- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

European Companies That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In recent weeks, European markets have experienced a pullback, with the pan-European STOXX Europe 600 Index closing lower amid concerns over artificial intelligence-related stock valuations. As investors navigate these fluctuating conditions, identifying stocks that might be trading below their estimated value can present opportunities for those seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.046 | €5.97 | 49% |

| XTPL (WSE:XTP) | PLN69.90 | PLN134.58 | 48.1% |

| STEICO (XTRA:ST5) | €20.30 | €39.77 | 49% |

| Spindox (BIT:SPN) | €12.90 | €24.92 | 48.2% |

| Roche Bobois (ENXTPA:RBO) | €34.80 | €69.24 | 49.7% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| NEUCA (WSE:NEU) | PLN798.00 | PLN1553.92 | 48.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.397 | €0.78 | 49.1% |

| E-Globe (BIT:EGB) | €0.645 | €1.29 | 50% |

| eDreams ODIGEO (BME:EDR) | €7.21 | €14.35 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Lisi (ENXTPA:FII)

Overview: Lisi S.A. designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors in France and internationally, with a market cap of €2.14 billion.

Operations: The company's revenue segments are comprised of €1.13 billion from LISI Aerospace, €561.21 million from LISI Automotive, and €183.94 million from LISI Medical.

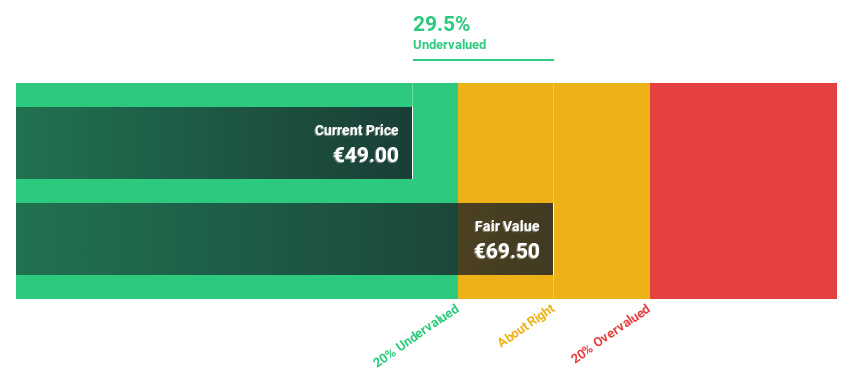

Estimated Discount To Fair Value: 15.3%

Lisi is trading at €46.9, below its estimated fair value of €55.4, presenting a potential opportunity for investors seeking undervalued stocks based on cash flows. Despite having a high level of debt and large one-off items affecting financial results, Lisi's earnings are forecast to grow significantly at 31% annually over the next three years, outpacing the French market's growth rate. However, its return on equity is expected to remain low at 10.9%.

- Our expertly prepared growth report on Lisi implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Lisi's balance sheet health report.

STMicroelectronics (ENXTPA:STMPA)

Overview: STMicroelectronics N.V. is a company that designs, develops, manufactures, and sells semiconductor products across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €18.37 billion.

Operations: The company's revenue segments include Power and Discrete Products at $2.54 billion and Analog, MEMS & Sensors Group at $4.32 billion.

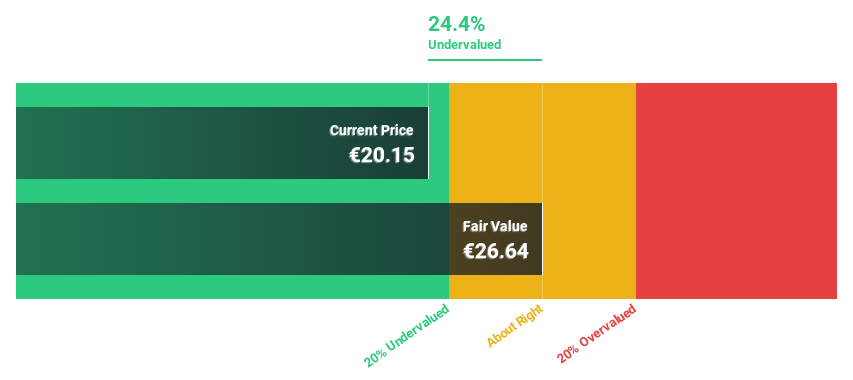

Estimated Discount To Fair Value: 19.6%

STMicroelectronics, trading at €20.63, is undervalued compared to its estimated fair value of €25.66. Despite lower profit margins this year and a forecasted low return on equity of 9.6% in three years, STMicroelectronics shows potential with expected annual earnings growth of 37.8%, surpassing the French market's growth rate. Recent product innovations like the ISM6HG256X sensor for industrial IoT applications could enhance cash flow prospects by tapping into high-demand sectors such as asset tracking and factory automation.

- Our comprehensive growth report raises the possibility that STMicroelectronics is poised for substantial financial growth.

- Take a closer look at STMicroelectronics' balance sheet health here in our report.

JOST Werke (XTRA:JST)

Overview: JOST Werke SE manufactures and supplies safety-critical systems for the commercial vehicle industry across various regions, with a market cap of €788.21 million.

Operations: JOST Werke SE generates its revenue from manufacturing and supplying safety-critical systems for the commercial vehicle industry across Germany, Europe, North America, Asia, the Pacific, and Africa.

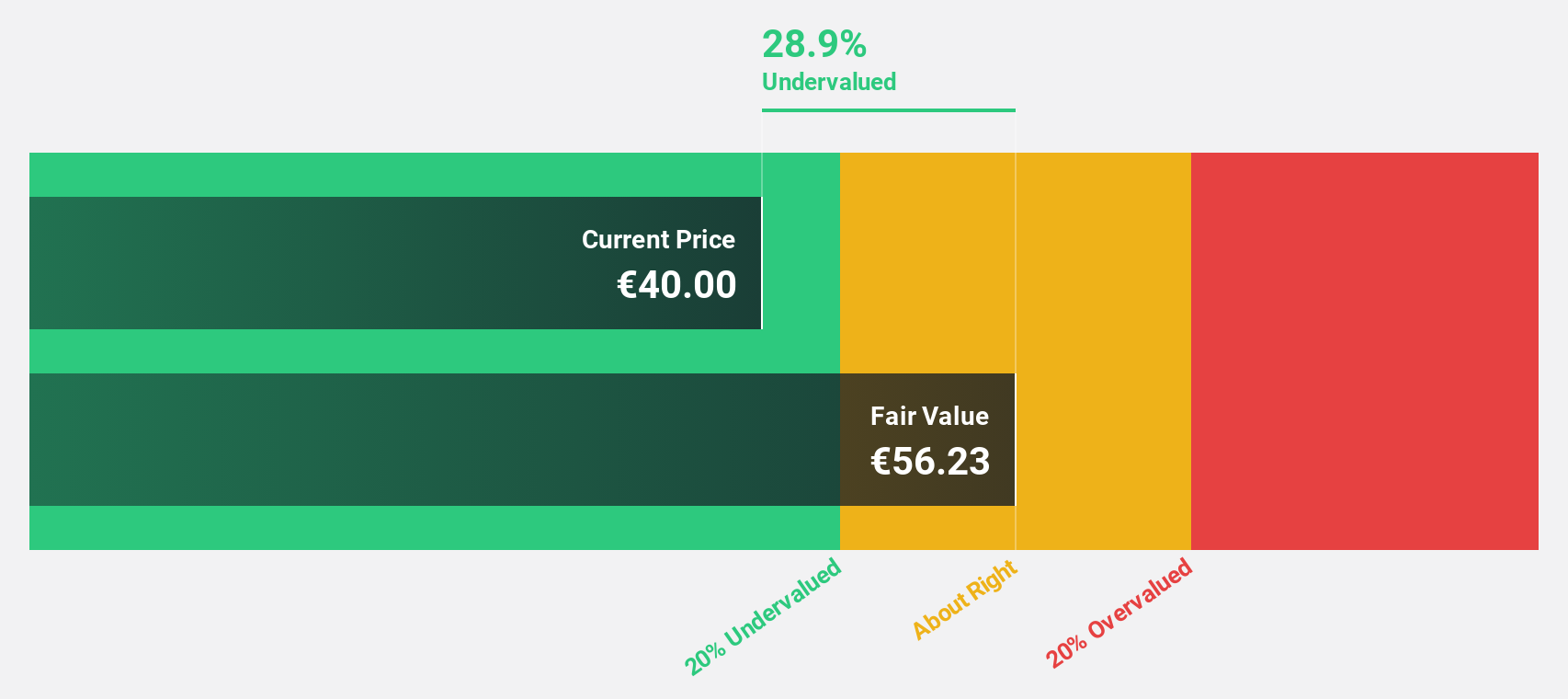

Estimated Discount To Fair Value: 43%

JOST Werke, trading at €52.9, is significantly undervalued with a fair value estimate of €92.81. Despite high debt levels and an unstable dividend history, its earnings are poised to grow 35.64% annually over the next three years, outpacing the German market's growth rate of 16.6%. Although revenue growth is slower than desired at 10.2% per year, it still exceeds the German market average of 6.2%, enhancing its cash flow potential amidst strategic divestments like the Cranes business.

- In light of our recent growth report, it seems possible that JOST Werke's financial performance will exceed current levels.

- Get an in-depth perspective on JOST Werke's balance sheet by reading our health report here.

Seize The Opportunity

- Investigate our full lineup of 187 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives