- France

- /

- Electrical

- /

- ENXTPA:NEX

Does Nexans Still Offer Value After Strong Multi Year Share Price Gains?

Reviewed by Bailey Pemberton

- If you are wondering whether Nexans at €124.40 is still a smart buy after its strong run, or if most of the upside is already priced in, this piece will walk you through the key valuation angles to help you decide.

- The stock has dipped 1.0% over the last week, but that comes after a solid 4.0% gain over the past month, a 19.3% rise year to date and a 22.8% jump over the last year, building on a 55.7% 3-year and 129.8% 5-year performance.

- Those moves have been underpinned by Nexans’ strategic pivot toward higher-value electrification and grid solutions, as investors have rewarded the company’s shift away from more commoditised cable activities. Broader market enthusiasm for energy transition infrastructure and grid modernisation has also helped rerate the stock as a potential long-term structural winner.

- On our checks, Nexans scores a 3 out of 6 valuation score, suggesting it screens as undervalued on half of the metrics we track, which is positive but not perfect. Next, we will unpack what those different valuation approaches are really saying about the stock, and why there might be an even better way to think about Nexans’ true value by the end of this article.

Approach 1: Nexans Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in € terms.

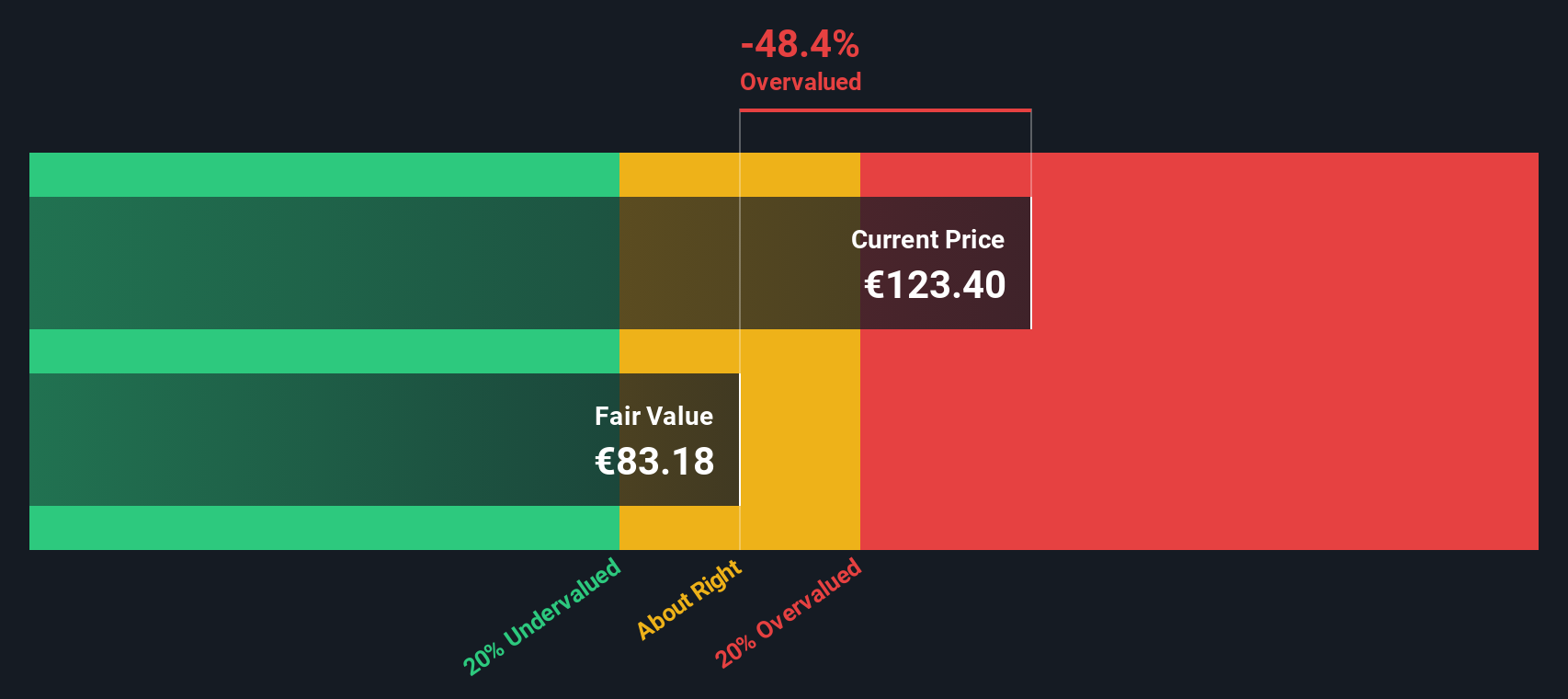

For Nexans, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about €554.5 million and uses analyst forecasts for the next few years, then extrapolates further out. On this basis, free cash flow is projected to settle at roughly €327.6 million in 2035, with the path from 2026 to 2035 implying modestly declining growth as the business matures.

When these projected cash flows are discounted back to today, the model arrives at an intrinsic value of around €86.66 per share. Compared with the current share price of €124.40, this model-based estimate suggests Nexans is about 43.6% above its DCF indication of fair value, which screens as materially overvalued on this metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nexans may be overvalued by 43.6%. Discover 900 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nexans Price vs Earnings

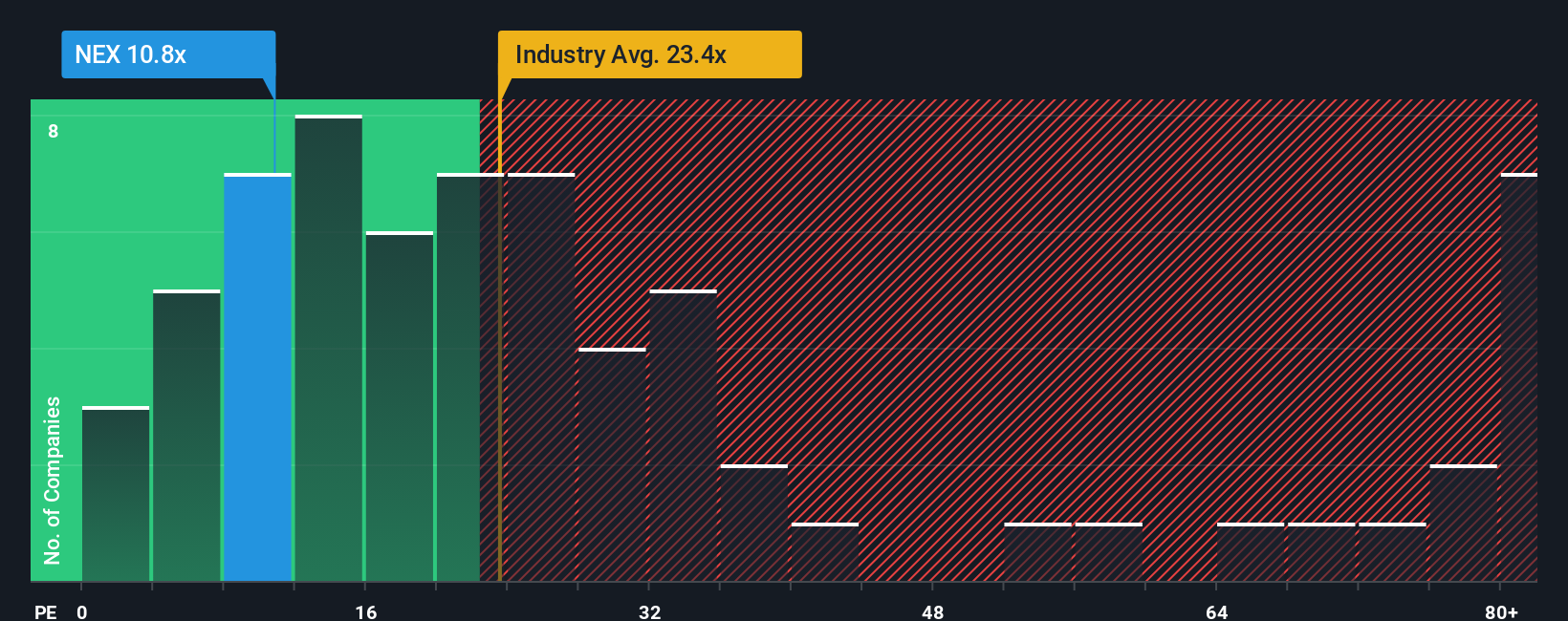

For a profitable business like Nexans, the price to earnings, or PE, ratio is a practical way to gauge whether investors are paying a reasonable price for each euro of current earnings. In general, companies with stronger growth prospects and lower perceived risk deserve a higher PE, while slower growing or riskier firms should trade on lower multiples.

Nexans currently trades on a PE of about 11.2x, which is notably below both the Electrical industry average of around 29.1x and the broader peer group average of roughly 21.8x. On the surface, that kind of discount might suggest the market is being cautious about the company’s outlook or factoring in higher risk compared to its peers.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating the PE Nexans should trade on, given its specific earnings growth profile, margins, risk factors, industry and market cap. For Nexans, the Fair Ratio comes out at about 15.0x, which is meaningfully above the current 11.2x. That indicates the shares look undervalued on an earnings multiple basis, even after considering company specific fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nexans Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, which are simple stories that connect your view of a company’s future revenue, earnings and margins to a financial forecast and, ultimately, a fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to spell out their assumptions, translate them into projected financials, and then compare their resulting Fair Value to today’s share price to decide whether Nexans looks like a buy, hold or sell.

Because Narratives are dynamically updated as new information like earnings releases, major contracts or executive changes arrive, they stay aligned with the latest facts rather than a static, one off model.

For example, one Nexans Narrative might lean bullish, pointing to accelerating electrification demand, higher long term margins and a fair value closer to €136. A more cautious Narrative could focus on revenue headwinds, competitive and regulatory risks and land nearer €91, and seeing those stories side by side helps you choose which outlook you believe and what that implies for your own decision.

Do you think there's more to the story for Nexans? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nexans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NEX

Nexans

Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion