Kering (ENXTPA:KER) Divests Beauty Unit and Trims Debt—Is Its Focus on Fashion Paying Off?

Reviewed by Sasha Jovanovic

- Kering SA reported that its group revenue for the third quarter of 2025 was €3.42 billion, representing a 10% decline as reported and a 5% decline on a comparable basis, with performance at Gucci and across the portfolio showing sequential improvement over the previous quarter.

- In parallel, Kering agreed to sell its beauty division and certain fragrance licenses to L'Oréal for €4 billion in cash, aligning with a broader restructuring plan to refocus on fashion and reduce debt while entering a new partnership in luxury beauty, wellness, and longevity sectors.

- We'll explore how Kering's decision to divest its beauty business and cut debt could influence its investment narrative moving forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Kering Investment Narrative Recap

For shareholders in Kering, the core belief centers on the company's ability to revitalize its flagship brands, most notably Gucci, and restore sales momentum after a period of decline. The recent agreement to divest the beauty division to L'Oréal brings in €4 billion cash, easing immediate balance sheet concerns and serving as the key short-term catalyst; however, reigniting sustained demand at Gucci remains critical, while ongoing brand weakness is still the largest risk to the business.

The announcement of Francesca Bellettini as President and CEO of Gucci is especially relevant here, given the role leadership plays in a successful turnaround. Aligning new management with the group’s sharper focus on fashion and core brands fits squarely into the company's urgent efforts to execute on recovery catalysts, yet also brings execution risk if consumer engagement fails to rebound.

In contrast, investors should be aware that persistent revenue pressures and brand fatigue could challenge even well-funded transformation plans if...

Read the full narrative on Kering (it's free!)

Kering's outlook anticipates €17.5 billion in revenue and €1.4 billion in earnings by 2028. This reflects a 3.5% annual revenue growth rate and an earnings increase of €671 million from current earnings of €729 million.

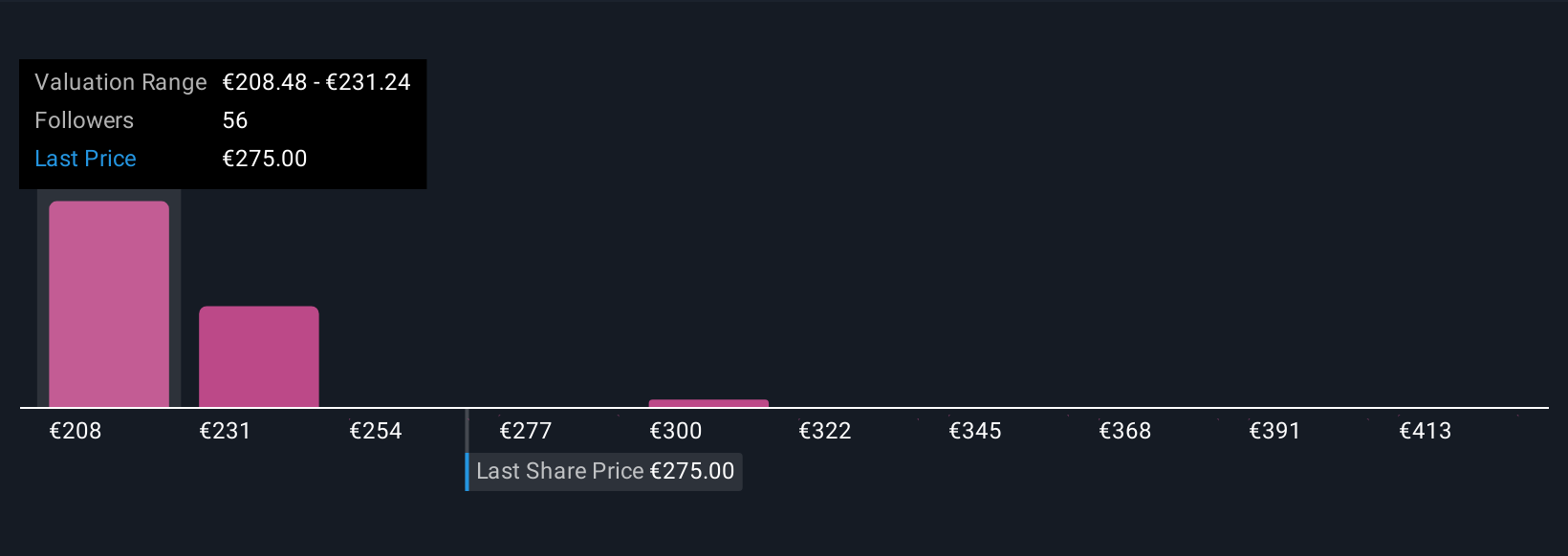

Uncover how Kering's forecasts yield a €252.91 fair value, a 24% downside to its current price.

Exploring Other Perspectives

Six community members on Simply Wall St place Kering's fair value between €250 and €370 per share, highlighting a wide spectrum of opinion. Still, ongoing brand turnaround efforts remain a pivotal factor shaping how the company’s longer-term prospects are viewed by many.

Explore 6 other fair value estimates on Kering - why the stock might be worth 24% less than the current price!

Build Your Own Kering Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kering research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Kering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kering's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives