How Does LVMH’s Recent 16.8% Rise Affect Its True Worth in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if LVMH Moët Hennessy Louis Vuitton Société Européenne is really worth its current price tag? You’re not alone. The stock often draws attention from both seasoned investors and newcomers looking for luxury sector opportunities.

- After dipping slightly by 0.1% in the last week, LVMH’s shares have actually surged 16.8% over the past month, hinting at renewed optimism or shifting perceptions of its growth prospects.

- Recent headlines highlight strong demand for luxury goods in key markets and the company’s strategic acquisitions, which have fueled both investor confidence and competitive positioning. Ongoing conversations around global consumer trends and market expansion continue to shape the sentiment driving LVMH’s share price.

- When it comes to valuation, LVMH scores a 2 out of 6 in our fundamental value checks, suggesting there is plenty to dig into regarding how the market is pricing this luxury powerhouse. Let’s take a closer look at the numbers and compare typical valuation methods. Plus, stick around for a potentially smarter way to judge value at the end of the article.

LVMH Moët Hennessy - Louis Vuitton Société Européenne scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LVMH Moët Hennessy Louis Vuitton Société Européenne Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's currency value. This helps investors gauge whether a stock is currently priced attractively relative to its underlying business performance.

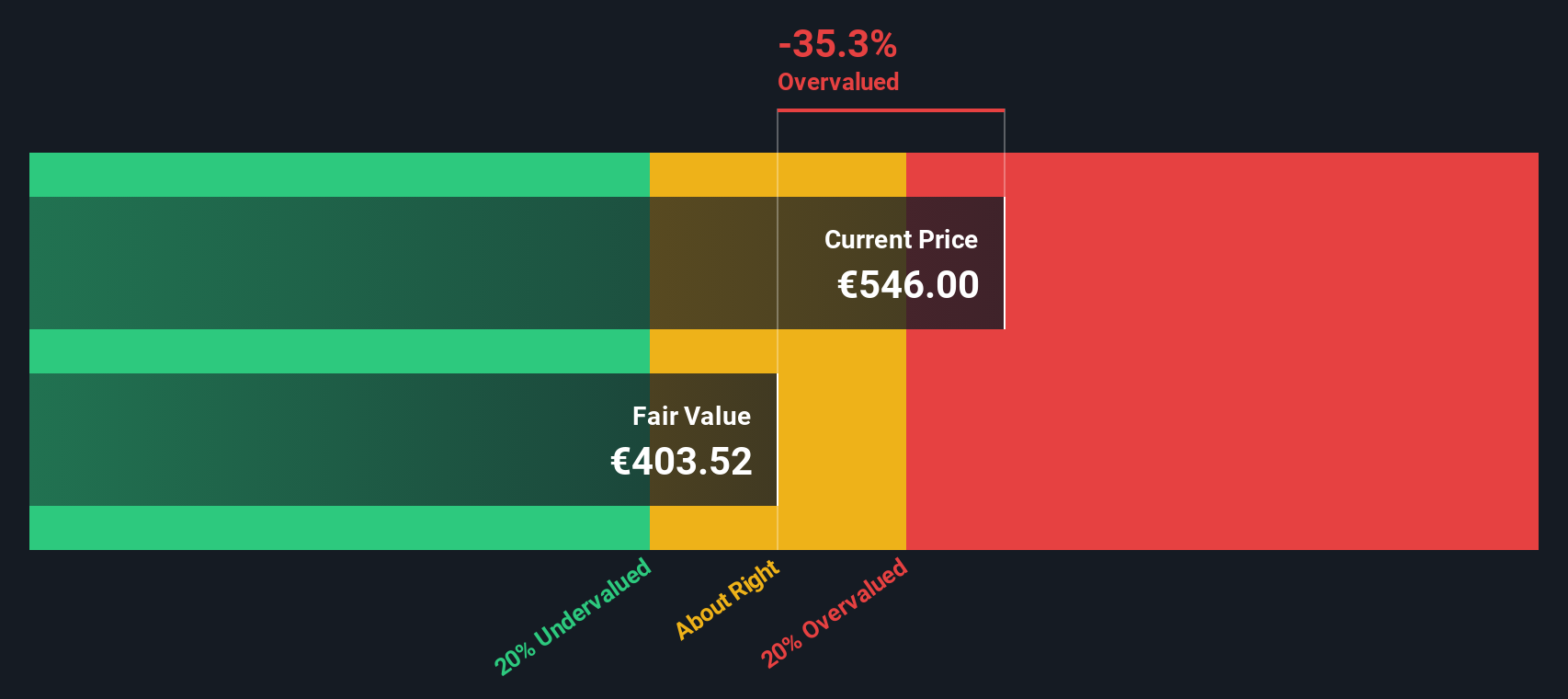

For LVMH Moët Hennessy Louis Vuitton Société Européenne, the latest reported Free Cash Flow is €13.3 billion. Analyst estimates cover the next five years, after which longer-term figures are extrapolated based on recent trends. According to projections, LVMH’s Free Cash Flow is forecasted to moderate slightly in the coming decade, reaching around €12.8 billion by 2029. These numbers are all presented in euros, the company’s reporting currency.

Based on this analysis, the DCF model calculates an estimated intrinsic value of €367.12 per share. However, when compared with the current share price, this implies the stock is trading at a 66.7% premium to its fair value. This suggests that the market price is much higher than what the company’s future cash flows would support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LVMH Moët Hennessy - Louis Vuitton Société Européenne may be overvalued by 66.7%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: LVMH Moët Hennessy Louis Vuitton Société Européenne Price vs Earnings

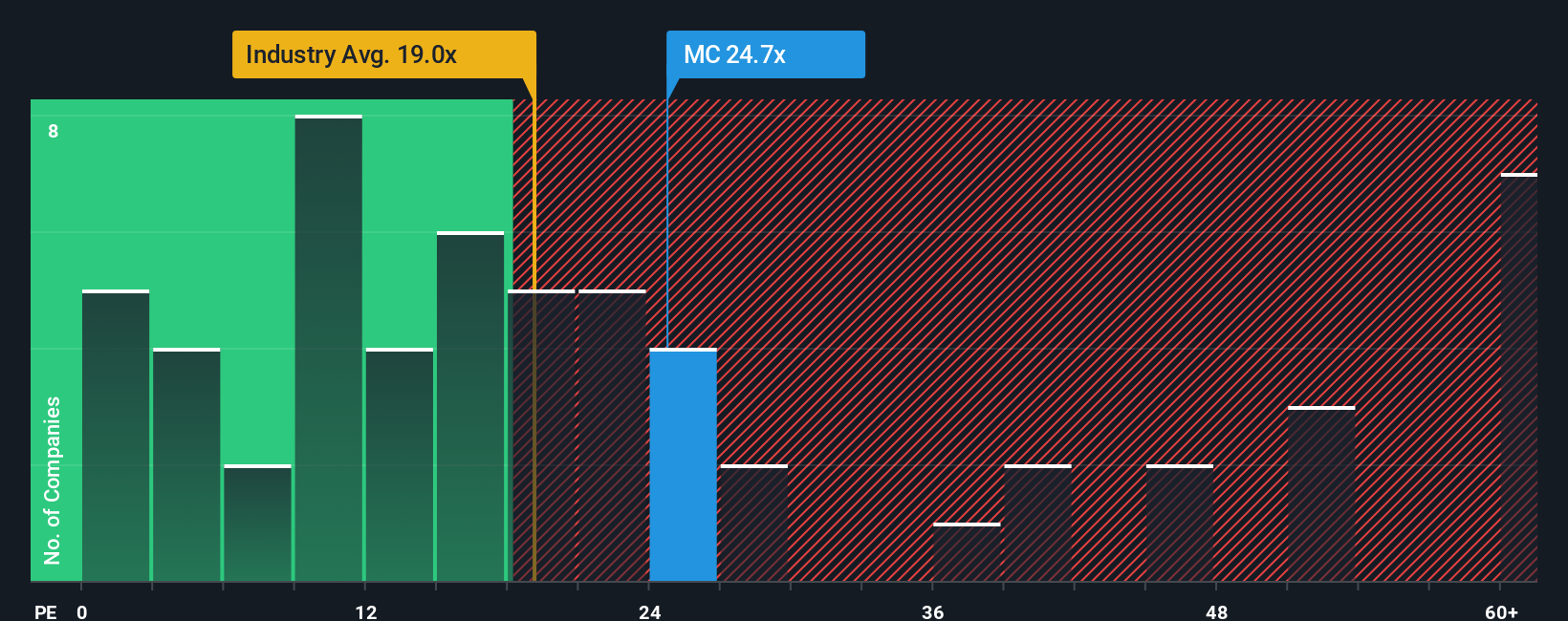

When it comes to valuing profitable companies, the Price-to-Earnings (PE) ratio is often the preferred metric. It provides a clear snapshot of how much investors are willing to pay for each euro of the company’s net income. This makes it straightforward and useful in comparing similar businesses.

Growth expectations and risk also play a crucial part in what counts as a “fair” or “normal” PE ratio. Companies with strong growth prospects or stable earnings usually justify higher PE ratios, while higher risk or slow growth generally pulls that number down.

Currently, LVMH trades at a PE ratio of 27.7x. For context, this sits well above the average for the luxury industry of 18.5x, but noticeably below the peer average of 37.8x. This suggests the market recognizes LVMH’s premium quality and solid profits, though it may not be as bullish as it is on some competitors.

An even more tailored measure is the Fair Ratio by Simply Wall St at 32.0x. This proprietary metric goes beyond broad industry and peer benchmarks by factoring in LVMH’s unique blend of earnings growth, margin strength, size, and specific risks. By focusing on these fundamentals, the Fair Ratio aims to reflect what investors truly ought to pay for this exact business rather than relying on generic comparisons.

With LVMH’s current PE ratio of 27.7x falling below its Fair Ratio of 32.0x, the shares look to be undervalued on this basis, especially considering the company’s robust financial profile and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LVMH Moët Hennessy - Louis Vuitton Société Européenne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company—your unique perspective on LVMH’s future profits, revenue, and margins—linked directly to a financial forecast and a fair value estimate.

On Simply Wall St’s Community page, millions of investors create, share, and update Narratives with just a few clicks. This makes the approach accessible to all. By connecting your view of the business’s trajectory to a modeled fair value, Narratives help you decide if the current share price is justified or if it is time to buy or sell, based on your own expectations and not just the consensus.

The best part is that Narratives are updated dynamically. When news breaks or earnings are released, your assumptions and fair value automatically refresh to reflect the latest information.

For example, some investors see LVMH’s long-term leadership and expanding margins as a reason for a high price target, while more cautious users point to pressure from Asia and cost inflation as grounds for a lower fair value. Narratives empower you to tailor your investment decision to your own insights, helping you act confidently in a changing market.

Do you think there's more to the story for LVMH Moët Hennessy - Louis Vuitton Société Européenne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives