Clínica Baviera And 2 Other European Small Caps With Strong Potential

Reviewed by Simply Wall St

The European market has recently shown resilience, with the STOXX Europe 600 Index rising by 0.65%, buoyed by easing trade tensions and slowing inflation in key economies like Germany and Italy. As investors navigate these shifting dynamics, small-cap stocks present intriguing opportunities, particularly those demonstrating robust fundamentals and adaptability to economic changes.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★★☆

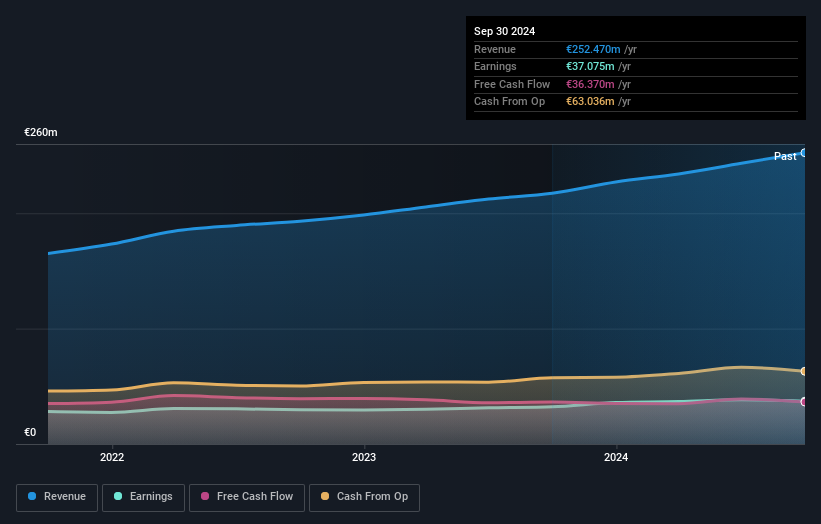

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe with a market cap of €669.04 million.

Operations: Clínica Baviera generates its revenue primarily from its network of ophthalmology clinics in Spain and Europe. The company has a market capitalization of €669.04 million, indicating its significant presence in the medical sector.

Clínica Baviera, a nimble player in the healthcare sector, showcases robust financial health with its debt-to-equity ratio dropping from 64.1% to 5.7% over five years and earnings growing at an impressive 20.8% annually during the same period. Trading at about 18.8% below estimated fair value, it presents a compelling opportunity for investors seeking undervalued stocks with potential upside. Despite not outpacing industry growth recently, its interest payments are covered by EBIT nearly 50 times over, underscoring solid financial management and stability within this dynamic market space.

Groupe CRIT (ENXTPA:CEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Groupe CRIT SA is a company that specializes in providing temporary work and recruitment services both in France and internationally, with a market capitalization of approximately €754.36 million.

Operations: Groupe CRIT generates revenue primarily from its Temporary Work segment, which accounts for approximately €2.60 billion. The Multiservices segment contributes through Airport Services and Other Services, totaling around €553.15 million after eliminating inter-segment transactions of about €33.95 million.

Groupe CRIT, a notable player in the European staffing and services sector, has shown resilience with its earnings growing by EUR 0.2 million to EUR 73 million for the year ending December 2024. The company is trading at an attractive value, estimated to be significantly below its fair market value. Its net income growth is modest but steady, which aligns with its strategic financial management. Additionally, Groupe CRIT announced a dividend of €6 per share payable in July 2025, signaling confidence in future cash flows and shareholder returns despite industry challenges.

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic region, Europe, North America, Asia, and internationally with a market cap of SEK13.56 billion.

Operations: Lesjöfors and Beijer Tech are the primary revenue segments for Beijer Alma, generating SEK4.95 billion and SEK2.40 billion respectively.

Beijer Alma, a notable player in the machinery sector, has been on an impressive trajectory with earnings surging 39% over the past year, outpacing industry growth of 2.8%. Trading at SEK 201.0, it's considered undervalued by around 30% relative to its fair value estimate. The company's net debt to equity ratio is high at 57.1%, but interest payments are well covered with EBIT at a healthy 5.3x coverage. Recent strategic moves include expanding operations globally through acquisitions and focusing on operational efficiencies within Lesjöfors and Beijer Tech divisions to bolster margins and profitability further.

Make It Happen

- Click here to access our complete index of 331 European Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives