Is Saint-Gobain an Opportunity After Recent 7% Price Dip and Sustainability Expansion?

Reviewed by Bailey Pemberton

- Wondering if Compagnie de Saint-Gobain is trading at a bargain or riding high on market hype? You are not alone; plenty of investors are asking the same after its latest moves.

- The stock has dipped 7.0% over the past week and is down 9.5% over the last month, but the longer view shows a 119.4% gain over three years and 158.3% over five years. This suggests there is still growth potential worth examining.

- Recently, investors and analysts have been digesting news of Saint-Gobain's expansion into new markets and strategic acquisitions aimed at sustainability initiatives. These moves have drawn attention to its long-term positioning and sparked discussion about whether the current pullback signals a buying opportunity or a necessary pause.

- With a 6/6 valuation score, Saint-Gobain looks robust by traditional standards. We will break down exactly how those numbers are calculated using different valuation methods, and we will reveal an even more insightful approach by the end of this article.

Find out why Compagnie de Saint-Gobain's 1.7% return over the last year is lagging behind its peers.

Approach 1: Compagnie de Saint-Gobain Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model provides a framework for estimating a company's worth by projecting its future cash flows and discounting them back to their present value. This approach helps investors move beyond market noise and focus on underlying business fundamentals.

For Compagnie de Saint-Gobain, the latest reported Free Cash Flow stands at approximately €3.5 billion. Analysts project gradual FCF growth, with estimates of €3.5 billion in 2026 and increasing to roughly €5.0 billion by 2035. While analyst coverage typically extends only to 2028 with a projected €4.0 billion FCF, Simply Wall St extrapolates further and anticipates a steady upward trend over the next decade.

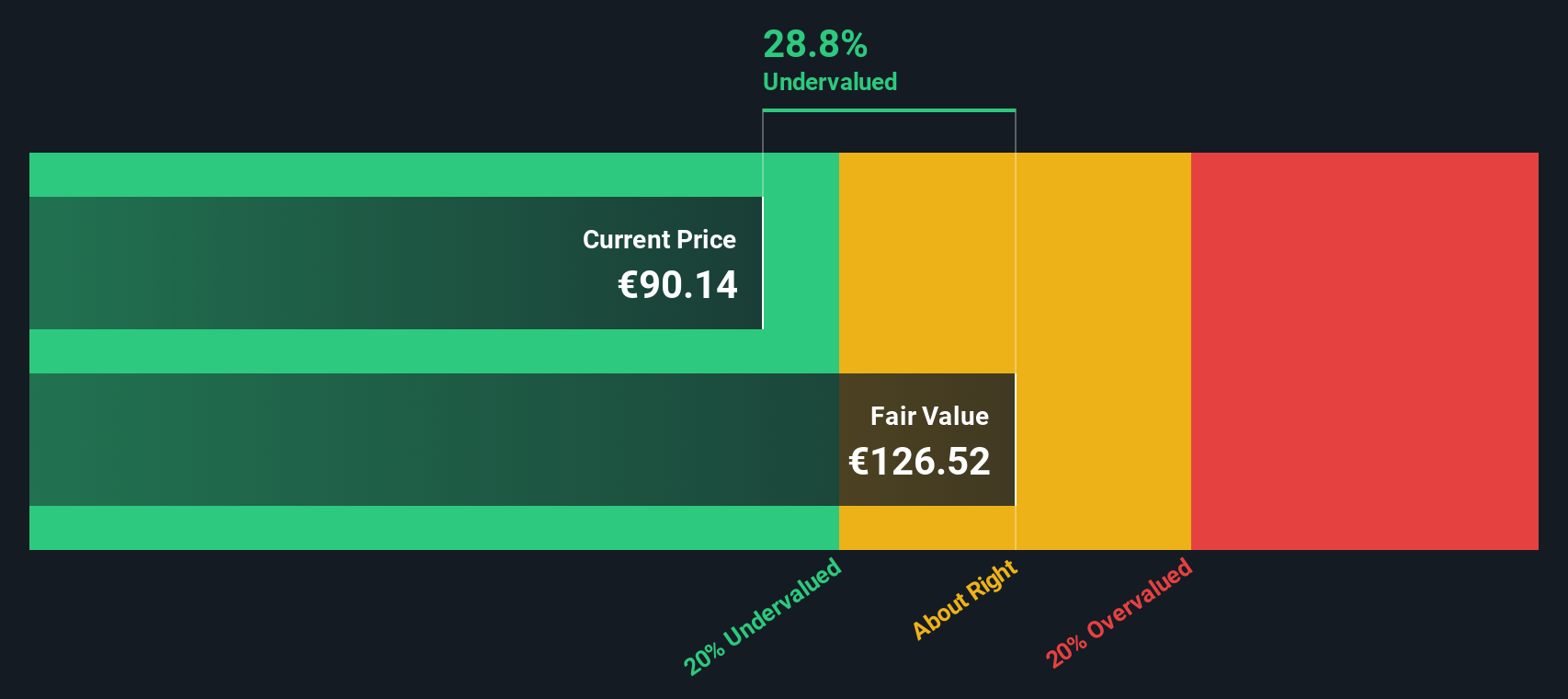

Based on these projections and using a 2 Stage Free Cash Flow to Equity model, the intrinsic value of the company is estimated at €122.20 per share. With its current share price reflecting a 31.2% discount to this calculated fair value, the DCF analysis suggests Compagnie de Saint-Gobain is significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Compagnie de Saint-Gobain is undervalued by 31.2%. Track this in your watchlist or portfolio, or discover 835 more undervalued stocks based on cash flows.

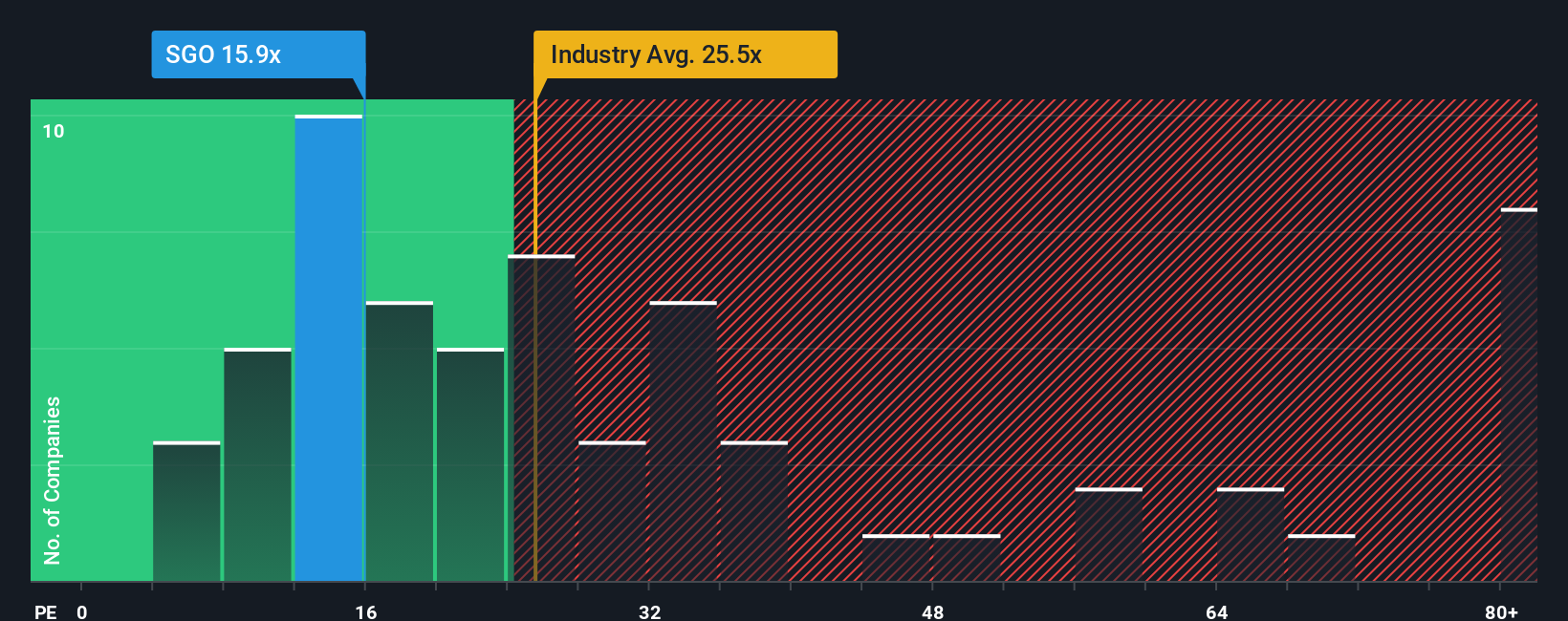

Approach 2: Compagnie de Saint-Gobain Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a common way to value profitable companies because it directly relates a company’s share price to its per-share earnings. This provides investors with a straightforward measure of how much they are paying for each euro of earnings. It is a helpful tool for comparing similar businesses within the same sector.

The “right” PE ratio depends on factors such as expected earnings growth, stability, and risk. Fast-growing and lower-risk companies usually command higher PE ratios, while slower-growing or riskier firms trade at lower multiples. Industry averages help set context, but may not capture a company’s unique strengths or weaknesses.

Currently, Compagnie de Saint-Gobain trades on a PE ratio of 14.8x. For comparison, the Building industry average stands at 21.2x, and the peer group average is an even higher 30.4x. On the surface, this looks like a discount, but there is more to the story. Simply Wall St’s “Fair Ratio,” which factors in Saint-Gobain’s earnings growth, risk profile, margin, industry, and size, suggests a fair value multiple of 26.7x. This offers a more tailored benchmark than industry or peer averages alone, as it incorporates key fundamentals that drive valuation.

Comparing the company’s actual PE ratio of 14.8x to its Fair Ratio of 26.7x reveals a clear gap, indicating that the stock may be undervalued based on its earnings potential and risk-adjusted outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

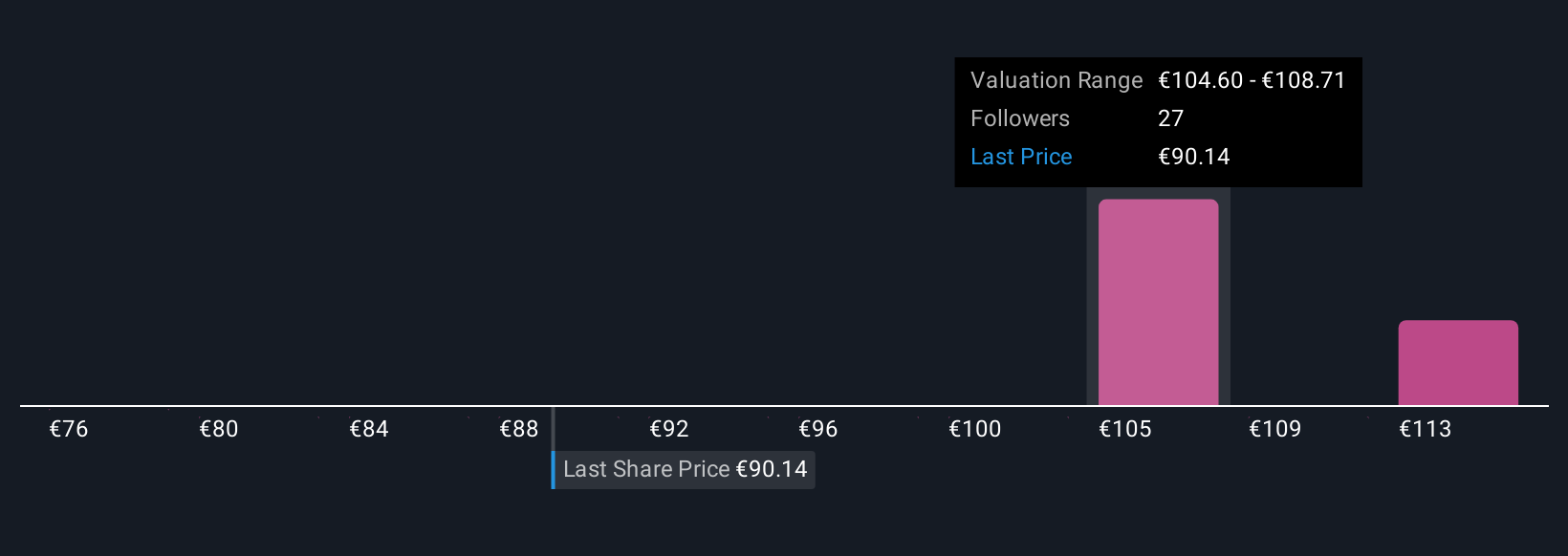

Upgrade Your Decision Making: Choose your Compagnie de Saint-Gobain Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story for a company, where you connect your understanding of its business and industry outlook to specific forecasts for revenue, margin, and fair value.

Put simply, a Narrative links what you believe is happening at Compagnie de Saint-Gobain to the numbers behind its share price. It helps you define your assumptions, create a tailored financial forecast, and arrive at your own fair value. This makes your investment decisions more personal and informed.

On Simply Wall St's Community page, millions of investors are already using Narratives as an easy and accessible tool. Narratives not only show your own fair value calculation but also compare it to the current share price, so you can quickly see if the stock looks over or underpriced according to your expectations.

What sets Narratives apart is that they update dynamically as new information such as news, earnings, or regulatory changes comes in, so your viewpoint can adapt in real time. For example, some Saint-Gobain investors believe that sustainability trends and margin expansion will drive future growth, giving a fair value over €140. In contrast, others who are more cautious about cost pressures estimate a fair value as low as €72. Narratives let you see and compare these perspectives, so you can take action when your story and the numbers truly align.

Do you think there's more to the story for Compagnie de Saint-Gobain? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives