- France

- /

- Trade Distributors

- /

- ENXTPA:THEP

Interested In Thermador Groupe's (EPA:THEP) Upcoming €2.00 Dividend? You Have Three Days Left

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Thermador Groupe SA (EPA:THEP) is about to trade ex-dividend in the next 3 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, Thermador Groupe investors that purchase the stock on or after the 12th of April will not receive the dividend, which will be paid on the 14th of April.

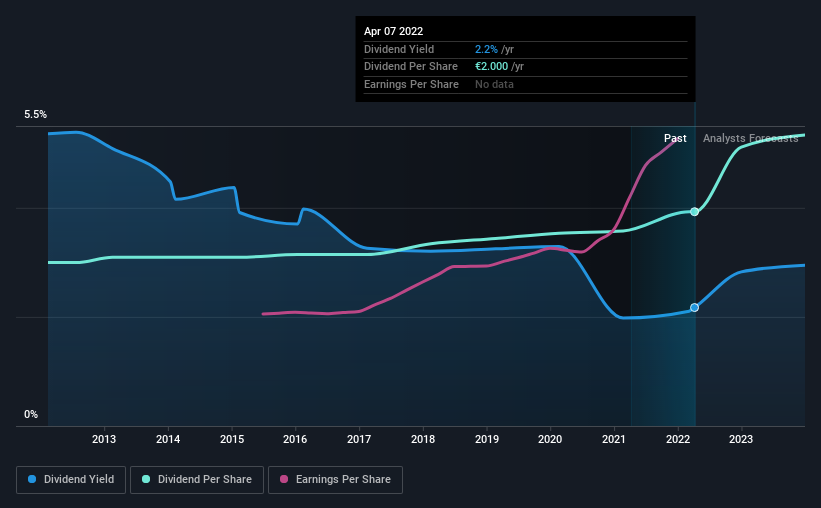

The company's next dividend payment will be €2.00 per share, on the back of last year when the company paid a total of €2.00 to shareholders. Last year's total dividend payments show that Thermador Groupe has a trailing yield of 2.2% on the current share price of €92.1. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Thermador Groupe can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Thermador Groupe

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see Thermador Groupe paying out a modest 35% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 103% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

While Thermador Groupe's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Thermador Groupe to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Thermador Groupe has grown its earnings rapidly, up 20% a year for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Thermador Groupe has lifted its dividend by approximately 2.7% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Thermador Groupe is keeping back more of its profits to grow the business.

The Bottom Line

Has Thermador Groupe got what it takes to maintain its dividend payments? We're glad to see the company has been improving its earnings per share while also paying out a low percentage of income. However, it's not great to see it paying out what we see as an uncomfortably high percentage of its cash flow. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

In light of that, while Thermador Groupe has an appealing dividend, it's worth knowing the risks involved with this stock. Our analysis shows 1 warning sign for Thermador Groupe and you should be aware of this before buying any shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Thermador Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:THEP

Thermador Groupe

Engages in the distribution business in France and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success