- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

Carrefour (ENXTPA:CA): Exploring Valuation Opportunities for the Retail Giant

Reviewed by Simply Wall St

Most Popular Narrative: 13.7% Undervalued

According to the most widely followed narrative, Carrefour appears to be undervalued by 13.7% versus its projected fair value, as calculated using a discount rate of 10.4%.

"Carrefour's digital transformation and focus on e-commerce, with an 18% growth to €6 billion in GMV, coupled with private label expansion, could drive higher margins due to the typically better profitability of online channels and private label products."

Looking for the inside track behind this valuation gap? There is a bold market assumption hidden at the heart of the narrative, with forecasts pegged on aggressive profit growth and a changed earnings structure. Want to see exactly which future milestones need to be hit and what analyst upgrades are driving the story? Do not miss the full breakdown of this valuation thesis. Discover which pivotal company shifts support these optimistic numbers.

Result: Fair Value of €14.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing competition in Europe and weak French market demand mean Carrefour could still face pressure on margins and overall profitability in the future.

Find out about the key risks to this Carrefour narrative.Another View: Looking Beyond the Price Tag

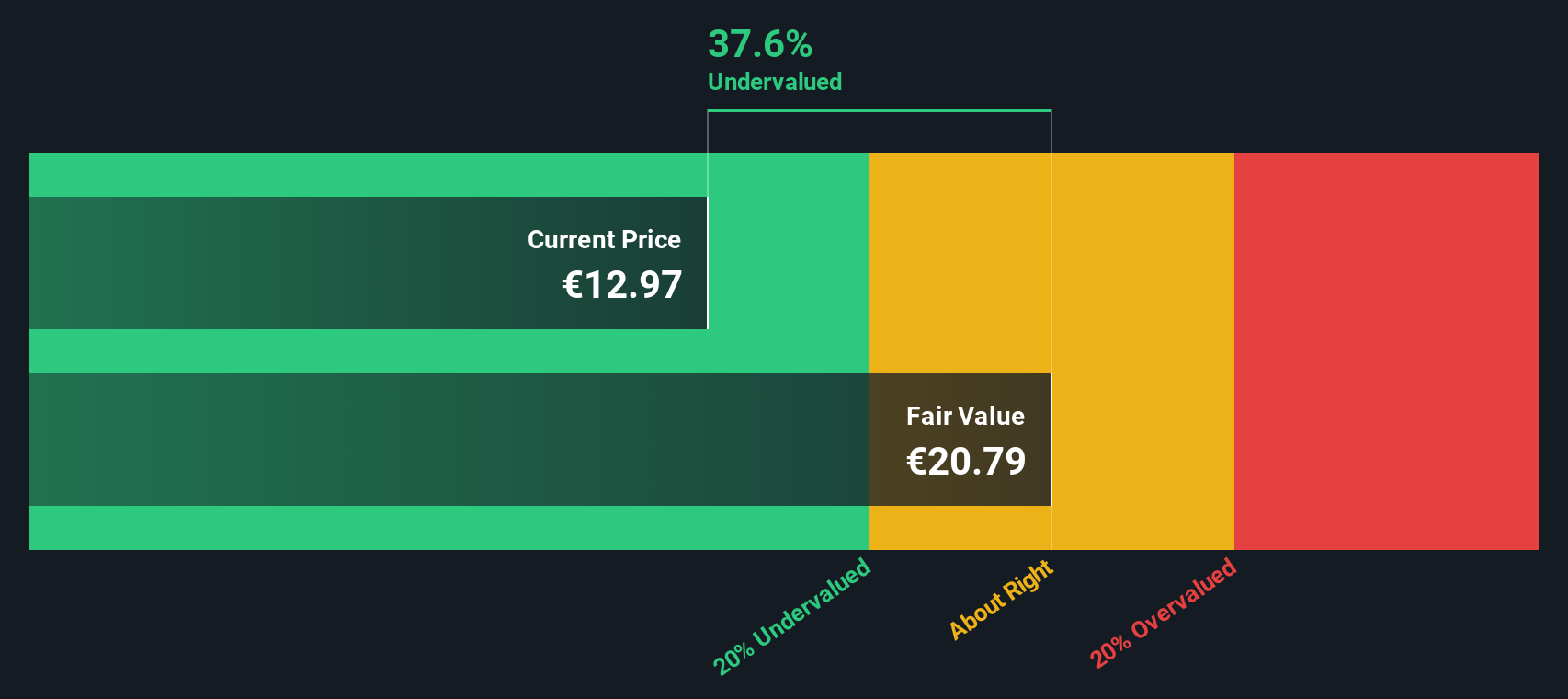

While analysts argue Carrefour is undervalued based on future earnings expectations, our DCF model also suggests the shares might be trading below their intrinsic worth. However, this method raises the question of whether it fully accounts for the risks and momentum shifts that markets observe.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carrefour Narrative

If you are not convinced by the prevailing narrative or want to dig into the numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way.

A great starting point for your Carrefour research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let standout opportunities pass you by. Expand your watchlist with stocks showing robust fundamentals, rising trends, or future-ready potential using these powerful screeners:

- Unlock potential gains by focusing on profitable up-and-comers with penny stocks with strong financials already proving their financial strength on the market’s toughest stage.

- Accelerate your search for tomorrow’s winners by targeting AI penny stocks at the forefront of artificial intelligence innovation and industry disruption.

- Maximize value by zeroing in on hidden gems with undervalued stocks based on cash flows spotlighting companies whose cash flows suggest real upside many have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:CA

Carrefour

Operates as a food retailer in France, Spain, Italy, Belgium, Poland, Romania, Brazil, Argentina, the Middle East, Africa, and Asia.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives