- France

- /

- Electrical

- /

- ENXTPA:SU

What Schneider Electric (ENXTPA:SU)'s Data Center Power Push and Guidance Update Means For Shareholders

Reviewed by Sasha Jovanovic

- Schneider Electric recently reaffirmed its 2025 earnings guidance, anticipating organic revenue growth of 7% to 10%, and announced several product and executive updates, including a collaboration with NVIDIA to develop advanced 800 VDC power systems for high-density data centers.

- The company's focus on innovation in renewable energy applications and data center power solutions underscores its commitment to meeting emerging industry demands while supporting sustainability and digital transformation.

- We'll review how Schneider Electric's robust guidance and advancements in data center power architecture may influence its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Schneider Electric Investment Narrative Recap

Grounded in global electrification and digitalization, Schneider Electric’s investment narrative centers on its capacity to capture long-term opportunity in data center growth, energy management, and sustainability. The company’s reaffirmed 2025 guidance and recent product news are welcome, but do not materially change the critical short-term catalyst: sustained momentum and margin resilience in high-growth digital infrastructure, despite margin pressures from mix headwinds and heavy reinvestment that remain top near-term risks.

The launch of Altivar Solar ATV320 variable speed drives, designed for off-grid solar-powered pumping, is particularly relevant amid Schneider’s focus on the expanding renewables market. This product extension sharpens the company's positioning as a solution provider in energy efficiency, which ties directly to the evolving catalysts around energy transition and grid modernization.

On the other hand, continued margin pressure in the Systems segment could create a headwind that investors should be aware of, especially if...

Read the full narrative on Schneider Electric (it's free!)

Schneider Electric's outlook anticipates €48.6 billion in revenue and €6.7 billion in earnings by 2028. This implies a 7.3% annual revenue growth rate and a €2.4 billion earnings increase from the current €4.3 billion.

Uncover how Schneider Electric's forecasts yield a €260.64 fair value, a 5% upside to its current price.

Exploring Other Perspectives

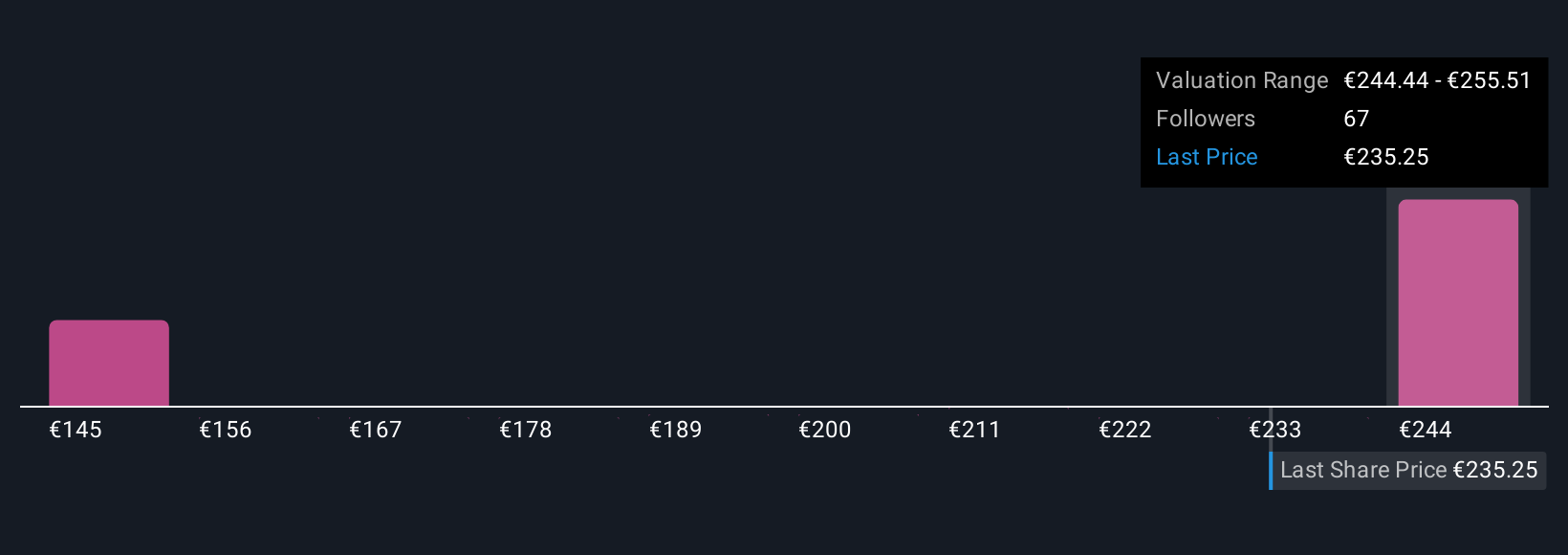

Simply Wall St Community members mapped Schneider Electric’s fair value estimates from €141.49 to €261.12, with 7 different viewpoints represented. While data center demand remains a catalyst, opinions on future performance are far from uniform, so reviewing the full range of forecasts may offer broader context.

Explore 7 other fair value estimates on Schneider Electric - why the stock might be worth 43% less than the current price!

Build Your Own Schneider Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schneider Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schneider Electric's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives