- France

- /

- Consumer Durables

- /

- ENXTPA:ALU10

The Returns On Capital At U10 (EPA:ALU10) Don't Inspire Confidence

What financial metrics can indicate to us that a company is maturing or even in decline? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This indicates the company is producing less profit from its investments and its total assets are decreasing. Having said that, after a brief look, U10 (EPA:ALU10) we aren't filled with optimism, but let's investigate further.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for U10:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0021 = €175k ÷ (€120m - €36m) (Based on the trailing twelve months to December 2020).

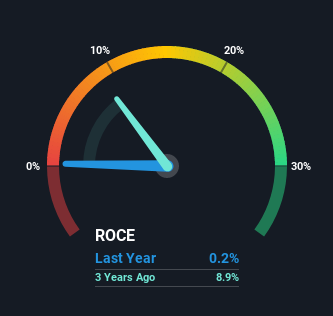

So, U10 has an ROCE of 0.2%. In absolute terms, that's a low return and it also under-performs the Consumer Durables industry average of 9.8%.

View our latest analysis for U10

In the above chart we have measured U10's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering U10 here for free.

What Can We Tell From U10's ROCE Trend?

The trend of ROCE at U10 is showing some signs of weakness. The company used to generate 10% on its capital five years ago but it has since fallen noticeably. What's equally concerning is that the amount of capital deployed in the business has shrunk by 30% over that same period. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a related note, U10 has decreased its current liabilities to 30% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Bottom Line

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. It should come as no surprise then that the stock has fallen 46% over the last five years, so it looks like investors are recognizing these changes. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

If you'd like to know more about U10, we've spotted 2 warning signs, and 1 of them is potentially serious.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade U10, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALU10

U10

Develops and distributes household linen and decorative articles in France.The company offers a range of curtains, net curtains, cushions, bed linen, terry towels, shower curtains, bath mats, armchair covers, sofa covers, throws, table linen, blinds, rods sets under the Douceur d'intérieur brand; and tableware, scented and glass candles, LED, sent, storage, kitchen bottles and boxes, decoeation products, brushes, cloths, and sponges under the Homea brand.

Fair value with moderate growth potential.

Market Insights

Community Narratives