- France

- /

- Commercial Services

- /

- ENXTPA:SPIE

A Fresh Look at SPIE (ENXTPA:SPIE) Valuation Following Upbeat Q3 2025 Earnings and Raised Guidance

Reviewed by Simply Wall St

SPIE (ENXTPA:SPIE) just wrapped up its Q3 2025 earnings call and issued updated guidance for the year. The company signaled that revenue will exceed €10 billion, boosted by further organic growth and active bolt-on acquisitions.

See our latest analysis for SPIE.

SPIE’s upbeat Q3 and forward-looking guidance have kept the spotlight on the stock, even as the share price pulled back 7.7% over the last month and nearly 19% in the most recent quarter. Despite these short-term swings, SPIE boasts a strong 40.3% total shareholder return over the past 12 months, with longer-term investors seeing their returns nearly triple in three years and almost triple again over five years. These are clear signs that momentum is still very much on their side.

If the latest growth signals have you searching for what else could be on the move, now is a great time to broaden your search and discover fast growing stocks with high insider ownership.

The question now is whether SPIE’s impressive long-term run and strong outlook mean the stock is trading at a bargain, or if the market has already factored in all the good news and future potential.

Most Popular Narrative: 19.1% Undervalued

The most widely followed valuation narrative puts SPIE’s fair value at €53, well above the last close of €42.88. This suggests significant upside potential, as the market price lags the value projected by consensus estimates.

The evolving mix toward higher-value services (e.g., Transmission & Distribution, High Voltage, battery storage, and data centers), combined with rigorous contract selection and pricing discipline, is enabling SPIE to deliver consistent margin expansion and support robust earnings growth.

Want to see what’s driving that bold fair value? The narrative’s foundation lies in strategic service shifts and a future profit multiple that would surprise most investors. Curious which ambitious growth levers and profit boosters set this story apart? Unlock the blueprint behind those assumptions inside the full narrative.

Result: Fair Value of €53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, SPIE’s reliance on core European markets and ongoing skilled labor shortages could disrupt growth and challenge the optimistic valuation narrative.

Find out about the key risks to this SPIE narrative.

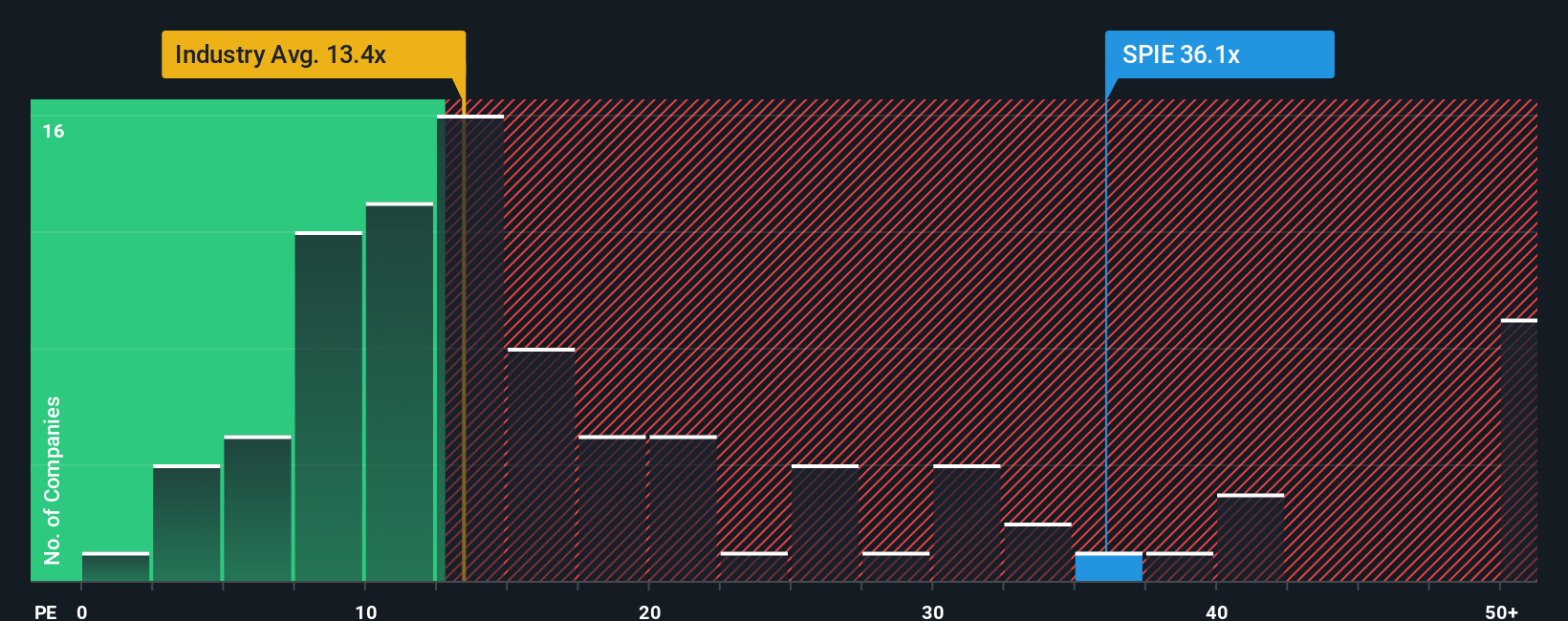

Another View: Price-to-Earnings Tells a Different Story

While the consensus points to SPIE being undervalued, a closer look at its price-to-earnings ratio suggests caution. SPIE trades at 35.5 times earnings, far above the European industry average of 13.4x and even its peer average of 14.6x. The fair ratio, based on market trends, sits at 18.9x. This means SPIE's stock is priced well above where the market might typically value similar businesses. Such a high premium leaves little margin for error and could expose investors to greater downside risk if expectations fall short. Does the strong outlook truly justify the rich valuation, or is the market already ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SPIE Narrative

If you have a different perspective or would rather analyze the numbers through your own lens, you can generate a personalized narrative in just a few minutes. Do it your way.

A great starting point for your SPIE research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Put yourself ahead by checking out the latest stocks shaking up different corners of the market. Don’t miss the chance to find your next big win with these carefully curated ideas:

- Boost your portfolio with steady cash flow and yields above 3 percent by checking out these 14 dividend stocks with yields > 3% offering reliable long-term income potential.

- Tap into cutting-edge growth and innovation. See which breakthrough companies are driving real results with these 27 AI penny stocks now powering advancements across industries.

- Unlock hidden gems trading below their true value through these 881 undervalued stocks based on cash flows, delivering outstanding upside for value-minded investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SPIE

SPIE

Provides multi-technical services in the areas of energy and communications in France, Germany, the Netherlands, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives