- France

- /

- Professional Services

- /

- ENXTPA:BVI

Do These 3 Checks Before Buying Bureau Veritas SA (EPA:BVI) For Its Upcoming Dividend

Readers hoping to buy Bureau Veritas SA (EPA:BVI) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Meaning, you will need to purchase Bureau Veritas' shares before the 5th of July to receive the dividend, which will be paid on the 7th of July.

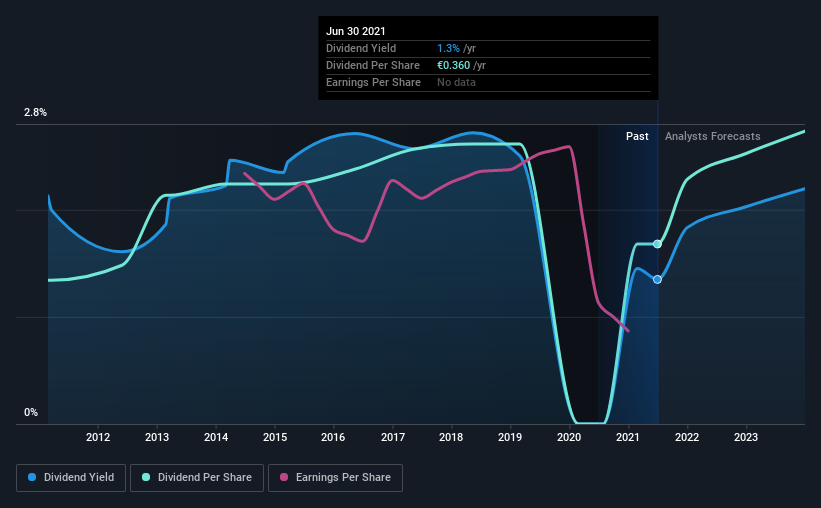

The company's next dividend payment will be €0.36 per share, and in the last 12 months, the company paid a total of €0.36 per share. Looking at the last 12 months of distributions, Bureau Veritas has a trailing yield of approximately 1.3% on its current stock price of €26.68. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Bureau Veritas has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Bureau Veritas

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Bureau Veritas distributed an unsustainably high 129% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. What's good is that dividends were well covered by free cash flow, with the company paying out 4.5% of its cash flow last year.

It's good to see that while Bureau Veritas's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Bureau Veritas's earnings per share have fallen at approximately 14% a year over the previous five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Bureau Veritas has increased its dividend at approximately 2.3% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Bureau Veritas is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

The Bottom Line

Is Bureau Veritas worth buying for its dividend? It's never great to see earnings per share declining, especially when a company is paying out 129% of its profit as dividends, which we feel is uncomfortably high. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Although, if you're still interested in Bureau Veritas and want to know more, you'll find it very useful to know what risks this stock faces. In terms of investment risks, we've identified 3 warning signs with Bureau Veritas and understanding them should be part of your investment process.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Bureau Veritas, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bureau Veritas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:BVI

Bureau Veritas

Provides laboratory testing, inspection, and certification services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026