Hermès (ENXTPA:RMS) Valuation: What Softer Birkin and Kelly Resale Prices Signal for the Stock

Reviewed by Simply Wall St

The cooling frenzy around Birkin and Kelly resale prices is giving investors a fresh lens on Hermès International Société en commandite par actions (ENXTPA:RMS), as the broader luxury market digests inflation driven pressure and shifting demand.

See our latest analysis for Hermès International Société en commandite par actions.

Even with chatter about softer Birkin and Kelly premiums, Hermès’ latest share price of €2,144 sits on a modest recent upswing, and the stock’s long term total shareholder return still reflects a robust, premium brand narrative rather than a growth story that has stalled.

If this shift in luxury appetite has you rethinking where growth and resilience might come from next, it could be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With Hermès shares still sitting near record levels despite cooling luxury demand, is the market underestimating the brand’s long term pricing power, or already baking in every ounce of its future growth potential?

Most Popular Narrative: 10.1% Undervalued

With Hermès last closing at €2,144 against a narrative fair value of about €2,385, the prevailing view leans toward a still underappreciated compounder.

Scarcity driven supply model, underpinned by disciplined capacity investments (opening four new leather workshops in the next four years) and exclusive distribution expansion into key markets (e.g., U.S., China, India), enables Hermès to maximize pricing power and protect industry leading gross/net margins.

Curious how a heritage brand commands a future profit multiple usually reserved for high growth tech? The answer lies in bold revenue, margin and valuation bets that could redefine what “expensive” really means.

Result: Fair Value of €2385.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness among Chinese clients and rising input costs could quickly challenge assumptions about Hermès’ seemingly untouchable margins and growth trajectory.

Another Lens on Valuation

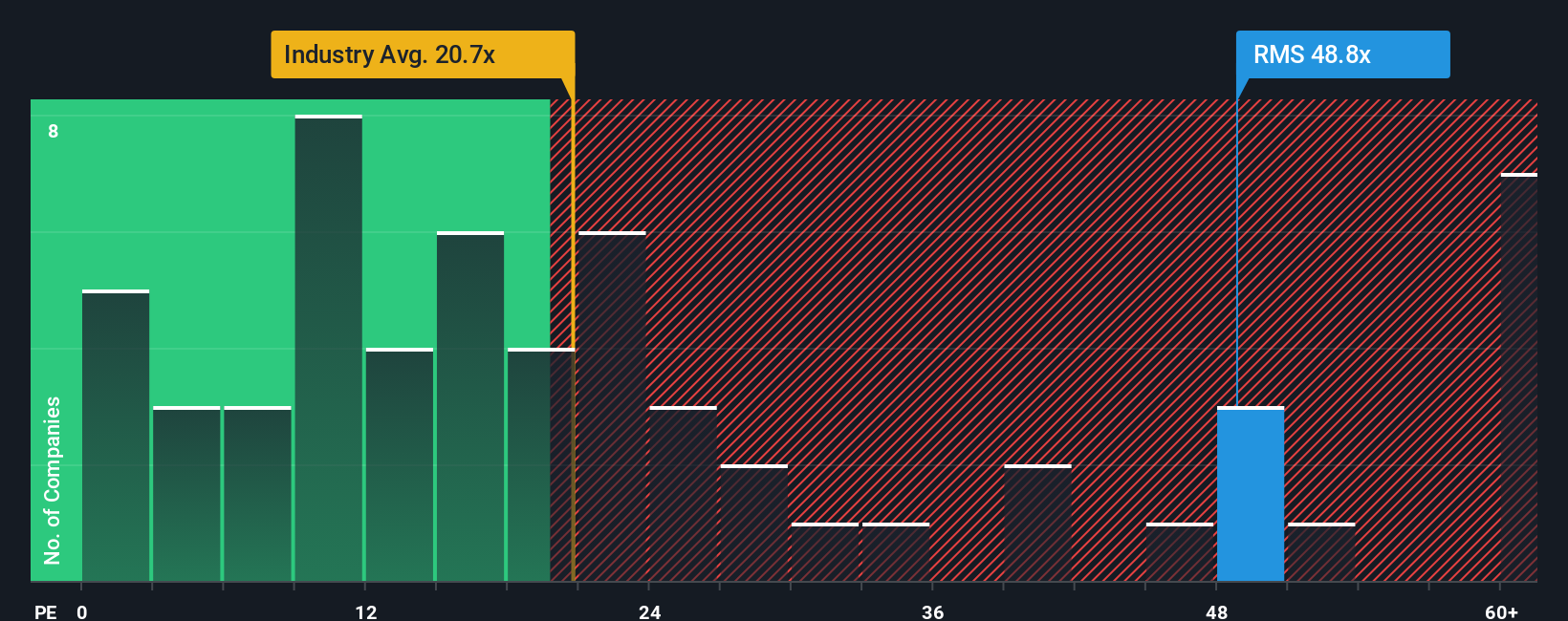

Step away from narratives and Hermès looks far from cheap. At about 50.2 times earnings versus 19.7 times for the European luxury group, and a fair ratio nearer 29.5 times, the share price loads a lot of perfection into today’s numbers, leaving little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hermès International Société en commandite par actions Narrative

If this framework does not quite match your view, or you would rather interrogate the numbers yourself, you can build a custom perspective in under three minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hermès International Société en commandite par actions.

Ready for your next investing edge?

Do not stop at Hermès; put your research momentum to work by using the Simply Wall Street Screener to uncover fresh, data driven opportunities other investors overlook.

- Capture early stage potential in companies that combine small share prices with solid fundamentals using these 3636 penny stocks with strong financials before the market catches on.

- Position yourself at the heart of the AI transformation by targeting innovators powering real world applications through these 24 AI penny stocks today.

- Lock in a growing income stream while rates and volatility shift by focusing on reliable payers found with these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hermès International Société en commandite par actions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RMS

Hermès International Société en commandite par actions

Engages in the production, wholesale, and retail of various goods.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion