- France

- /

- Hospitality

- /

- ENXTPA:BAIN

Société des Bains de Mer (ENXTPA:BAIN): Assessing Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (ENXTPA:BAIN) is hardly ever in the fast lane of stock market headlines, but the recent uptick in its share price could turn some heads among value seekers and patient investors. The move might seem subtle if you are used to the high drama elsewhere, but when a company like this stirs, it is fair to wonder if there is something brewing beneath the calm surface or if we are just seeing the effects of market noise. Either way, investors eyeing BAIN today are right to ask: is this a signal or just another blip?

Looking at the bigger picture, the stock has seen a gentle climb in the past 3 months and is now up around 6% over that period. Over the year, however, performance has remained flat, even dipping very slightly compared to last year. Notably, long-term returns tell a different story; the last 5 years have delivered strong cumulative gains, amplified by momentum building over the past several years, though that pace has cooled in the most recent year.

So is this pause an opportunity to buy Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco on the cheap, or do current prices already bake in all the growth on the horizon?

Price-to-Earnings of 24.2x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco appears overvalued compared to both its industry and similar peers. The company's P/E multiple stands at 24.2 times earnings, which is notably higher than the European hospitality industry average of 20 times and the peer average of 14.7 times.

The price-to-earnings ratio helps investors gauge how much they are paying for each euro of company earnings. In the hospitality sector, a higher multiple is often associated with robust earnings growth, premium brands or expectations of superior future performance.

However, in this case, the elevated P/E may suggest the market is pricing in stronger growth than industry benchmarks or perhaps overestimating future profitability. With BAIN trading above these comparative ratios, investors should question whether the current price truly reflects future earnings potential or if enthusiasm has run ahead of fundamentals.

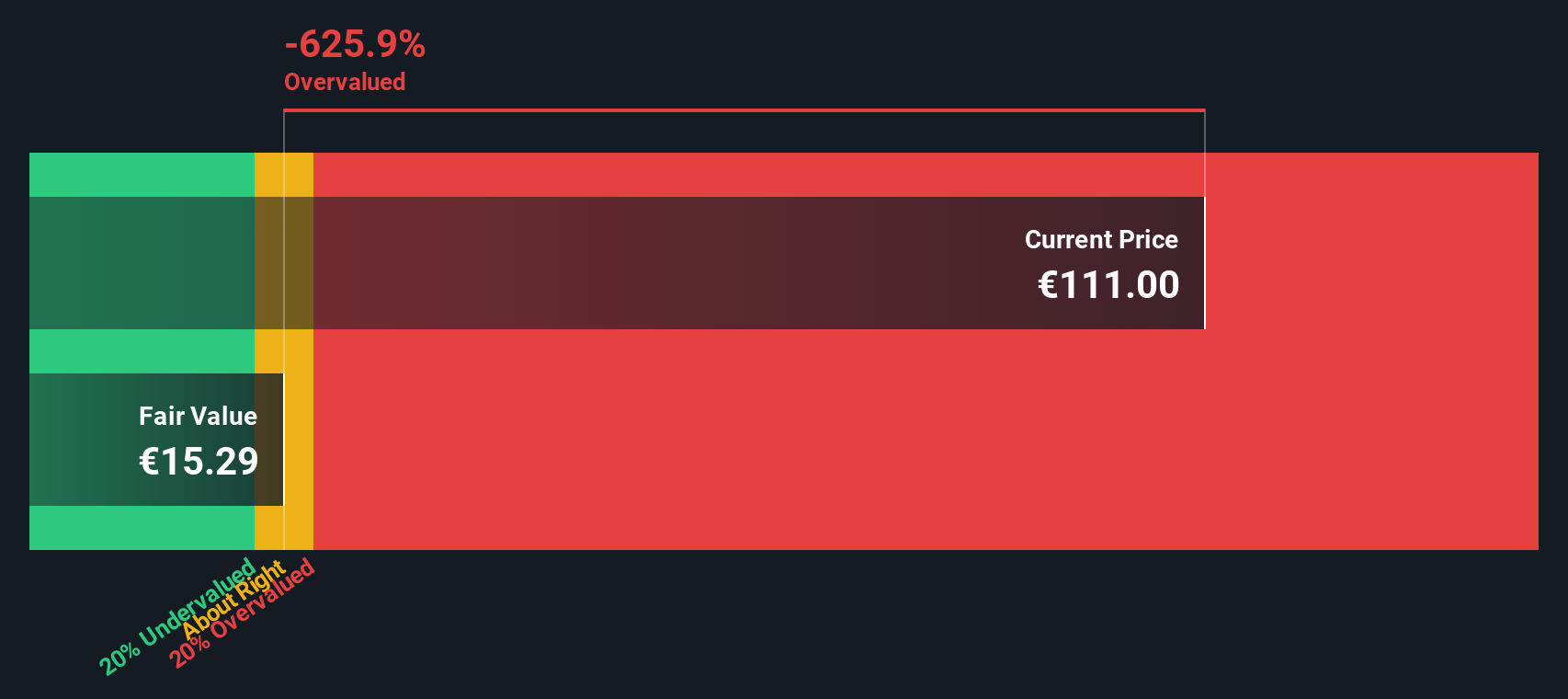

Result: Fair Value of €14.97 (OVERVALUED)

See our latest analysis for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco.However, weak revenue growth or shifts in market sentiment could quickly challenge the stock's valuation. This momentum is sensitive to broader economic conditions.

Find out about the key risks to this Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco narrative.Another View: What Does Our DCF Model Suggest?

While the market's multiple might say one thing, our SWS DCF model tells a similar story. According to this approach, the shares also appear overvalued. If both methods point in the same direction, could this be a warning sign, or does the market see something these models might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco Narrative

If you think there is a different story to tell, or you want to dig into the details yourself, you can shape your own view in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco.

Looking for More Smart Investment Moves?

Don’t let your next big opportunity slip away. Boost your portfolio with companies that stand out for their financial strength, future potential, or sector leadership. Take the next step and make your research pay off.

- Capture the potential of up-and-coming companies by searching for penny stocks with strong financials using penny stocks with strong financials.

- Harvest reliable income streams by targeting stocks with yields above 3% through our selection of dividend stocks with yields > 3%.

- Seize undervalued opportunities the market may have overlooked and unlock hidden value with our curated collection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BAIN

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

Operates in the gaming, hotels, and rental sectors in Monaco.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives