- France

- /

- Hospitality

- /

- ENXTPA:BAIN

Is There Room for Growth in Monte-Carlo SBM After a 7% Share Price Rise in 2025?

Reviewed by Simply Wall St

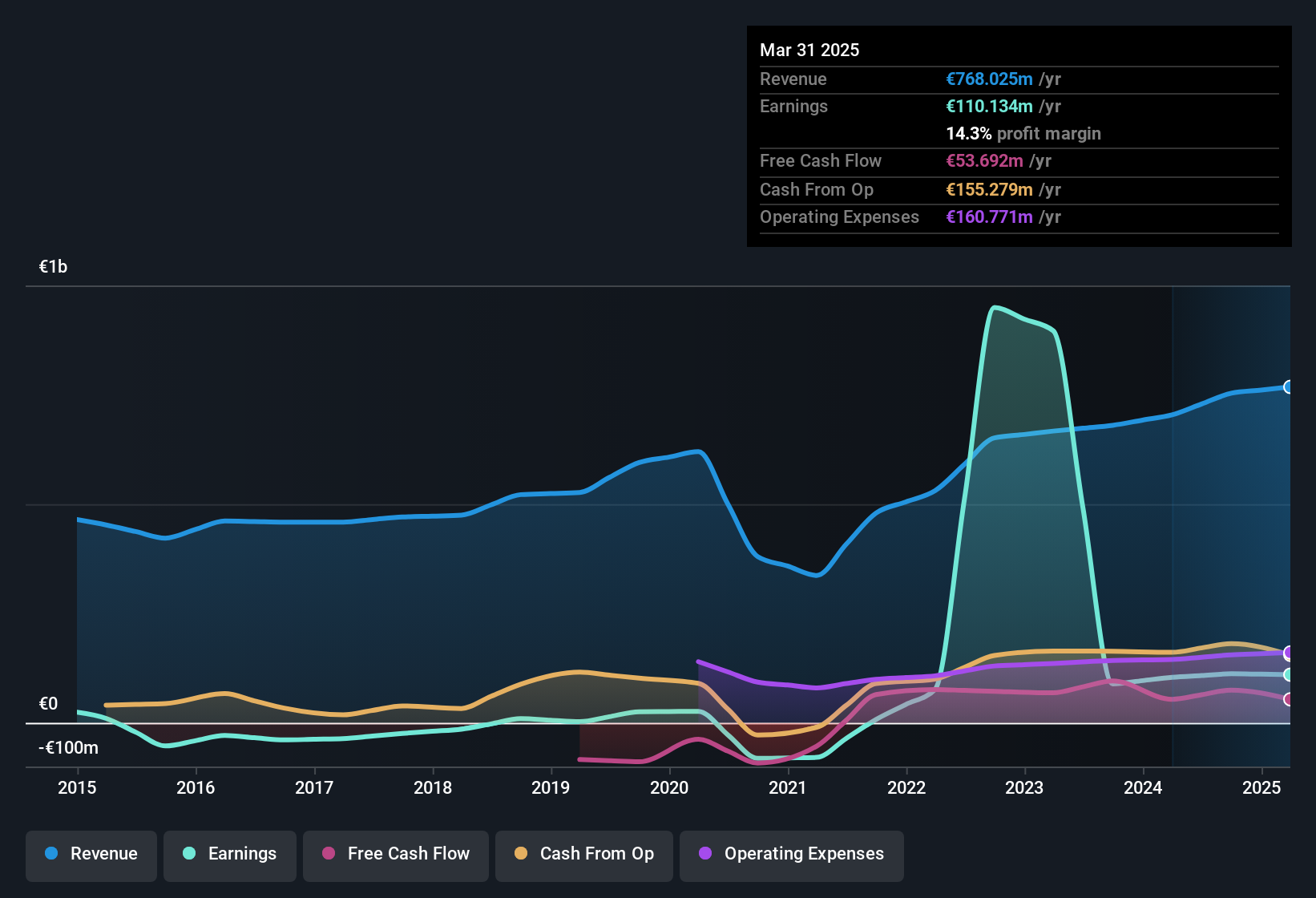

If you are weighing your options on Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco, you are not alone. There is a lot to consider with this unique stock, especially for those looking at its place within Monaco's luxury and hospitality sector. The share price has been quietly on the move, with a 1.9% gain over the past week and 4.3% over the last month. Zoom out, and you will see a year-to-date climb of 7.4%, which stands in sharp contrast to the small dip of -1.8% over the past twelve months. For the patient investor, the five-year return of 94.1% and a 23.7% uptick over three years both underscore the company's long-term resilience.

Some of these shifts seem tied to the evolving tourism landscape and renewed interest in luxury experiences, even as global markets deal with uncertainty. Yet, price movements always invite a deeper question: are you paying too much, or maybe not enough, to own a piece of Monaco's storied glamour?

Right now, if you are thinking about value, the company posts a valuation score of 0 out of 6. This means it is not showing undervaluation across any of the main checks, at least by the usual metrics investors look to for a bargain. But the real story behind valuation can be more nuanced than a checklist. Next, we will break down the different ways to assess value, from classic ratios to more modern approaches, before revealing the perspective we find most actionable at the end.

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco Discounted Cash Flow (DCF) Analysis

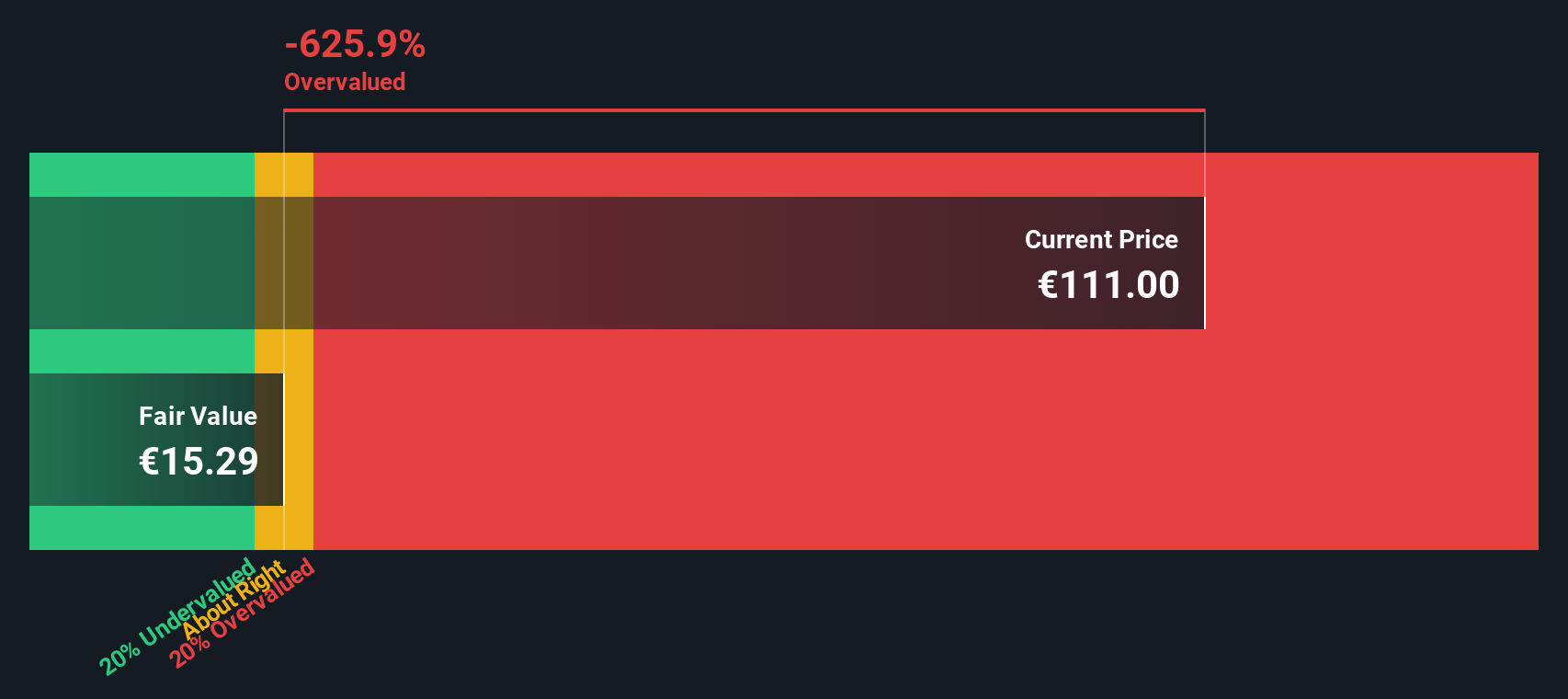

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to present-day values. This helps investors determine what the business may truly be worth today, based on expectations of future performance rather than just current profits or assets.

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco currently generates Free Cash Flow of €45.9 million annually. Analyst estimates suggest a decline over the coming years, with projected Free Cash Flow in 2026 at €39.8 million. By extrapolating out to 2035, projections hover around €33.3 million, with the bulk of estimates showing a gentle decline or near-flat performance. While only five years of estimates are typically provided, the extension to a full decade gives an idea of longer-term cash generation potential.

When these future cash flows are discounted back, the resulting intrinsic value comes to €15.03 per share. At the current market price, this implies the company is trading at a significant premium. Specifically, it appears to be overvalued by 621.9% according to this DCF model.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco.

Approach 2: Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco Price vs Earnings

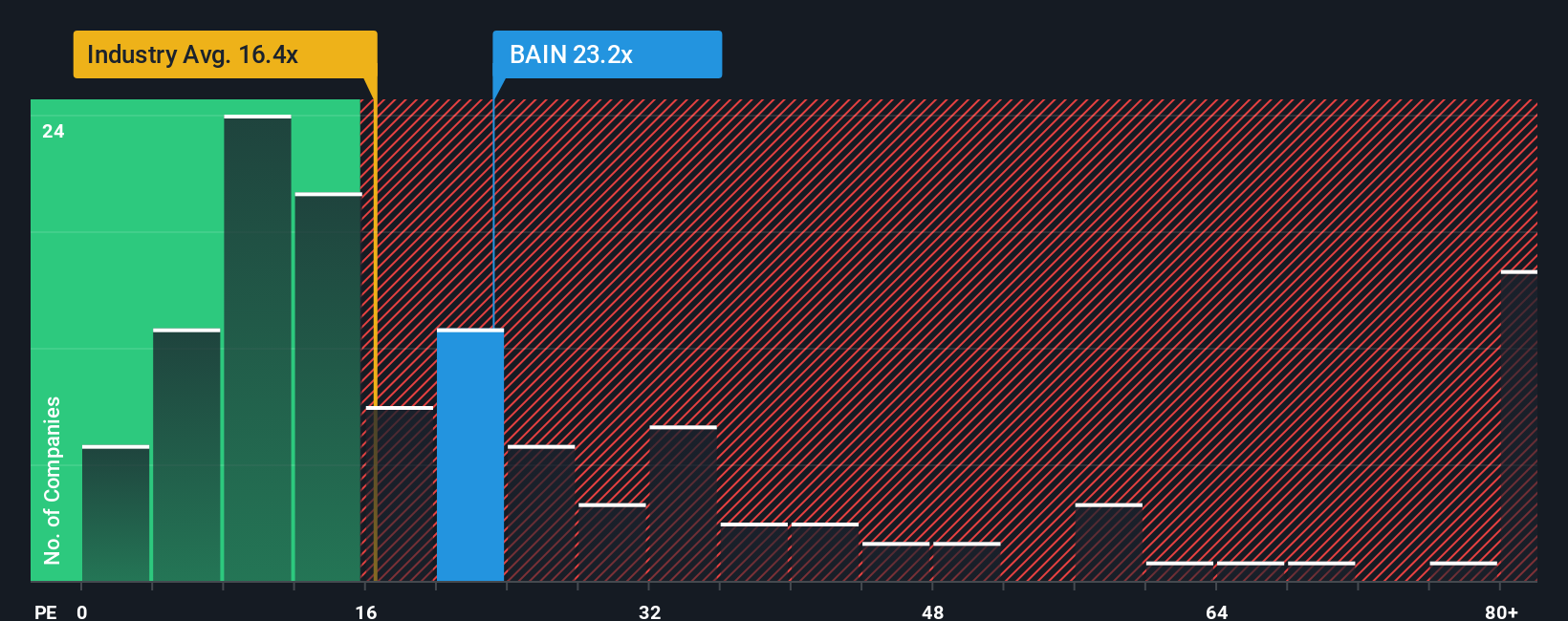

For profitable companies, the Price-to-Earnings (PE) ratio remains one of the most widely used valuation metrics. It provides investors with a quick sense of how much they are paying for each euro of earnings, allowing easy cross-checking against comparable companies and the broader sector. A “normal” or “fair” PE ratio is often shaped by expectations for future earnings growth and the perceived riskiness of those earnings. Higher anticipated growth or lower risk tends to justify a higher PE multiple, while flat or volatile prospects usually result in a lower figure.

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco is trading at a PE ratio of 24.2x. This is above both the Hospitality industry average of 21.8x and the average for its closest peers at 14.7x. On the surface, this might suggest the stock is somewhat expensive compared to its sector, hinting that investors expect more growth or lower risk relative to others.

However, comparing strictly to peers or industry averages can miss important context. That is why Simply Wall St’s proprietary “Fair Ratio” comes into play, taking into account not just sector norms but also the company’s earnings growth, risk factors, profit margins, and market size. It gives a more tailored view of what a reasonable PE should be for this business specifically. If the actual PE is significantly higher than this Fair Ratio, it points to overvaluation. A much lower PE signals undervaluation.

Comparing the company’s actual PE ratio with the Fair Ratio shows the stock price is about in line with its underlying prospects and risks, particularly given the uniqueness of its business model and exposure to luxury hospitality in Monaco.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story about a company, where you explain why you think it is valuable by outlining your assumptions about its future revenue, earnings, and margins, and what you believe its fair value should be. Narratives connect a company’s story to detailed financial forecasts, letting you clearly see how your perspective leads to a fair value estimate.

On Simply Wall St’s platform, millions of investors harness Narratives from the Community page, making this advanced approach accessible and interactive for everyone. Narratives make it easier to decide when to buy or sell by directly comparing the Fair Value you assign, based on your outlook, to the current Price in real time. Even better, Narratives update automatically when significant news or fresh earnings reports are released, helping your analysis stay current and relevant.

For Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco, some investors see tremendous upside and assign their highest fair value forecasts, while others anticipate a decline and set the lowest valuations. This highlights just how personal and powerful Narratives can be in shaping smart investment decisions.

Do you think there's more to the story for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BAIN

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

Operates in the gaming, hotels, and rental sectors in Monaco.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives