Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Piscines Desjoyaux SA (EPA:ALPDX) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Piscines Desjoyaux

What Is Piscines Desjoyaux's Debt?

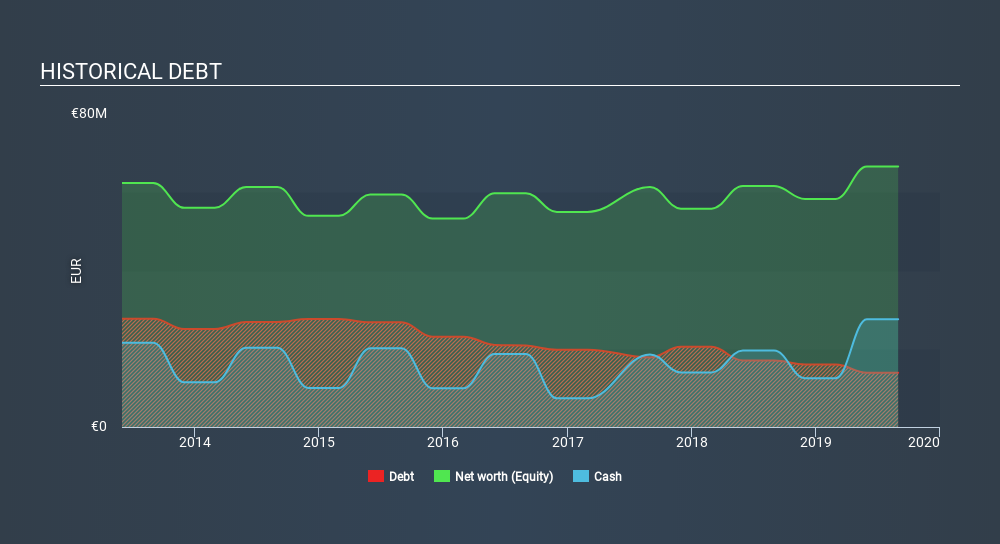

As you can see below, Piscines Desjoyaux had €13.9m of debt at August 2019, down from €17.0m a year prior. But it also has €27.5m in cash to offset that, meaning it has €13.6m net cash.

How Healthy Is Piscines Desjoyaux's Balance Sheet?

The latest balance sheet data shows that Piscines Desjoyaux had liabilities of €25.7m due within a year, and liabilities of €10.5m falling due after that. On the other hand, it had cash of €27.5m and €10.0m worth of receivables due within a year. So it can boast €1.32m more liquid assets than total liabilities.

This state of affairs indicates that Piscines Desjoyaux's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the €96.0m company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that Piscines Desjoyaux has more cash than debt is arguably a good indication that it can manage its debt safely.

In addition to that, we're happy to report that Piscines Desjoyaux has boosted its EBIT by 79%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Piscines Desjoyaux's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Piscines Desjoyaux may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Piscines Desjoyaux generated free cash flow amounting to a very robust 88% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Piscines Desjoyaux has net cash of €13.6m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of €15m, being 88% of its EBIT. So we don't think Piscines Desjoyaux's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Piscines Desjoyaux you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:ALPDX

Piscines Desjoyaux

Designs, manufactures, and markets swimming pools and related products in France and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives