- France

- /

- Professional Services

- /

- ENXTPA:BVI

Bureau Veritas (ENXTPA:BVI): Assessing Valuation After Recent 10% Share Price Rise

Reviewed by Simply Wall St

Bureau Veritas (ENXTPA:BVI) shares have seen a steady climb over the past month, gaining more than 10%. Investors are taking note of the company’s recent momentum as they look for clues about whether this move could continue.

See our latest analysis for Bureau Veritas.

While Bureau Veritas has enjoyed a strong 1-month share price return of nearly 11%, this builds on a longer-term track record reflected in a 1-year total shareholder return of 1.3% and an impressive 73.5% gain over five years. Momentum seems to be picking up again, suggesting that market sentiment around its growth story is strengthening.

If you're looking to spot the next potential risers, now is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares up sharply in recent weeks, investors may be wondering whether Bureau Veritas is trading below its true value or if the current price fully reflects its growth prospects. Is there still a buying opportunity, or is the market already factoring in the future?

Most Popular Narrative: 15.3% Undervalued

Bureau Veritas is trading at €28.72, while the most followed narrative calculates a fair value close to €33.93 using a specialist discount rate. That’s a significant gap, hinting at meaningful upside according to consensus forecasts.

The company's rapid expansion into high-growth areas such as sustainability and cybersecurity services positions it to capture outsized revenue gains and potential margin uplift as client demand for ESG reporting, supply chain audits, renewable energy projects, and cyber assurance intensifies globally.

Want to see which powerful levers push this stock’s valuation higher? Discover what financial forecasts and strategic moves are baked into this bold price target. The numbers might surprise you. See how a unique blend of market trends and management ambitions shapes what could be a breakout value story.

Result: Fair Value of $33.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, earnings targets could falter if acquisitions underperform or if currency volatility persists, both of which may pressure margins in coming years.

Find out about the key risks to this Bureau Veritas narrative.

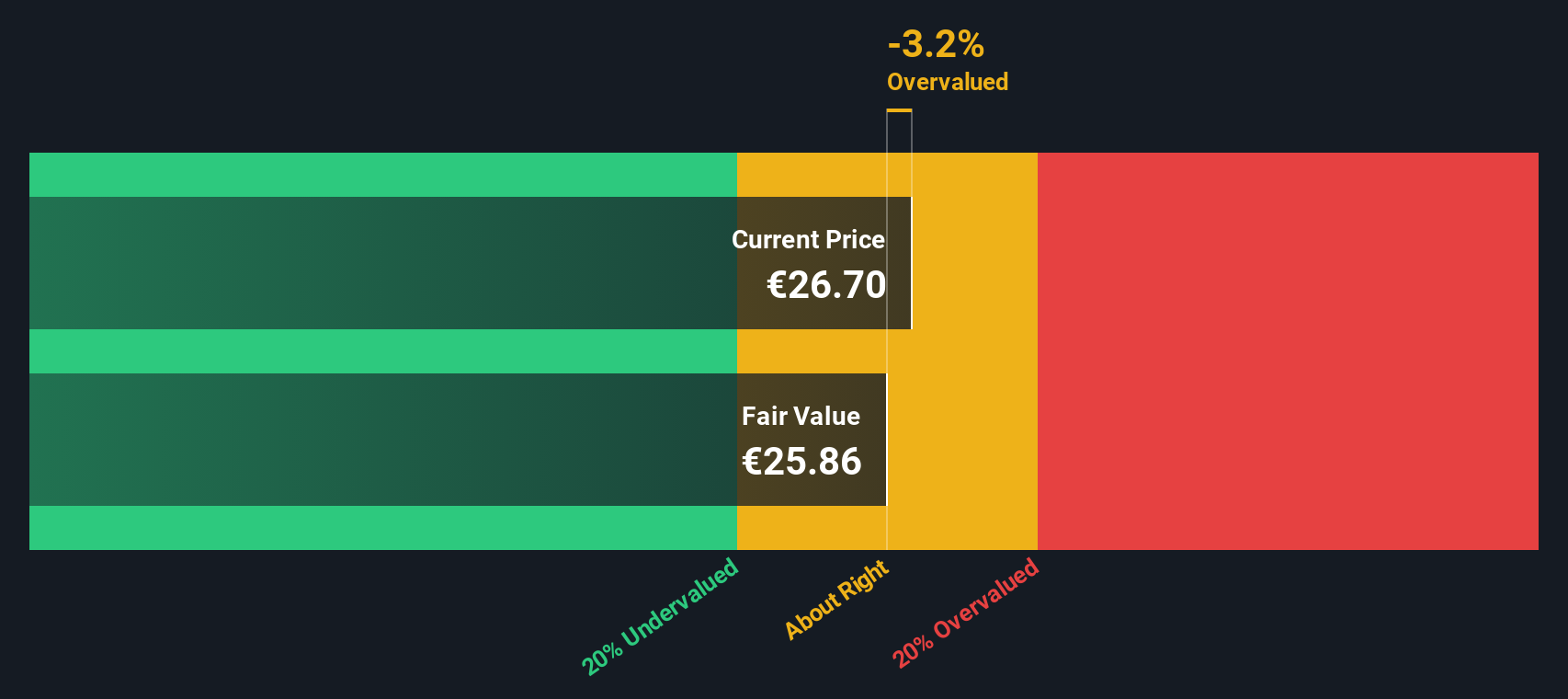

Another View: SWS DCF Model Offers a Cautious Perspective

While analyst forecasts suggest Bureau Veritas could be worth over €33 per share, our DCF model values the shares at €25.99, which is below today’s price. This points to a potential overvaluation if growth does not meet optimistic expectations. Are analysts overlooking possible risks in their outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bureau Veritas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bureau Veritas Narrative

If you think there’s more to the story, or want to build your own investment case using the data and insights available, you can create your own analysis in just a few minutes. Do it your way

A great starting point for your Bureau Veritas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors are already using the Simply Wall Street Screener to spot hidden opportunities others are missing. Don’t let your next winning pick slip by.

- Tap into tomorrow’s market movers by checking out these 3559 penny stocks with strong financials with strong financials and standout momentum.

- Pinpoint robust income potential as you review these 17 dividend stocks with yields > 3% paying yields above 3% and fueling steady returns for shareholders.

- Stay ahead of the curve by screening these 27 AI penny stocks that lead innovation in machine learning and artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bureau Veritas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BVI

Bureau Veritas

Provides laboratory testing, inspection, and certification services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives