- Switzerland

- /

- Electric Utilities

- /

- SWX:NEAG

Uncovering Undiscovered Gems in Europe for July 2025

Reviewed by Simply Wall St

As the European markets experience a mixed landscape with indices like the STOXX Europe 600 showing modest gains amidst trade deal optimism, investors are keenly watching for opportunities that may arise from economic shifts such as the UK's contracting GDP and fluctuating industrial outputs in Germany and Italy. In this environment, identifying stocks that demonstrate resilience and potential growth despite broader market challenges can be particularly rewarding for those looking to explore lesser-known opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Groupe CRIT (ENXTPA:CEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Groupe CRIT SA offers temporary work and recruitment services both in France and internationally, with a market capitalization of approximately €686.93 million.

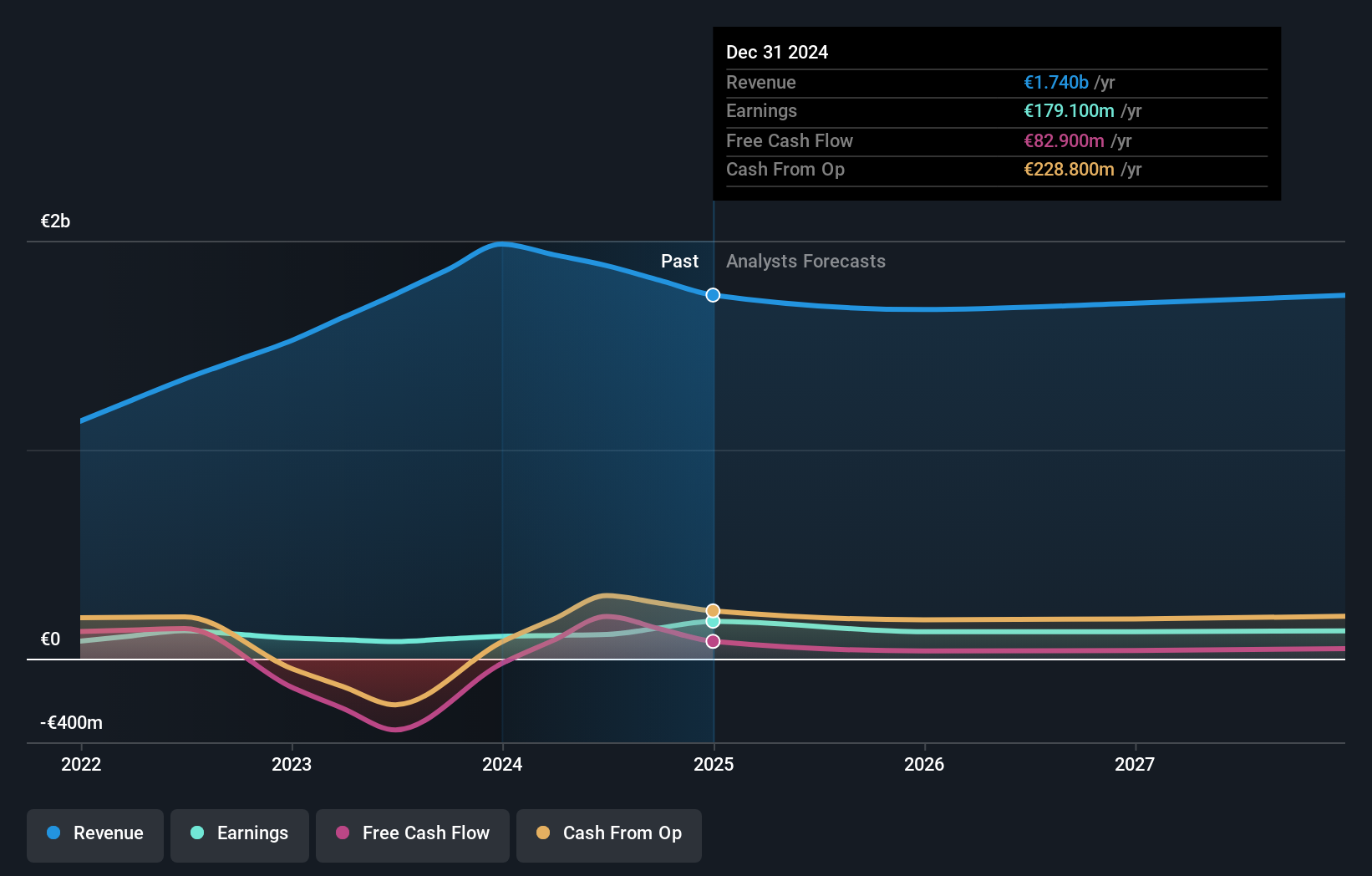

Operations: The company's primary revenue stream comes from its Temporary Work segment, generating approximately €2.60 billion, followed by Multiservices - Airport services at €422.77 million and Multiservices - Other Services at €130.38 million. The net profit margin is a key financial metric to consider when evaluating the company's profitability trends over time.

Groupe CRIT, a notable player in the staffing industry, exhibits strong fundamentals despite its smaller market presence. With earnings growth of 0.3% last year, it outpaced the broader Professional Services industry's -6.3% performance. The company's debt is well-managed with an interest coverage ratio of 41x EBIT, and it holds more cash than total debt, underscoring financial stability. Trading at 67% below estimated fair value highlights potential for upside in valuation. Looking ahead, earnings are forecasted to grow by 8%, suggesting promising prospects for investors seeking opportunities in under-the-radar European stocks.

- Click here and access our complete health analysis report to understand the dynamics of Groupe CRIT.

Review our historical performance report to gain insights into Groupe CRIT's's past performance.

Caisse Régionale de Crédit Agricole du Morbihan (ENXTPA:CMO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole du Morbihan offers a range of banking products and services to diverse clients including individuals, professionals, farmers, and local authorities in France with a market cap of €439.87 million.

Operations: The company generates its revenue primarily from the retail banking segment, which accounted for €229.27 million.

Crédit Agricole du Morbihan, with €13.7B in assets and €2.1B in equity, stands out for its robust financial health. The bank's total deposits of €11.0B and loans of €11.4B are primarily funded by low-risk customer deposits, comprising 96% of liabilities. Its earnings surged by 33% over the past year, significantly outpacing the industry average of 3.2%. With a sufficient allowance for bad loans at 105% and non-performing loans at a manageable 1.8%, it trades at an attractive valuation, being priced 30% below its estimated fair value according to our analysis.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand in Switzerland and internationally, with a market capitalization of CHF1.03 billion.

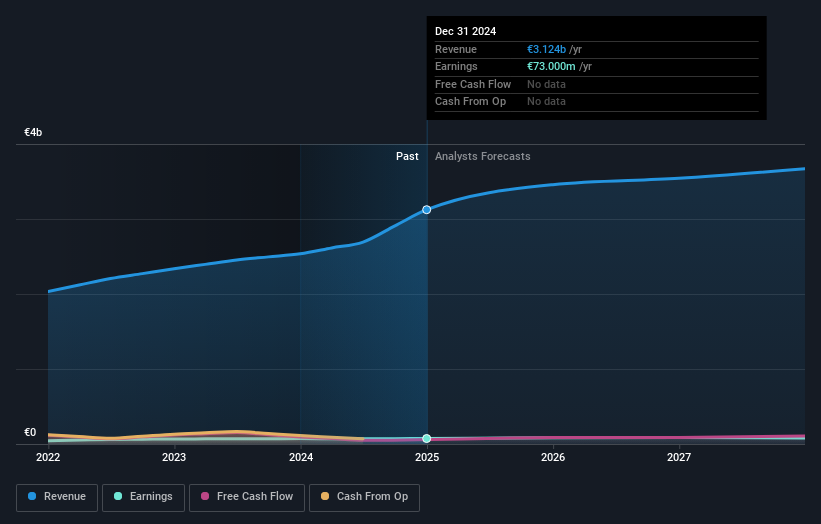

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.03 billion), Renewable Generation Infrastructure (€903.30 million), and System Relevant Infrastructure (€455.10 million). The company's financial structure is significantly influenced by its focus on these key segments, reflecting a diversified approach to revenue generation within the energy sector.

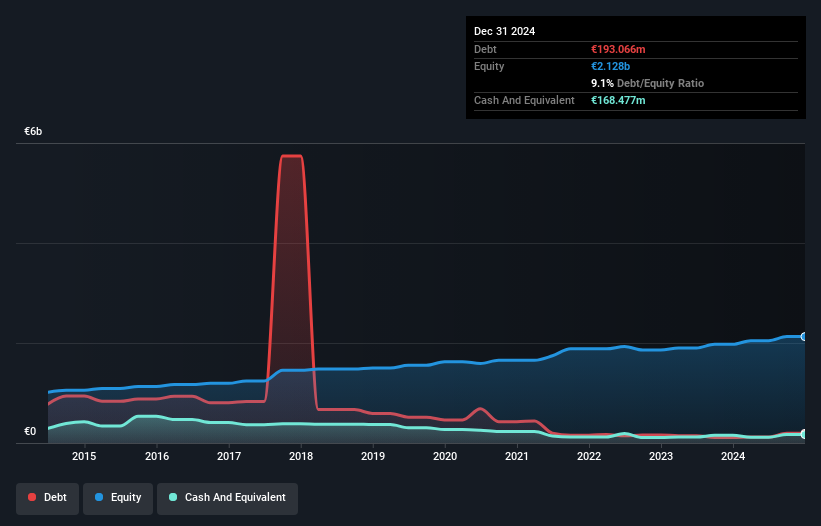

Naturenergie Holding, a player in the European energy sector, has shown impressive earnings growth of 67.2% over the past year, outpacing its industry peers who saw a -4.1% change. The company's debt management appears robust with interest payments well covered by EBIT at 253 times, and its debt-to-equity ratio improved from 10.9 to 8 over five years. Trading at a price-to-earnings ratio of just 6.2x compared to the Swiss market's average of 20.4x suggests it offers good value relative to peers despite forecasts indicating an average earnings decline of 9.4% annually for the next three years.

- Navigate through the intricacies of naturenergie holding with our comprehensive health report here.

Understand naturenergie holding's track record by examining our Past report.

Seize The Opportunity

- Dive into all 322 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NEAG

naturenergie holding

Through its subsidiaries, engages in the production, distribution, and sale of electricity under the naturenergie brand in Switzerland and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives