- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

Thales Stock Jumps 84% in 2024 as Defense Contracts Boost Investor Sentiment

Reviewed by Bailey Pemberton

Thinking about what to do with Thales stock right now? You’re definitely not alone. With a share price last closing at 253.4, Thales has captured attention, up over 84% year-to-date and an eye-popping 404.7% over the past five years. That kind of long-term growth makes it tough to ignore, even if the past month was a little softer, dipping a modest 1.1%.

Recent investor excitement has been fueled by several strategic developments in the defense and cybersecurity sectors where Thales operates. The company's push into cutting-edge digital identity solutions and its steady expansion of international defense contracts have resonated with market watchers. As a result, the stock bounced back 3.3% in just the past week, reflecting renewed confidence and perhaps a shift in how investors are viewing risk in this space.

But spectacular growth and headline-making news only tell part of the story. When it comes to valuation, Thales scores 2 out of 6 on our value checklist, suggesting it’s undervalued in two of the six methods we track. That brings us to the real question: does Thales present value, or could these gains be price optimism running ahead of fundamentals?

Let’s break down the different valuation approaches. Later, I’ll share a perspective that goes beyond the standard ratios to help you see whether Thales is still a buy.

Thales scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Thales Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach essentially asks, “What are all of Thales’s future cash flows worth in today’s euros?”

For Thales, the most recent Free Cash Flow is €2.57 Billion. Analysts project steady growth, with Free Cash Flow expected to reach €3.52 Billion by 2029. While analyst estimates typically extend five years out, beyond 2029 these forecasts rely on extrapolations, offering a directional view and some added uncertainty. These forward-looking numbers help capture how much value the market believes Thales can generate as it expands within the defense and digital sectors.

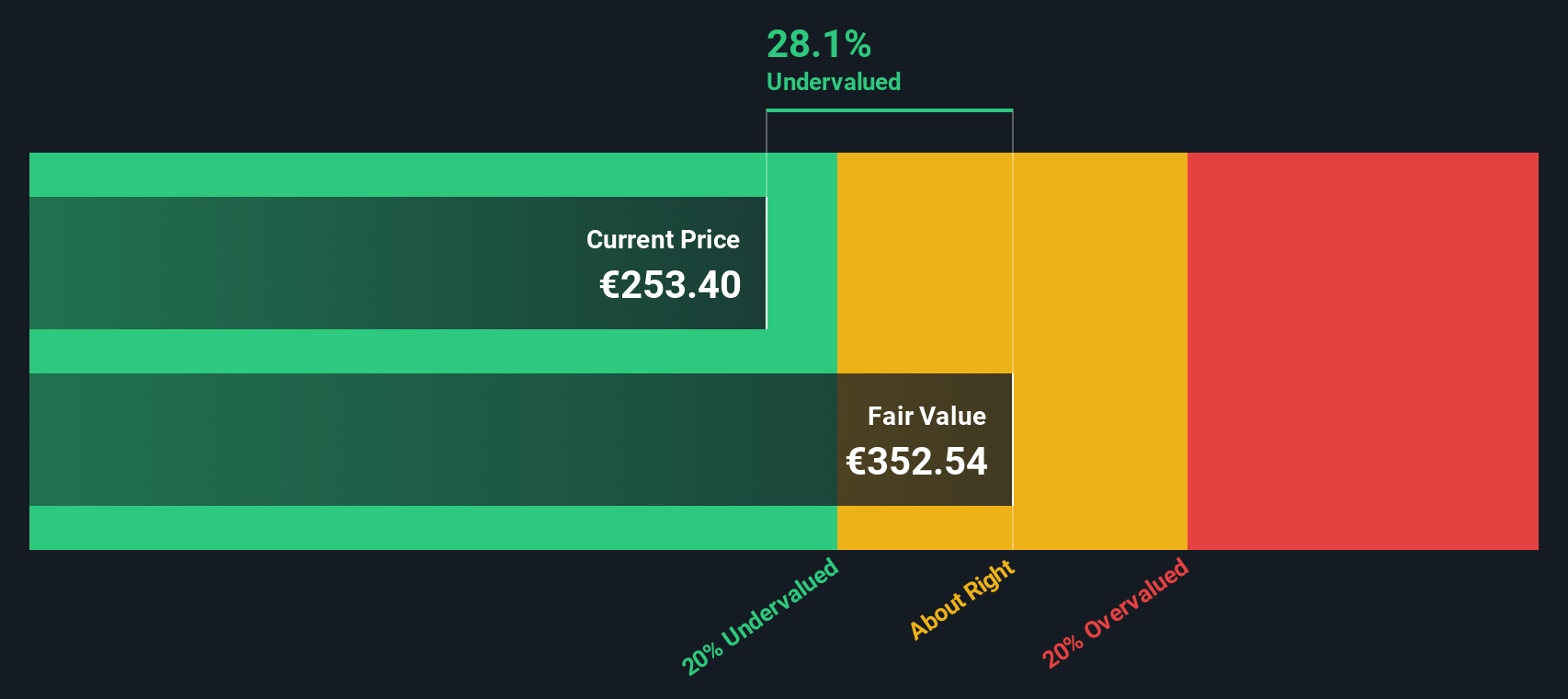

Based on this two-stage forecast and discounting method, the DCF model estimates Thales’s intrinsic value at €352.54 per share. With the current share price at €253.4, the calculation suggests the stock is trading at a 28.1% discount to its theoretical value. This indicates potential upside for investors who rely on the underlying cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Thales is undervalued by 28.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Thales Price vs Earnings

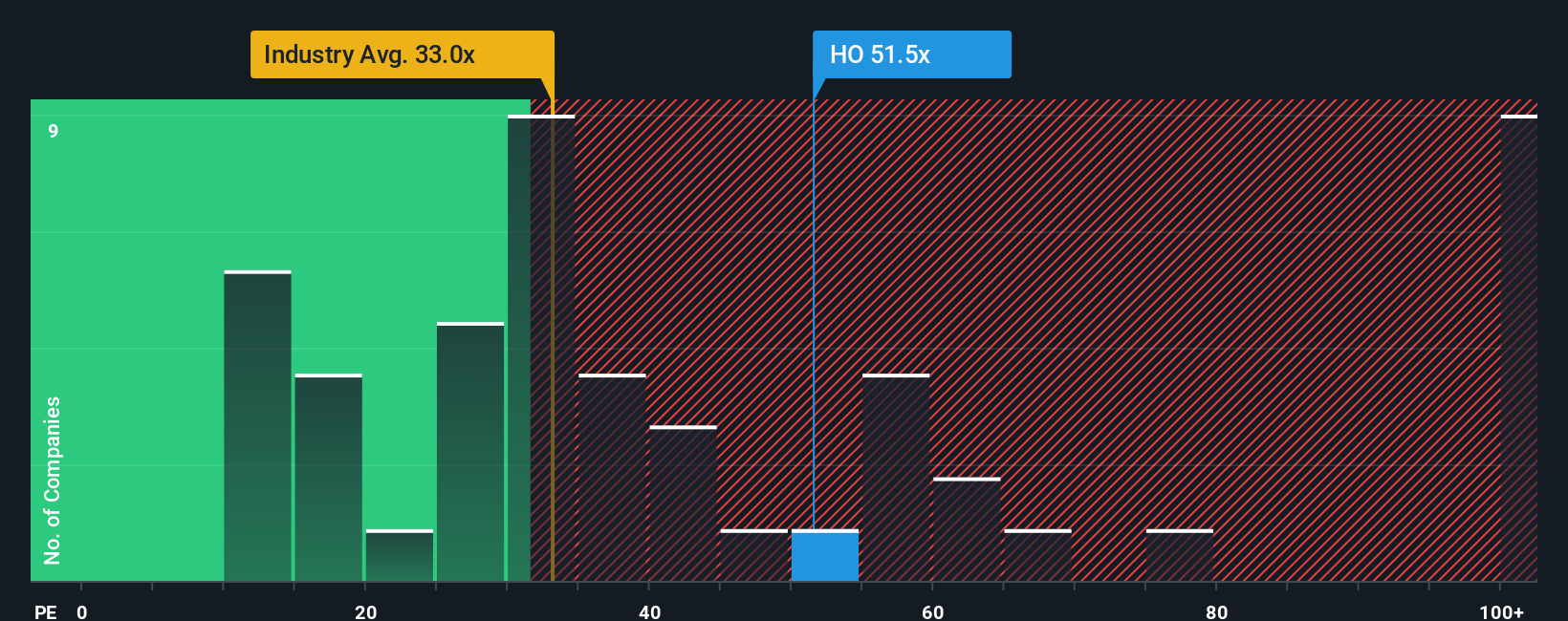

The Price-to-Earnings (PE) ratio is a favorite among investors for analyzing profitable companies like Thales. It reveals how much the market is willing to pay today for a euro of the company’s earnings. This makes the PE ratio a direct and relevant metric to gauge valuation, especially when earnings are stable and growing.

What counts as a “normal” or fair PE ratio can swing depending on factors such as growth rates and risk profiles. Fast-growing companies or those with strong profit margins often command higher PEs, while riskier or slower-growing companies trade at lower multiples. Comparing Thales to these benchmarks gives useful context, but not all companies in the same sector are on equal footing.

Thales currently trades at a PE of 49.8x, which is just above the Aerospace and Defense industry average of 47.4x and notably higher than the peer average of 31.9x. However, using Simply Wall St’s Fair Ratio model, which tailors the “perfect-fit” PE based on growth, profit margins, industry conditions, risks, and market cap, we estimate a Fair Ratio of 33.8x for Thales. This proprietary measure goes deeper than simple peer or industry averages and provides a more nuanced valuation by factoring in everything that makes Thales unique.

Given Thales’s current PE is well above the Fair Ratio, the stock appears to be trading at a premium that might not be justified by fundamentals alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thales Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective on Thales’s story—where it is headed, how it will perform, and what that means for fair value—backed up by your specific forecasts for future revenue, earnings, and profit margins.

Instead of just comparing numbers or applying rigid ratios, Narratives help you bring the "why" behind a company’s trajectory into focus. This links your own thesis about Thales to an estimated financial outcome and a clear fair value. On Simply Wall St’s Community page, millions of investors use Narratives as an approachable tool to capture their expectations, adjust forecasts, and compare their investment story with others.

Narratives make decision-making clear. As your fair value gets compared to the live share price, you can decide if Thales is a buy, hold, or sell for you. They also update automatically when new news or earnings are released, so your valuations stay relevant without manual rework.

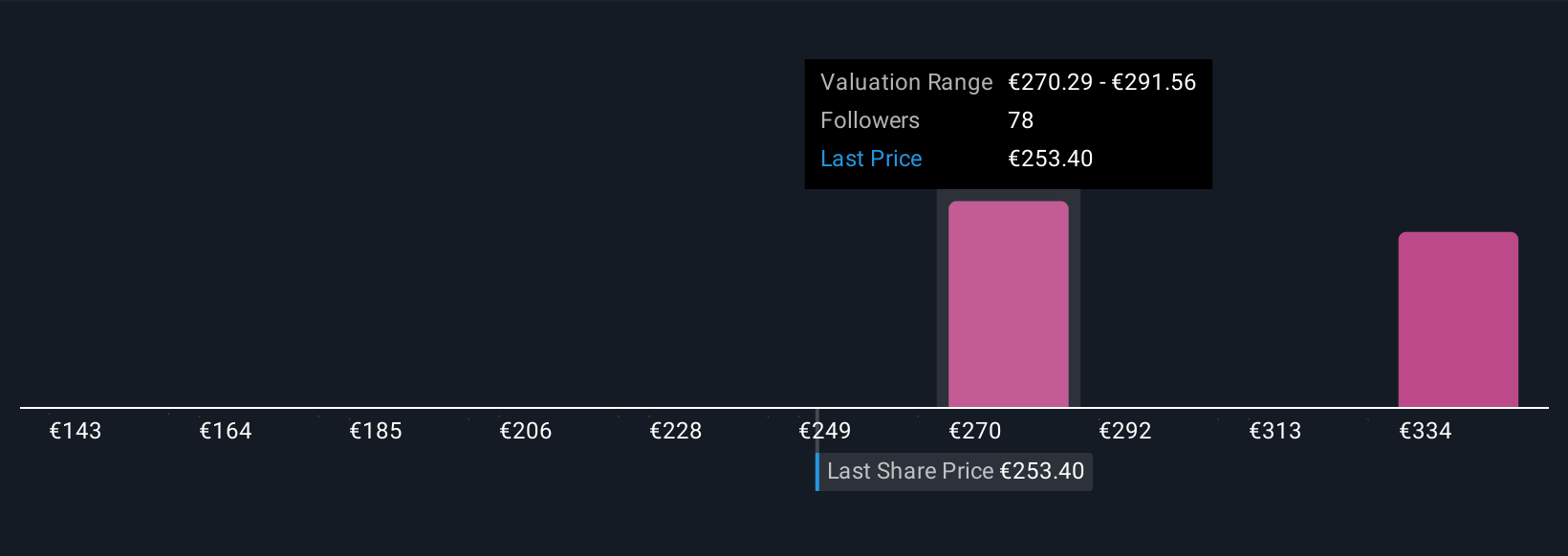

For example, on Simply Wall St, some investors’ Narratives take a bullish stance with a fair value of €350 per share, based on aggressive earnings growth and sector tailwinds. Others see limited upside and set a more cautious target like €240, reflecting concerns about valuation and execution risks. Narratives let you compare these views and decide which story best fits your outlook.

Do you think there's more to the story for Thales? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives