David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Kaufman & Broad S.A. (EPA:KOF) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Kaufman & Broad

How Much Debt Does Kaufman & Broad Carry?

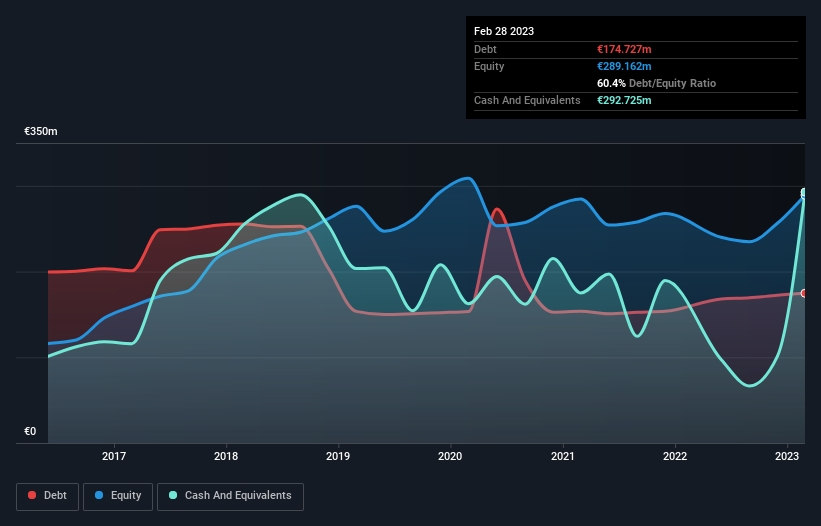

As you can see below, at the end of February 2023, Kaufman & Broad had €174.7m of debt, up from €153.6m a year ago. Click the image for more detail. However, it does have €292.7m in cash offsetting this, leading to net cash of €118.0m.

How Healthy Is Kaufman & Broad's Balance Sheet?

According to the last reported balance sheet, Kaufman & Broad had liabilities of €1.09b due within 12 months, and liabilities of €298.4m due beyond 12 months. On the other hand, it had cash of €292.7m and €685.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €412.4m.

This deficit is considerable relative to its market capitalization of €562.5m, so it does suggest shareholders should keep an eye on Kaufman & Broad's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Despite its noteworthy liabilities, Kaufman & Broad boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, Kaufman & Broad grew its EBIT by 30% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Kaufman & Broad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Kaufman & Broad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Kaufman & Broad produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

Although Kaufman & Broad's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €118.0m. And it impressed us with its EBIT growth of 30% over the last year. So we are not troubled with Kaufman & Broad's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Kaufman & Broad is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Kaufman & Broad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:KOF

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026