- France

- /

- Electrical

- /

- ENXTPA:MRN

Why Mersen (ENXTPA:MRN) Is Down 14.5% After Cutting Outlook Due to Ongoing Solar Weakness

Reviewed by Sasha Jovanovic

- Mersen recently reported Q3 results that missed market expectations, citing ongoing weakness in its solar power segment and reducing its full-year organic sales growth, profit margin, and capital expenditure guidance due to a lack of recovery in this area.

- An important takeaway is that management expressed limited visibility on a turnaround in the solar segment, prompting analysts to anticipate downward revisions to consensus estimates for the company.

- We'll explore how weak activity and uncertainty in Mersen's solar segment now affect the broader investment narrative outlined by analysts.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mersen Investment Narrative Recap

To be a shareholder in Mersen right now, you need to believe in the company’s ability to weather uncertainty in the solar power segment while capturing future upside from renewables and electrification. The recent warning on solar and trimmed guidance has shifted short-term focus, with weak solar activity now the main risk to near-term earnings momentum and consensus forecasts. However, the core investment case centered on long-term sector growth remains, though investors should watch for further updates on demand recovery and margin pressures.

Of the latest announcements, Mersen’s updated guidance for 2025, projecting stable or slightly positive revenue compared to 2024, directly reflects solar segment weakness highlighted in the recent results. This subdued outlook is a critical backdrop for any reassessment of future catalysts in renewables, as ongoing softness in solar could delay broader growth narratives across Mersen’s end markets.

In contrast to the optimism around renewables, investors should be aware that persistent underperformance or late-cycle risks in cyclical end markets could...

Read the full narrative on Mersen (it's free!)

Mersen's outlook projects €1.4 billion in revenue and €98.9 million in earnings by 2028. This assumes annual revenue growth of 3.8% and a €49.5 million increase in earnings from the current €49.4 million.

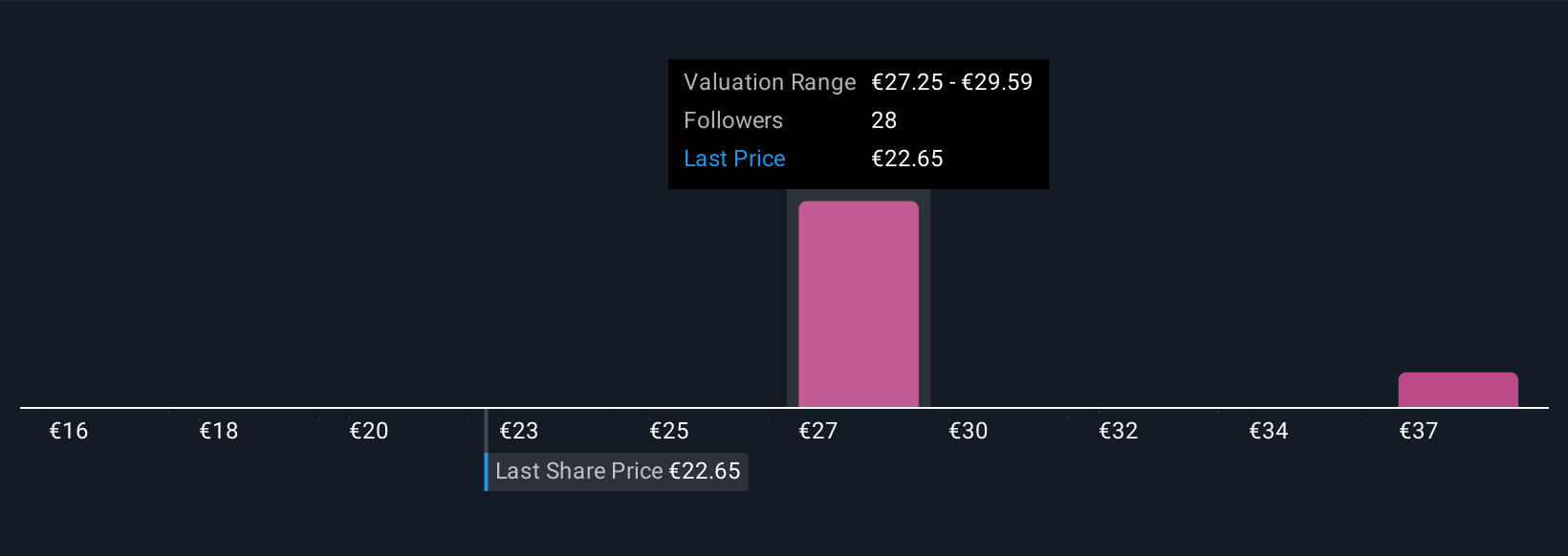

Uncover how Mersen's forecasts yield a €28.37 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fair value estimates from five Simply Wall St Community members range from €15.52 to €38.97, reflecting a wide spread of expectations. Many are focused on the impact that the prolonged solar downturn could have on near-term growth, making it essential to compare perspectives before deciding your next move.

Explore 5 other fair value estimates on Mersen - why the stock might be worth as much as 72% more than the current price!

Build Your Own Mersen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mersen research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Mersen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mersen's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MRN

Mersen

Manufactures and sells electrical power products and advanced materials in France, North America, rest of Europe, the Asia-Pacific, and internationally.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives