As hopes for interest rate cuts grow and the CAC 40 Index advances, the French market is showing signs of resilience amid broader European economic stability. In this environment, investors may find dividend stocks particularly appealing due to their potential for steady income and relative stability. When evaluating top dividend stocks on Euronext Paris, it's crucial to consider companies with strong financial health and a consistent track record of dividend payments, especially in light of current market optimism.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.54% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.99% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.33% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.06% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.94% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.59% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.23% | ★★★★★☆ |

| Rexel (ENXTPA:RXL) | 5.30% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products in France and internationally, with a market cap of €109.04 million.

Operations: Piscines Desjoyaux SA generates revenue through the design, manufacturing, and marketing of swimming pools and related products both domestically in France and internationally.

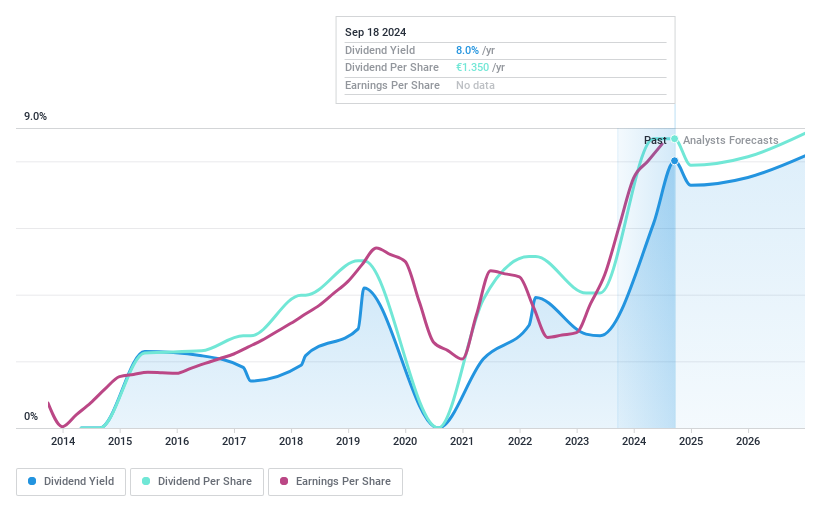

Dividend Yield: 8.2%

Piscines Desjoyaux's dividend payments have been stable and growing over the past decade, but recent earnings show a significant decline, with net income dropping to €2.51 million from €6.28 million year-over-year. Although its dividend yield is among the top 25% in France, the high cash payout ratio of 486.2% indicates that dividends are not well covered by free cash flows, raising concerns about sustainability despite a reasonable payout ratio of 72.5%.

- Unlock comprehensive insights into our analysis of Piscines Desjoyaux stock in this dividend report.

- According our valuation report, there's an indication that Piscines Desjoyaux's share price might be on the cheaper side.

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA, with a market cap of €60.48 billion, operates in concessions, energy, and construction sectors both in France and internationally through its subsidiaries.

Operations: Vinci SA generates revenue from several segments: Cobra IS (€6.74 billion), VINCI Energies (€19.76 billion), Concessions - VINCI Airports (€4.57 billion), Concessions - VINCI Autoroutes (€6.98 billion), and VINCI Construction, including Eurovia (€31.83 billion).

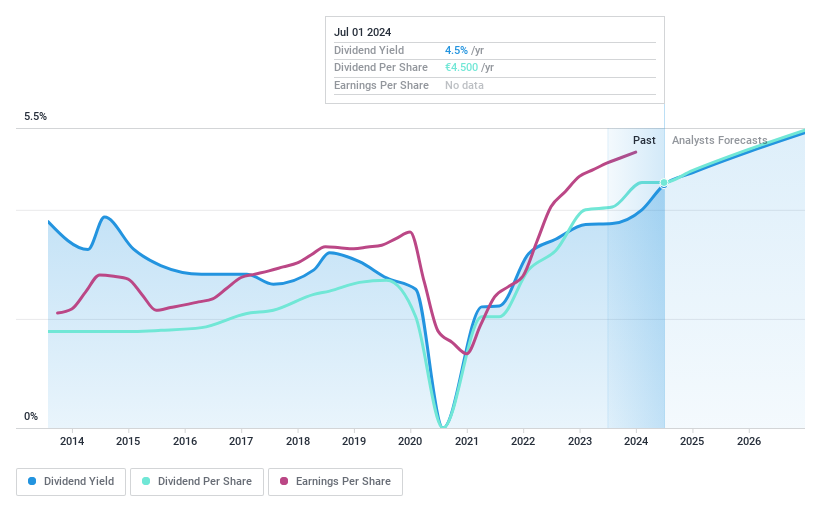

Dividend Yield: 4.2%

Vinci's dividend payments have been volatile over the past decade, but they are well covered by earnings (55.8% payout ratio) and cash flows (34.7% cash payout ratio). Despite a lower dividend yield compared to top-tier payers, the company trades at 25.7% below its estimated fair value. Recent earnings showed a slight decline in net income to €1.99 billion for H1 2024, yet Vinci approved an interim dividend of €1.05 per share for October 2024 payment.

- Delve into the full analysis dividend report here for a deeper understanding of Vinci.

- Insights from our recent valuation report point to the potential undervaluation of Vinci shares in the market.

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Manitou BF SA, with a market cap of €722.46 million, develops, manufactures, and provides equipment and services globally through its subsidiaries.

Operations: Manitou BF SA generates revenue primarily from its Products Division (€2.47 billion) and its Services & Solutions (S&S) Division (€395.12 million).

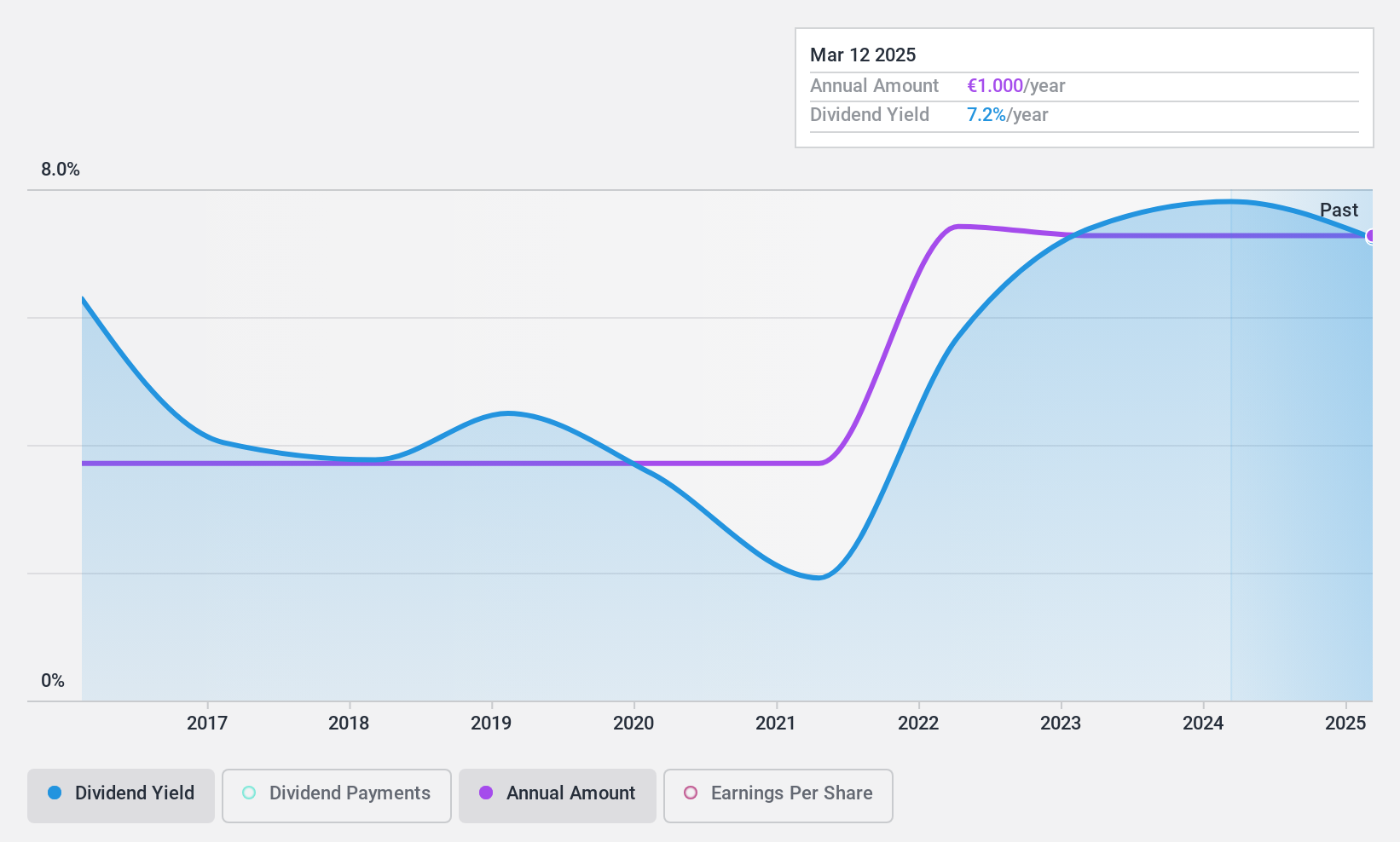

Dividend Yield: 7.2%

Manitou BF's dividend yield (7.15%) ranks in the top 25% of French dividend payers, supported by a low payout ratio (31.7%). However, its dividend history is unstable and has been paid for only 9 years with volatility. Recent earnings showed growth, with H1 2024 net income rising to €81.75 million from €62.53 million a year ago, indicating strong financial performance despite high debt levels and forecasted earnings decline over the next three years.

- Click here to discover the nuances of Manitou BF with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Manitou BF is priced lower than what may be justified by its financials.

Seize The Opportunity

- Delve into our full catalog of 34 Top Euronext Paris Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MTU

Manitou BF

Engages in the development, manufacture, and provision of equipment and services worldwide.

Solid track record, good value and pays a dividend.