- Switzerland

- /

- Aerospace & Defense

- /

- SWX:AERO

European Stocks Estimated Below Intrinsic Value In October 2025

Reviewed by Simply Wall St

As European markets reach record levels, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are keenly assessing opportunities for undervalued stocks across the continent. In this environment, identifying stocks trading below their intrinsic value can offer potential for growth, particularly when supported by strong fundamentals and favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SBO (WBAG:SBO) | €27.20 | €53.30 | 49% |

| Profoto Holding (OM:PRFO) | SEK17.80 | SEK35.06 | 49.2% |

| Nexam Chemical Holding (OM:NEXAM) | SEK3.76 | SEK7.47 | 49.7% |

| Micro Systemation (OM:MSAB B) | SEK62.40 | SEK122.50 | 49.1% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.19 | 49.1% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.30 | €12.55 | 49.8% |

| Echo Investment (WSE:ECH) | PLN5.48 | PLN10.71 | 48.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.40 | €6.59 | 48.4% |

| Atea (OB:ATEA) | NOK143.20 | NOK279.95 | 48.8% |

| Absolent Air Care Group (OM:ABSO) | SEK258.00 | SEK501.95 | 48.6% |

Underneath we present a selection of stocks filtered out by our screen.

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally with a market cap of €7.88 billion.

Operations: The company's revenue segments include Germany with €3.46 billion, Central Europe with €775.20 million, North-Western Europe with €2.09 billion, and Global Services Energy contributing €483.40 million.

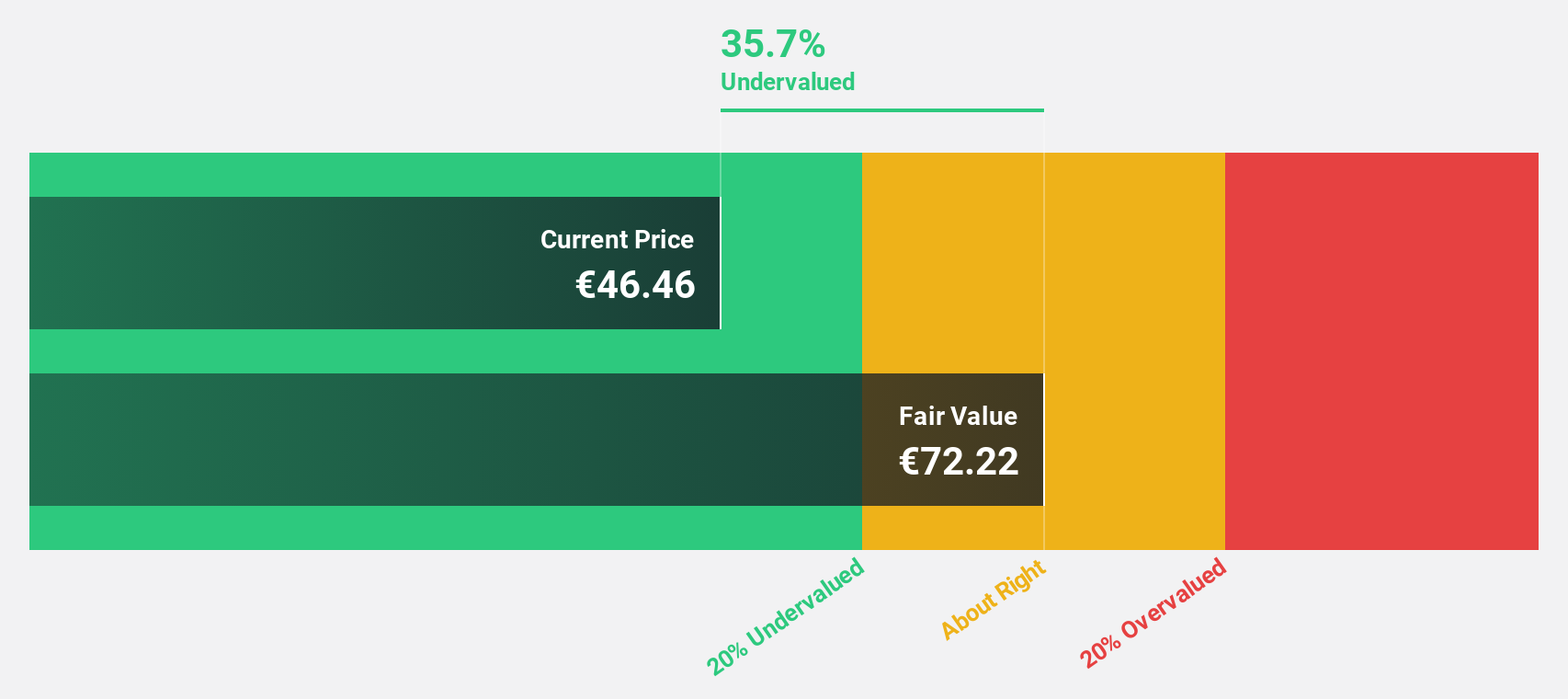

Estimated Discount To Fair Value: 41.8%

SPIE is trading at €46.9, significantly below its estimated fair value of €80.56, suggesting it may be undervalued based on cash flows. Despite a high debt level and unstable dividend history, SPIE's earnings are forecast to grow 21.3% annually, outpacing the French market's growth rate of 12.2%. However, recent financial results reported a net loss for H1 2025, contrasting with the previous year's profit and indicating potential volatility in performance.

- Our comprehensive growth report raises the possibility that SPIE is poised for substantial financial growth.

- Navigate through the intricacies of SPIE with our comprehensive financial health report here.

STMicroelectronics (ENXTPA:STMPA)

Overview: STMicroelectronics N.V. is a company that designs, develops, manufactures, and sells semiconductor products across various regions including Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €22.03 billion.

Operations: STMicroelectronics generates revenue from its Power and Discrete Products segment, which accounts for $2.76 billion, and its Analog, MEMS & Sensors Group segment, contributing $4.22 billion.

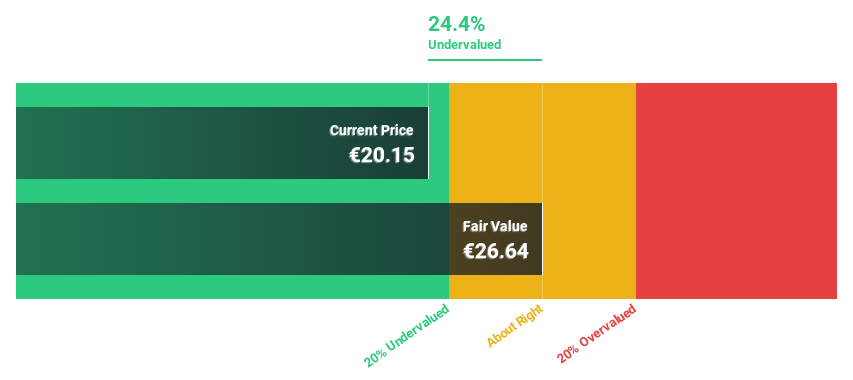

Estimated Discount To Fair Value: 11.8%

STMicroelectronics is trading at €24.7, slightly below its estimated fair value of €28, reflecting limited undervaluation based on cash flows. Despite a recent net loss and reduced profit margins, the company forecasts significant earnings growth of 34.8% annually over the next three years, surpassing French market expectations. Recent advancements in automotive sensing systems and silicon photonics highlight STMicroelectronics' strategic focus on innovation and technological leadership in high-growth sectors.

- Our expertly prepared growth report on STMicroelectronics implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of STMicroelectronics.

Montana Aerospace (SWX:AERO)

Overview: Montana Aerospace AG designs, develops, and manufactures system components and complex assemblies globally, with a market cap of CHF1.72 billion.

Operations: The company's revenue is primarily derived from its Aerostructures segment at €836.54 million and Energy segment at €687.64 million.

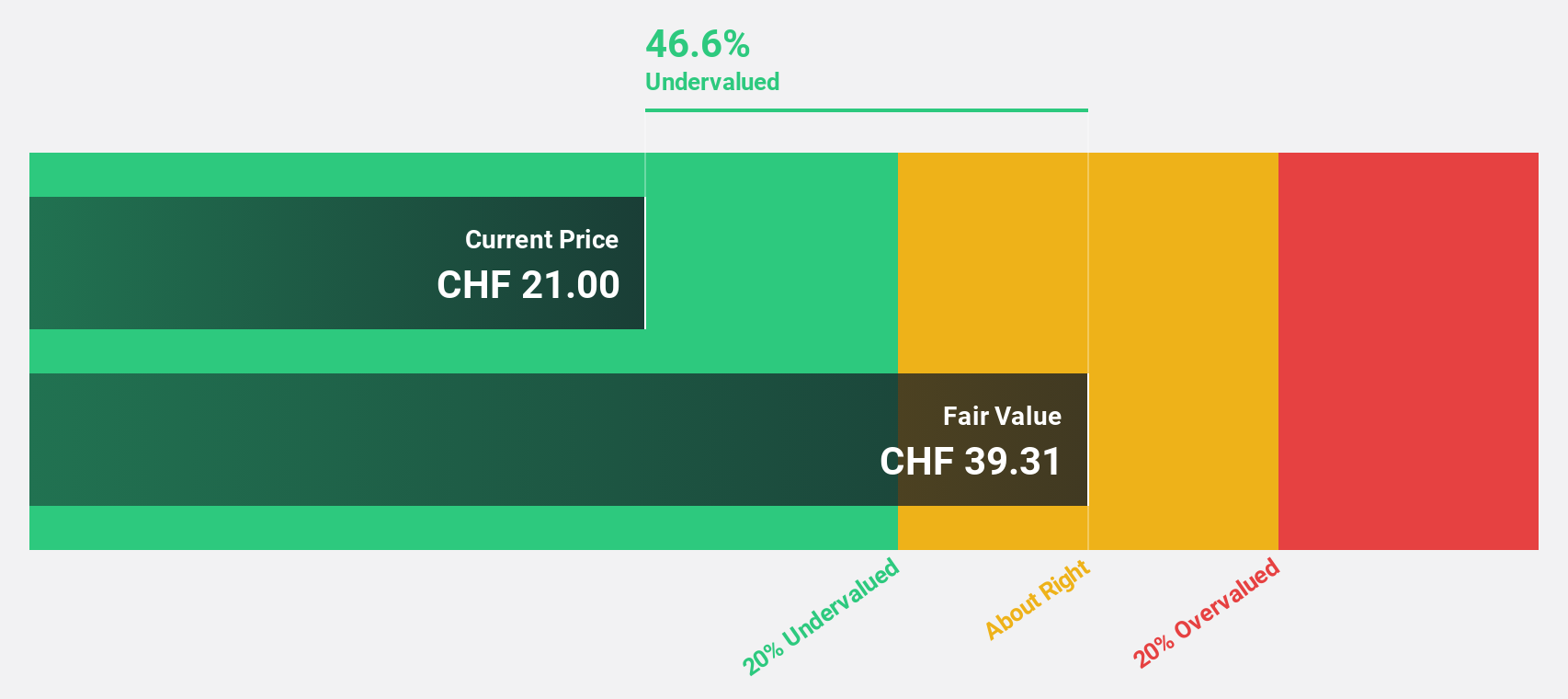

Estimated Discount To Fair Value: 31.4%

Montana Aerospace, trading at CHF27.5, is significantly undervalued with an estimated fair value of CHF40.09. Its earnings are expected to grow substantially at 55% annually over the next three years, outperforming the Swiss market's growth rate of 10.7%. Recent financial results show improved profitability with net income reaching EUR 6.39 million for H1 2025 compared to a loss last year, reinforcing its potential as an undervalued investment based on cash flows.

- The growth report we've compiled suggests that Montana Aerospace's future prospects could be on the up.

- Take a closer look at Montana Aerospace's balance sheet health here in our report.

Next Steps

- Click here to access our complete index of 205 Undervalued European Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AERO

Montana Aerospace

Montana Aerospace AG design, develop, and manufacture system components and complex assemblies worldwide.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success