European Market Insights: AFYREN SAS And 2 Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

As the European markets navigate mixed performances, with indices like Germany’s DAX gaining slightly and others such as France’s CAC 40 experiencing declines, investors are closely watching policy signals from the European Central Bank. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite their somewhat outdated label. This article will explore three noteworthy penny stocks in Europe that may offer unique opportunities by combining financial strength with potential growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.75 | €1.64B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.70 | €83.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.06 | €64.91M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.10 | SEK188.6M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.315 | €381.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.77 | €25.79M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 291 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AFYREN SAS offers biobased products as alternatives to petroleum-based molecules in France, with a market cap of €72.72 million.

Operations: The company generates its revenue primarily from the Chemicals segment, which amounts to €2.70 million.

Market Cap: €72.72M

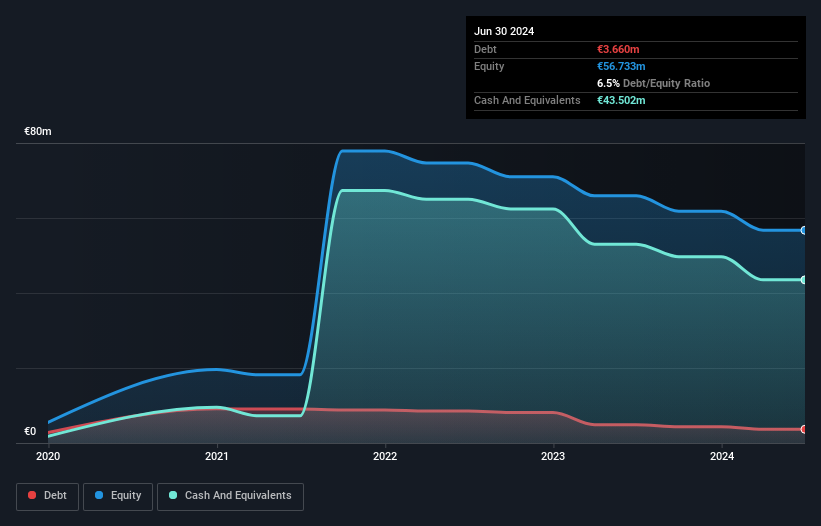

AFYREN SAS, with a market cap of €72.72 million, is navigating the penny stock landscape by leveraging its innovative biobased products as alternatives to petroleum-based molecules. Despite being unprofitable and lacking significant revenue (€3M), it has a strong cash position with assets exceeding liabilities and no meaningful shareholder dilution recently. The company has partnered with Esse Skincare to introduce bio-based propionic acid for skincare, highlighting its commitment to sustainability and innovation. A recent private placement raised nearly €23 million, indicating investor confidence despite high share price volatility and ongoing financial challenges.

- Jump into the full analysis health report here for a deeper understanding of AFYREN SAS.

- Gain insights into AFYREN SAS' future direction by reviewing our growth report.

écomiam (ENXTPA:ALECO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: écomiam SA operates stores selling food products in France and has a market cap of €9.35 million.

Operations: The company's revenue is generated entirely from its retail grocery store operations, amounting to €39.49 million.

Market Cap: €9.35M

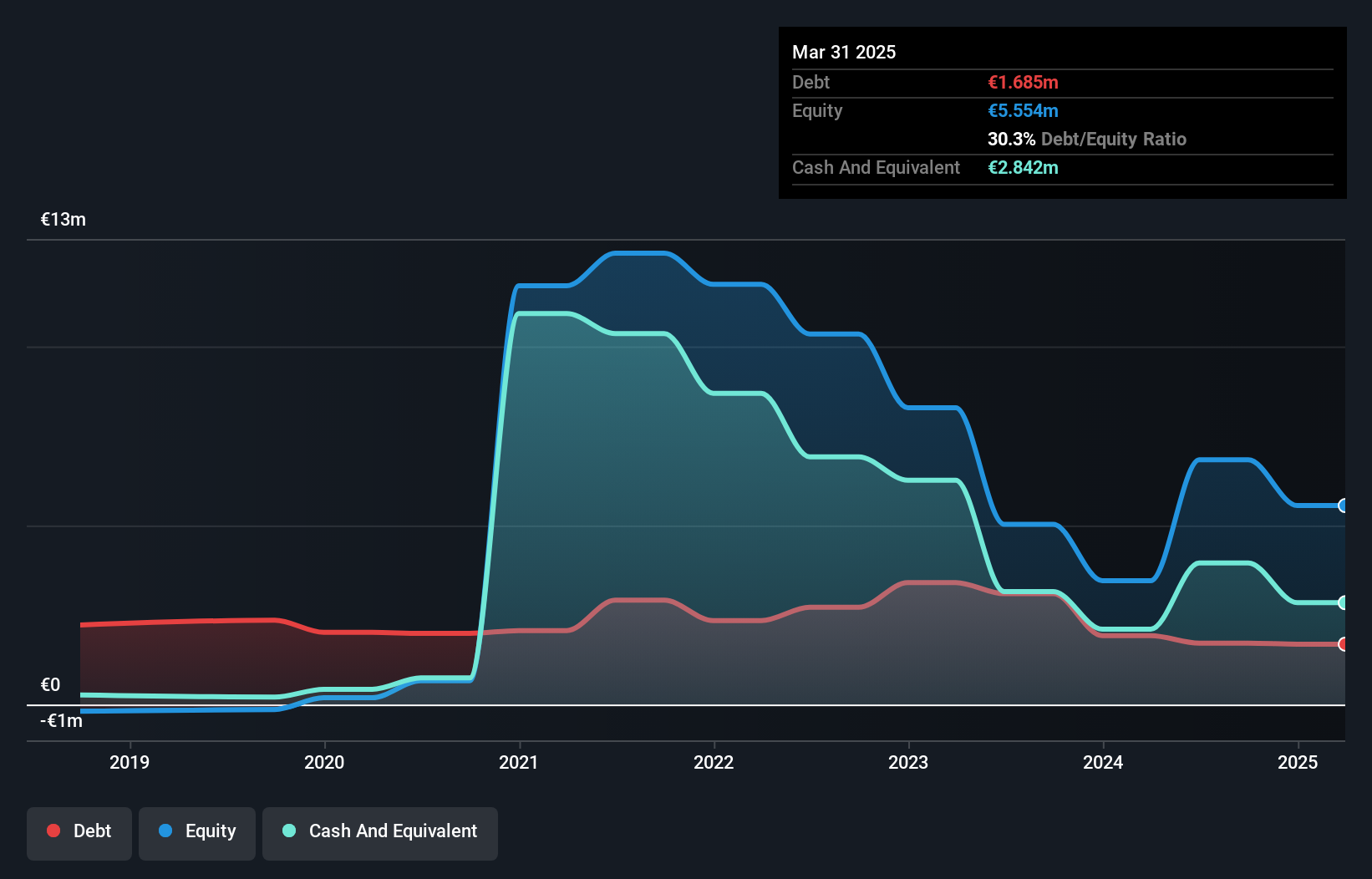

écomiam SA, with a market cap of €9.35 million, operates in the retail grocery sector, generating €39.49 million in revenue from its stores across France. While currently unprofitable and not expected to achieve profitability within the next three years, it maintains a stable financial position with short-term assets (€8.8M) exceeding both its short-term (€4.2M) and long-term liabilities (€2M). The company has managed to reduce its debt significantly over five years and retains a cash runway of 1.7 years if cash flow continues to decline at historical rates, without significant shareholder dilution recently observed.

- Navigate through the intricacies of écomiam with our comprehensive balance sheet health report here.

- Assess écomiam's future earnings estimates with our detailed growth reports.

Navigo Invest (OM:NAVIGO STAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Navigo Invest AB (publ) is a private equity and venture capital firm that focuses on various investment stages including buyouts, early and later stage, acquisition, growth capital, middle markets, turnaround and mature stage investments, with a market cap of SEK363.23 million.

Operations: Navigo Invest generates revenue primarily from Chemgroup (SEK281.08 million), The Vinga Group (SEK219.62 million), The Calorimeter (SEK90.83 million), and The Geogroup (SEK41.41 million).

Market Cap: SEK363.23M

Navigo Invest AB, with a market cap of SEK363.23 million, has shown significant revenue growth, reporting SEK152.21 million for Q3 2025 compared to SEK117.81 million the previous year. Despite being unprofitable and having a negative return on equity (-18.27%), the company has reduced its debt-to-equity ratio from 309.8% to 10.9% over five years and maintains a satisfactory net debt-to-equity ratio of 8.5%. Its short-term assets cover both short- and long-term liabilities, providing financial stability alongside a cash runway exceeding three years due to positive free cash flow growth of 44.1% annually.

- Click to explore a detailed breakdown of our findings in Navigo Invest's financial health report.

- Understand Navigo Invest's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 288 European Penny Stocks now.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALAFY

AFYREN SAS

Provides biobased products to replace petroleum-based molecules in France.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion