- France

- /

- Hospitality

- /

- ENXTPA:ELIOR

Elior Group (EPA:ELIOR) adds €72m to market cap in the past 7 days, though investors from five years ago are still down 72%

It is a pleasure to report that the Elior Group SA (EPA:ELIOR) is up 38% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 73% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

The recent uptick of 9.8% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Elior Group

Elior Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Elior Group grew its revenue at 2.7% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 12%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

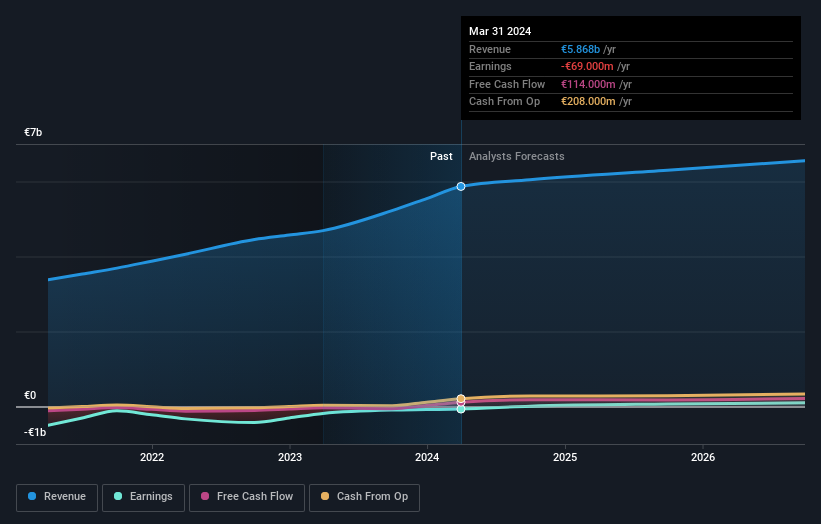

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Elior Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Elior Group stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's good to see that Elior Group has rewarded shareholders with a total shareholder return of 13% in the last twelve months. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Elior Group you should be aware of.

We will like Elior Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Elior Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELIOR

Elior Group

Offers contract catering and support services in France and internationally.

Undervalued with moderate growth potential.