- France

- /

- Commercial Services

- /

- ENXTPA:ELIS

Elis'(EPA:ELIS) Share Price Is Down 39% Over The Past Three Years.

While not a mind-blowing move, it is good to see that the Elis SA (EPA:ELIS) share price has gained 23% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 39% in the last three years, significantly under-performing the market.

View our latest analysis for Elis

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

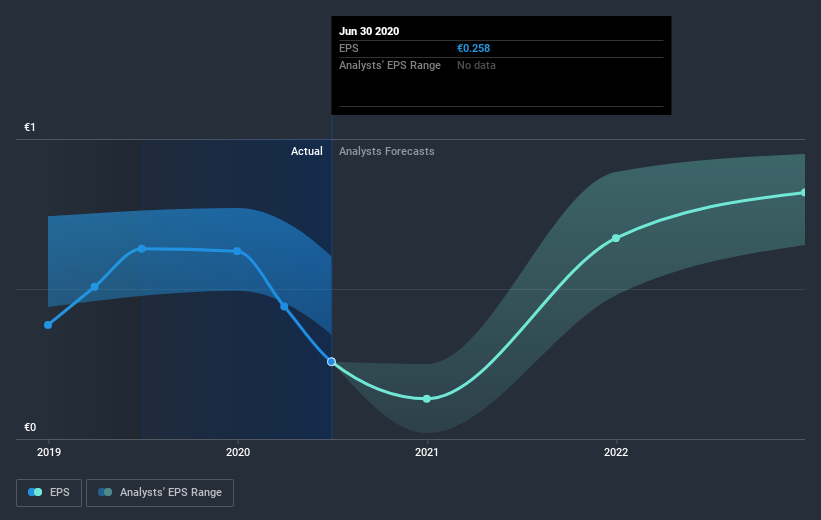

Elis saw its EPS decline at a compound rate of 29% per year, over the last three years. This fall in the EPS is worse than the 15% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. This positive sentiment is also reflected in the generous P/E ratio of 51.76.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Elis' key metrics by checking this interactive graph of Elis's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Elis' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Elis shareholders, and that cash payout explains why its total shareholder loss of 36%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Elis shareholders are down 24% for the year. Unfortunately, that's worse than the broader market decline of 0.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 1.0%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Elis better, we need to consider many other factors. For example, we've discovered 4 warning signs for Elis (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course Elis may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading Elis or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Elis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ELIS

Elis

Engages in the provision of flat linen, workwear, and hygiene and well-being solutions in France, Central Europe, Scandinavia, Eastern Europe, the United Kingdom, Ireland, Latin America, Southern Europe, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives