- France

- /

- Professional Services

- /

- ENXTPA:AAA

Some Confidence Is Lacking In Alan Allman Associates (EPA:AAA) As Shares Slide 29%

The Alan Allman Associates (EPA:AAA) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

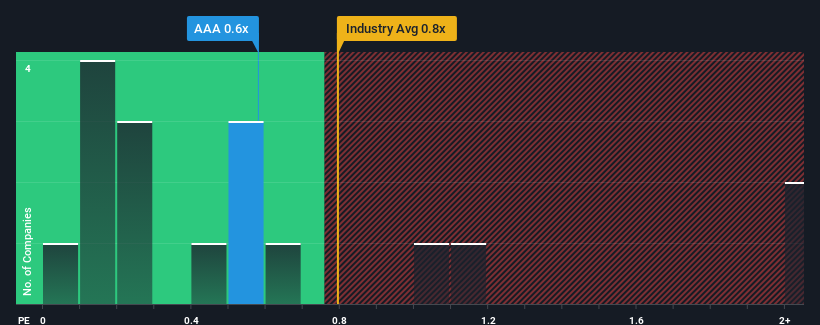

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Alan Allman Associates' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Professional Services industry in France is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Alan Allman Associates

What Does Alan Allman Associates' Recent Performance Look Like?

Alan Allman Associates certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alan Allman Associates.How Is Alan Allman Associates' Revenue Growth Trending?

In order to justify its P/S ratio, Alan Allman Associates would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.3% last year. Pleasingly, revenue has also lifted 147% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 3.5% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.3%, which is noticeably more attractive.

With this information, we find it interesting that Alan Allman Associates is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Alan Allman Associates' P/S?

Following Alan Allman Associates' share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Alan Allman Associates' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Alan Allman Associates is showing 3 warning signs in our investment analysis, and 2 of those are a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:AAA

Alan Allman Associates

Engages in the provision of consulting services in Canada, France, Belgium, Luxembourg, Switzerland, and Singapore.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives