Prodways Group SA (EPA:PWG) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Prodways Group SA (EPA:PWG) shares have had a horrible month, losing 26% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

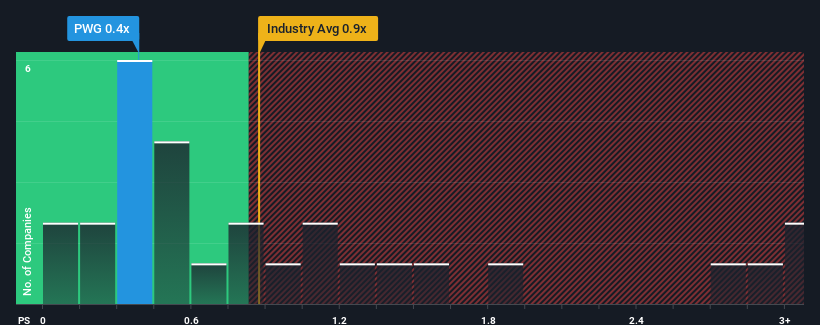

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Prodways Group's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in France is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Prodways Group

What Does Prodways Group's P/S Mean For Shareholders?

Prodways Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Prodways Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Prodways Group?

The only time you'd be comfortable seeing a P/S like Prodways Group's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 0.5% per year over the next three years. With the industry predicted to deliver 6.6% growth per year, that's a disappointing outcome.

In light of this, it's somewhat alarming that Prodways Group's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Prodways Group's P/S

Following Prodways Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Prodways Group's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Having said that, be aware Prodways Group is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALPWG

Excellent balance sheet and good value.

Market Insights

Community Narratives