Is the Recent 27% Rally in Kering Shares Justified in 2025?

Reviewed by Bailey Pemberton

- Curious if Kering’s stock price reflects its true value? You’re not alone. Untangling this question could reveal some intriguing opportunities or potential pitfalls.

- Kering’s shares have seen a wild ride, with a 26.7% jump so far this year. After a recent uptick of just 0.7% in the past week, the stock is still down 8.9% over the last month.

- Recent headlines highlight shifting dynamics in the luxury sector, including changing consumer preferences and competitive pressure from emerging brands. Both factors have contributed to Kering’s volatile share prices. News regarding the company's strategic portfolio adjustments has also contributed to this changing narrative.

- How does Kering stack up on value? Its current valuation score is 0 out of 6, meaning it isn’t undervalued by any of our standard checks. Next, let’s break down how we arrived at that score and why the real story might be even more nuanced.

Kering scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kering Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors judge whether a stock is trading above or below what its future cash generation might justify.

For Kering, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. The company’s latest twelve months Free Cash Flow stands at €1.7 billion. Over the next decade, analysts forecast moderate growth, with projected Free Cash Flow reaching €2.5 billion by 2029. After 2029, future numbers are estimates, extrapolated based on recent trends and analyst expectations, so they come with added uncertainty.

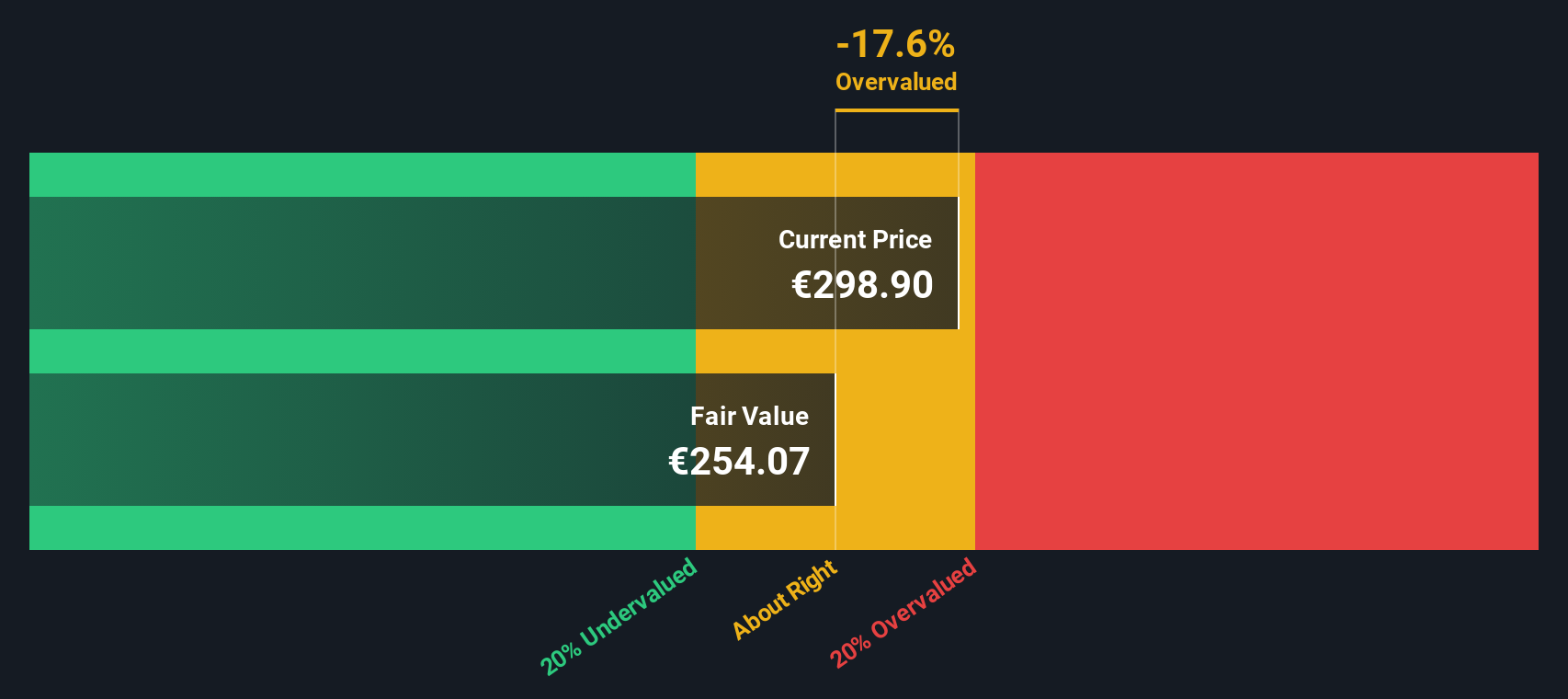

Based on these projections, the DCF calculation sets Kering’s fair value at around €298 per share. Comparing this to its current market price, the implied discount is just 0.2%, suggesting the stock is trading almost exactly in line with its estimated intrinsic value.

Result: ABOUT RIGHT

Kering is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Kering Price vs Earnings

The price-to-earnings (PE) ratio is the preferred multiple for valuing profitable companies like Kering because it directly relates a company’s market price to its earnings. Investors often use the PE ratio to quickly gauge whether a stock is expensive or cheap relative to its profits. This can be especially insightful for companies with stable and predictable earnings streams.

Growth expectations and risk profiles play a big role in determining what constitutes a “normal” or “fair” PE ratio. Fast-growing companies or those perceived as lower risk typically warrant higher PE multiples. In contrast, slower growth or higher risk calls for a lower ratio.

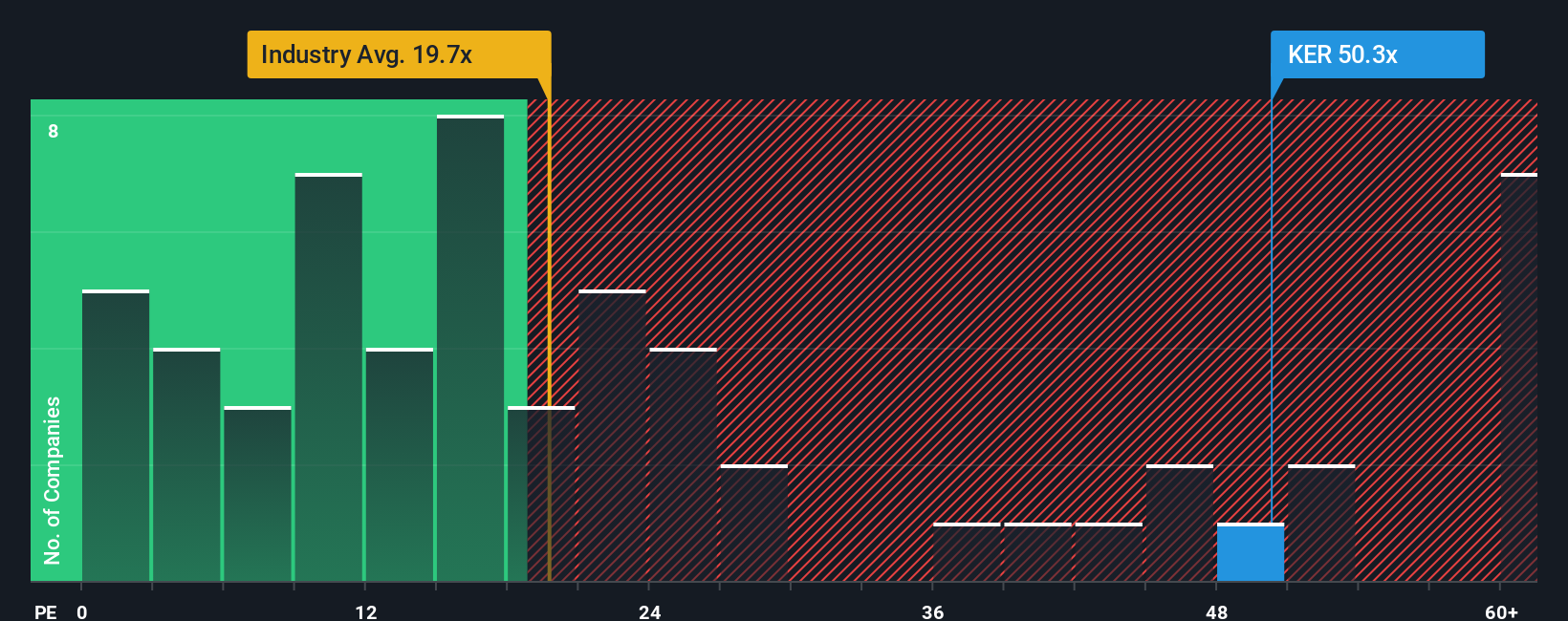

Kering currently trades on a PE ratio of 50.3x. This is well above the luxury industry average of 17.5x and also higher than its peer group’s average of 31.7x. At first glance, this premium might raise concerns about overvaluation.

Simply Wall St’s proprietary “Fair Ratio” offers a deeper perspective. It adjusts for factors including anticipated earnings growth, profit margins, company size and sector-specific risks. This approach provides a more nuanced picture than vanilla peer or industry comparisons can provide. For Kering, the Fair Ratio stands at 36.9x, reflecting the company’s unique profile and growth outlook.

Comparing the current PE (50.3x) to the Fair Ratio (36.9x) suggests the stock is trading notably higher than what these fundamentals justify, pointing to overvaluation using this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kering Narrative

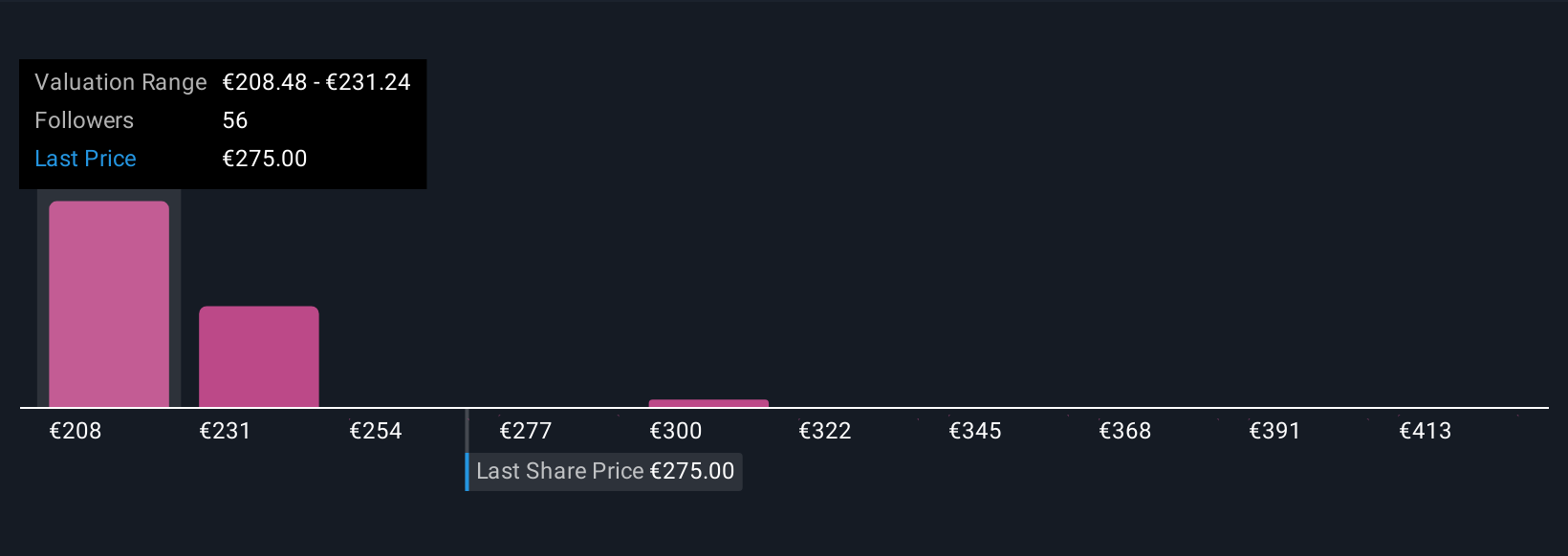

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. This approach allows you to bring a company's numbers to life by attaching a story and future assumptions behind your fair value estimate.

A Narrative connects your unique perspective on Kering, including how you see its revenue, earnings, and profit margins developing over time, to a concrete financial forecast and a calculated fair value. Instead of relying solely on historic ratios or analyst consensus, Narratives let you set out your own expectations, providing a transparent, story-driven logic for every investment decision.

On Simply Wall St’s Community page, Narratives are accessible and easy to use. Millions of investors already share their perspectives this way. Narratives help you track how your fair value estimate compares to the current share price, guiding you to act when there is a meaningful gap between your story and the market’s.

Best of all, Narratives update automatically as fresh company news, sector shifts or earnings releases come in, keeping your investment view relevant and flexible. For example, recent Narratives for Kering span optimistic forecasts (fair value €360) based on effective cost controls and strong leadership, to more cautious outlooks (fair value €135) reflecting creative risks and luxury headwinds. This serves as a powerful reminder that your view matters as much as any analyst’s.

Do you think there's more to the story for Kering? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success