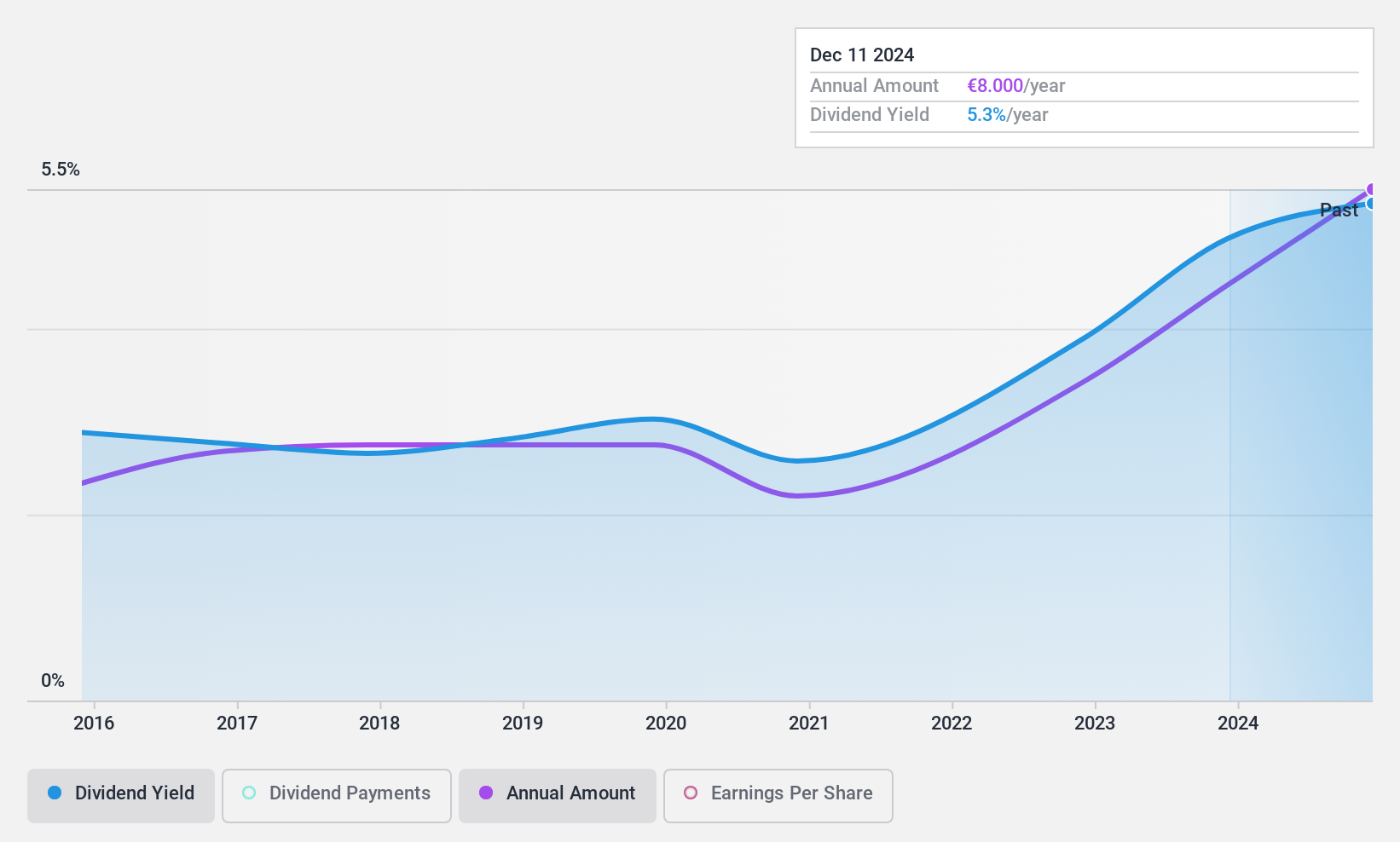

Compagnie Du Mont-Blanc (ENXTPA:MLCMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Du Mont-Blanc operates as a ski lift company in France, with a market cap of €128.62 million.

Operations: Compagnie Du Mont-Blanc generates its revenue from Sports Lift operations (€143.40 million) and Restaurants and Stores (€4.73 million).

Dividend Yield: 5.6%

Compagnie Du Mont-Blanc's dividend yield of 5.59% ranks in the top 25% of French market payers, yet its dividends have been volatile over the past decade. Despite a low payout ratio of 35.7%, indicating coverage by earnings, dividends are not supported by free cash flows and have seen significant annual drops previously. Recent earnings growth of EUR 20.14 million suggests improving profitability, but sustainability concerns persist due to lack of free cash flow coverage.

- Unlock comprehensive insights into our analysis of Compagnie Du Mont-Blanc stock in this dividend report.

- The analysis detailed in our Compagnie Du Mont-Blanc valuation report hints at an inflated share price compared to its estimated value.

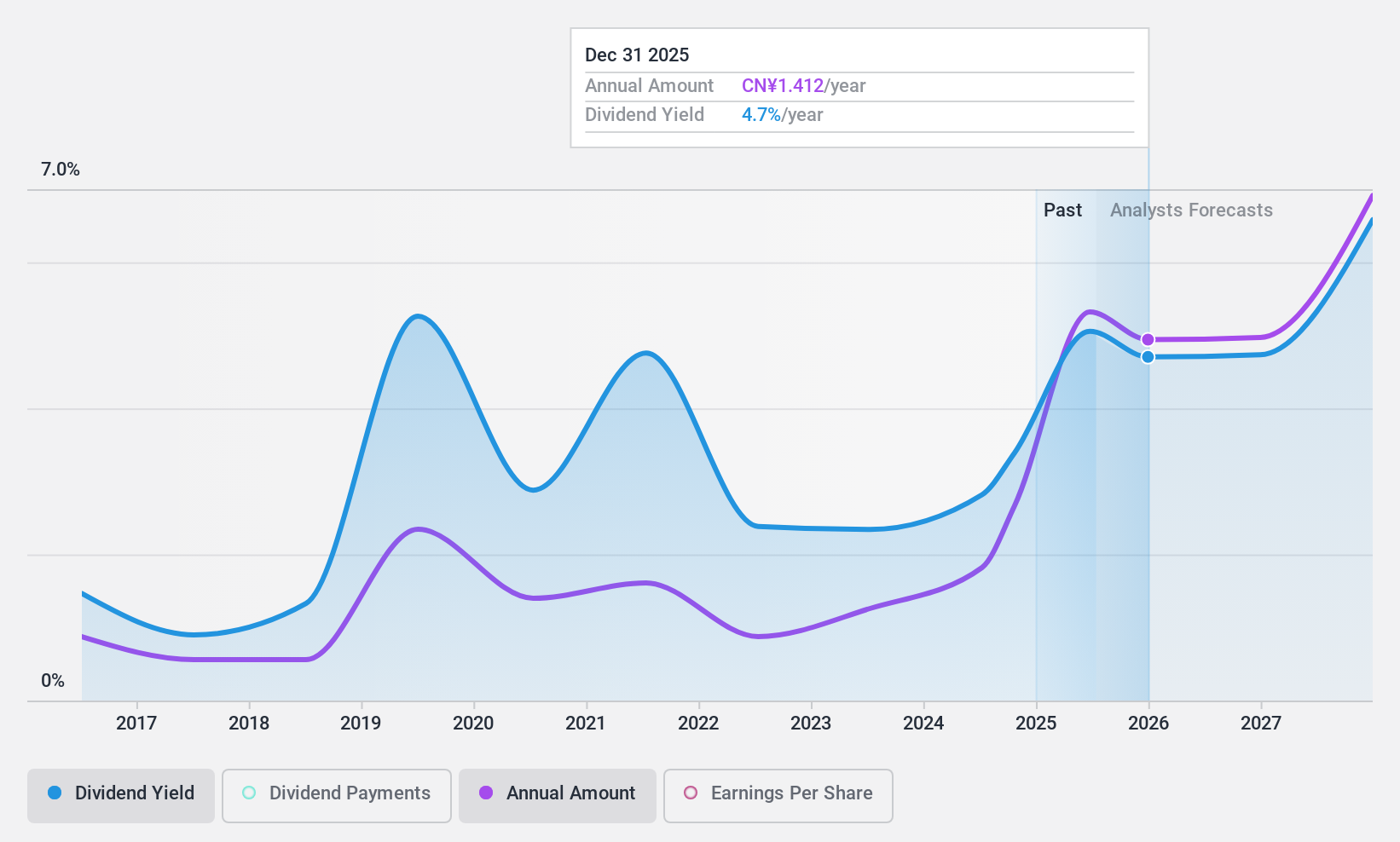

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. is engaged in the research, development, production, sale, and servicing of industrial valves both in China and internationally, with a market cap of CN¥17.96 billion.

Operations: Neway Valve (Suzhou) Co., Ltd.'s revenue from the valve industry segment is CN¥5.76 billion.

Dividend Yield: 3.2%

Neway Valve (Suzhou) offers a 3.22% dividend yield, placing it in the top 25% of CN market payers. However, its dividends have been volatile and unreliable over the past decade. Despite recent earnings growth and a reasonable payout ratio of 71.4%, dividends are not well covered by free cash flows, raising sustainability concerns. Recent earnings reports show improved profitability with net income rising to CNY 827.84 million for the first nine months of 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Neway Valve (Suzhou).

- In light of our recent valuation report, it seems possible that Neway Valve (Suzhou) is trading beyond its estimated value.

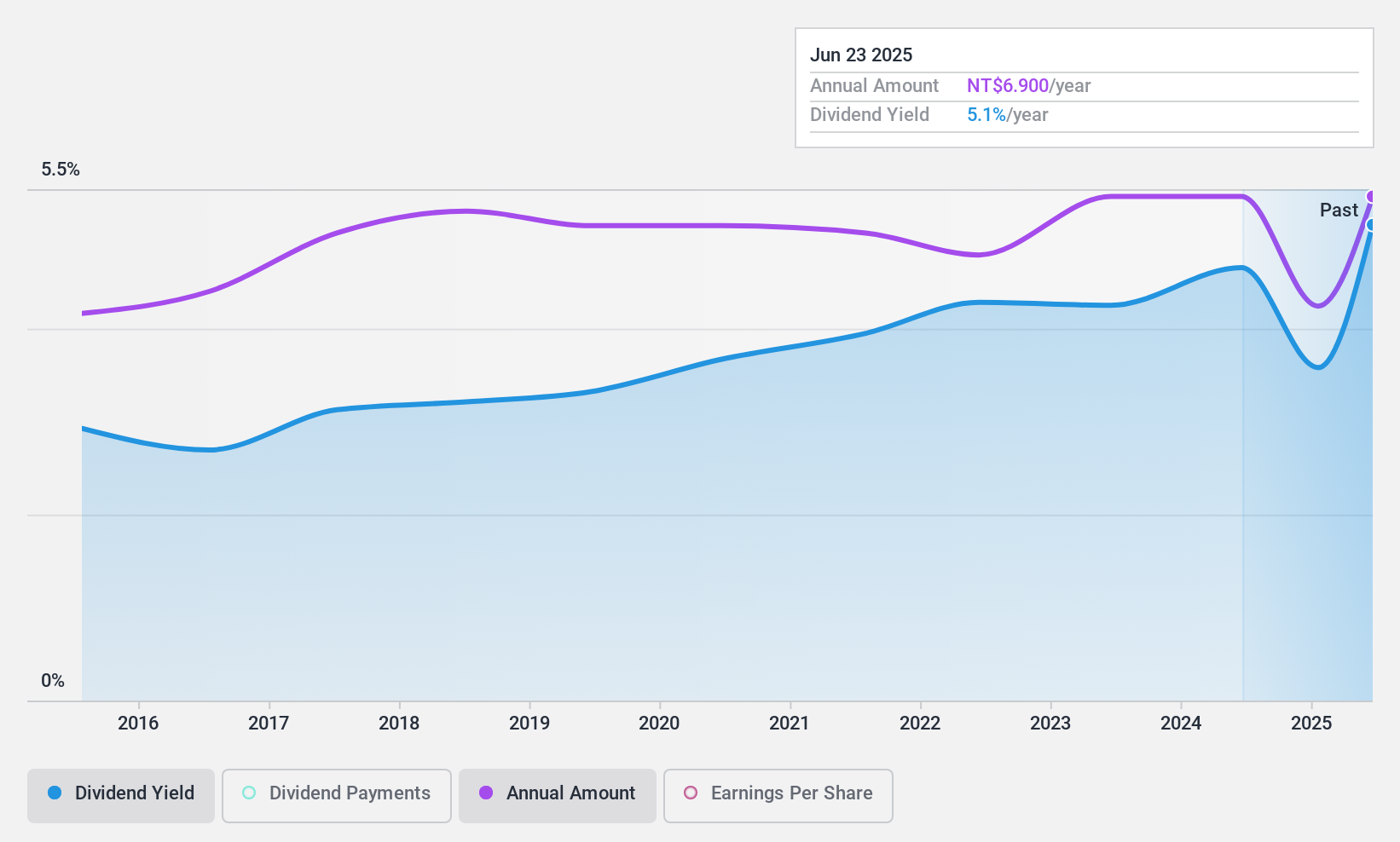

Grape King Bio (TWSE:1707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grape King Bio Ltd, along with its subsidiaries, is engaged in the production and sale of pharmaceutical preparations, patent medicines, liquid tonics, drinks, and healthy food across Taiwan, China, and international markets with a market cap of NT$23.26 billion.

Operations: Grape King Bio Ltd's revenue is derived from its diverse portfolio, including pharmaceutical preparations, patent medicines, liquid tonics, drinks, and healthy food products across various markets.

Dividend Yield: 3.4%

Grape King Bio's dividend yield of 3.44% is below the top 25% in the TW market. While dividends are covered by earnings and cash flows, they have been unreliable and volatile over the past decade. Recent earnings show modest growth, with net income reaching TWD 1 billion for the first nine months of 2024. The company announced a cash dividend of TWD 2.7 per share to be paid in February 2025, reflecting ongoing shareholder returns despite historical volatility.

- Get an in-depth perspective on Grape King Bio's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Grape King Bio is priced lower than what may be justified by its financials.

Next Steps

- Access the full spectrum of 1954 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1707

Grape King Bio

Produces and sells pharmaceutical preparations, patent medicines, liquid tonics, drinks, and healthy food in Taiwan, China, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives