- France

- /

- Commercial Services

- /

- ENXTPA:ELIS

Elis (ENXTPA:ELIS): Assessing Valuation Following This Week’s Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Elis.

While Elis shares have eased back this week, their momentum over the past year is hard to overlook. The share price is up nearly 28% year-to-date and there is a robust 27.5% total shareholder return for the year. This latest blip follows a strong multi-year run and points to investors reassessing value and growth potential as recent gains cool slightly.

If this shift in Elis’ trajectory has you curious about other opportunities, now is the perfect moment to widen your view and discover fast growing stocks with high insider ownership

Given Elis’ moderate valuation discount and robust long-term performance, the key question for investors is whether today’s dip unlocks hidden value, or if strong fundamentals are already reflected in the stock price.

Most Popular Narrative: 12.2% Undervalued

Elis’s last close of €24.16 sits notably below the fair value outlined in the most followed narrative, suggesting a meaningful valuation gap. The narrative brings together aggressive growth, sector momentum, and recurring revenues as core pillars driving this view.

Persistent outsourcing momentum across healthcare, workwear, and cleanroom segments, supported by stricter hygiene requirements and regulations, continues to drive new contract wins and organic revenue growth. This aligns Elis with high-visibility, recurring revenue streams. Rising client and regulatory focus on sustainability and the circular economy is enabling Elis to leverage its expertise in closed-loop textile management and demonstrable decarbonisation initiatives. Improved ESG scores and tangible client engagement are also evident, which should support pricing power and margin expansion.

Want the real story behind this price target? This narrative stakes its fair value on forecast improvements in margin and substantial revenue growth. There is a bold projection about future earnings expansion that could surprise you. Dive in to see how the narrative calculates upside from these quantitative drivers.

Result: Fair Value of €27.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant margin pressure in Latin America or unexpected weakness in the hospitality sector could quickly challenge this optimistic outlook for Elis.

Find out about the key risks to this Elis narrative.

Another View: Multiples Tell a Different Story

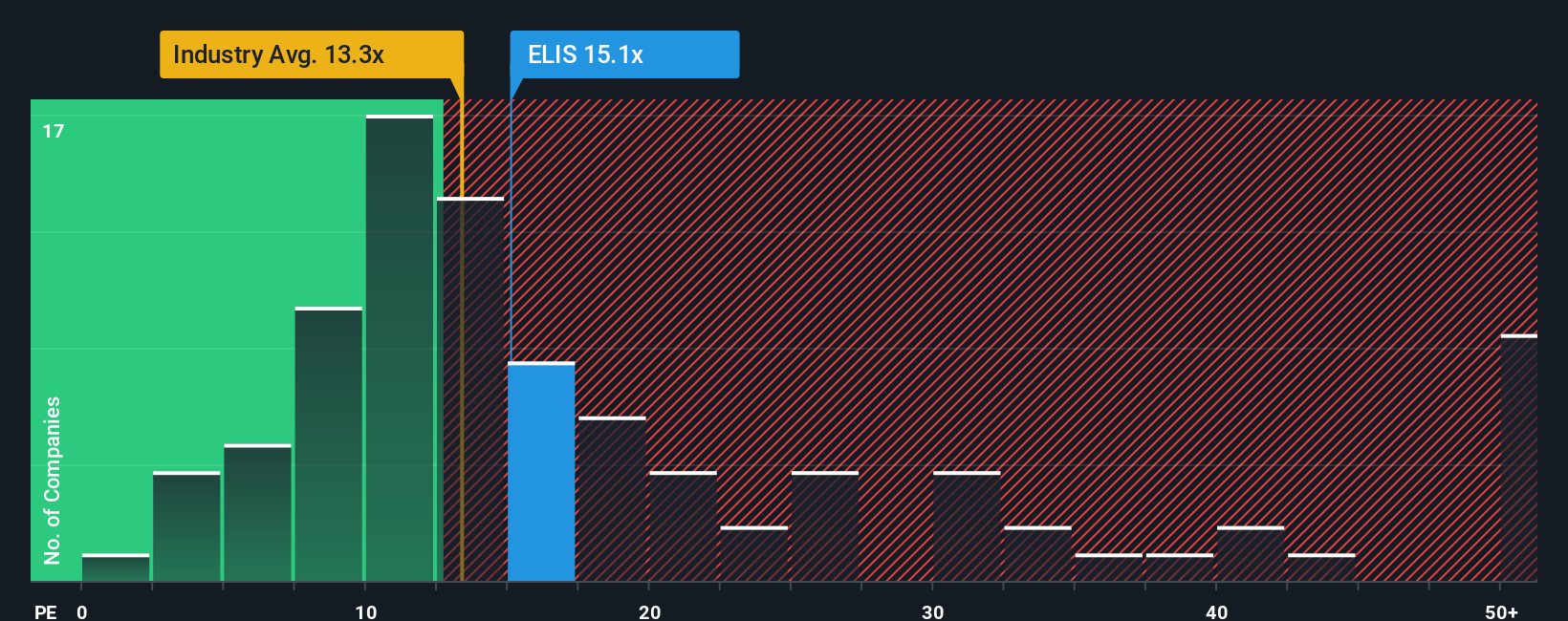

Looking through a different lens, Elis is trading on a price-to-earnings ratio of 15.1x. This is higher than the European Commercial Services industry average of 13.7x and above the estimated fair ratio of 14.6x. While it is cheaper than the peer group average at 17.9x, the premium over the industry and fair ratio could signal limited upside or valuation risk if growth expectations are not met. So which view is truer to Elis’s future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Elis Narrative

Whether you have a different take or prefer hands-on analysis, you can dig into the numbers and shape your own story about Elis in just a few minutes. Do it your way.

A great starting point for your Elis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Opportunities?

If you want the edge in today’s market, don’t stop at Elis. The Simply Wall Street Screener has handpicked ideas for smart investors seeking their next big win.

- Maximize your income potential by tapping into these 14 dividend stocks with yields > 3% that have standout yields above 3% and a record of strong financial performance.

- Get ahead of tomorrow’s tech trends by exploring these 26 AI penny stocks where innovation in artificial intelligence could fuel exceptional growth.

- Catch the early movers by uncovering value in these 3581 penny stocks with strong financials that combine solid financials with breakthrough potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELIS

Elis

Engages in the provision of flat linen, workwear, and hygiene and well-being solutions in France, Central Europe, Scandinavia, Eastern Europe, the United Kingdom, Ireland, Latin America, Southern Europe, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success