Stock Analysis

Amidst a backdrop of fluctuating European indices, with France's CAC 40 Index experiencing a notable decline, investors continue to seek stable income through dividend stocks. This cautious sentiment aligns well with the enduring appeal of dividend-yielding investments in uncertain times, offering potential resilience and steady returns.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 6.96% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| SCOR (ENXTPA:SCR) | 8.73% | ★★★★★☆ |

| Carrefour (ENXTPA:CA) | 5.99% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.72% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.18% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.03% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.02% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.38% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.47% | ★★★★★☆ |

Click here to see the full list of 37 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market capitalization of approximately €13.48 billion.

Operations: Amundi generates its revenue primarily through asset management, contributing approximately €6.03 billion.

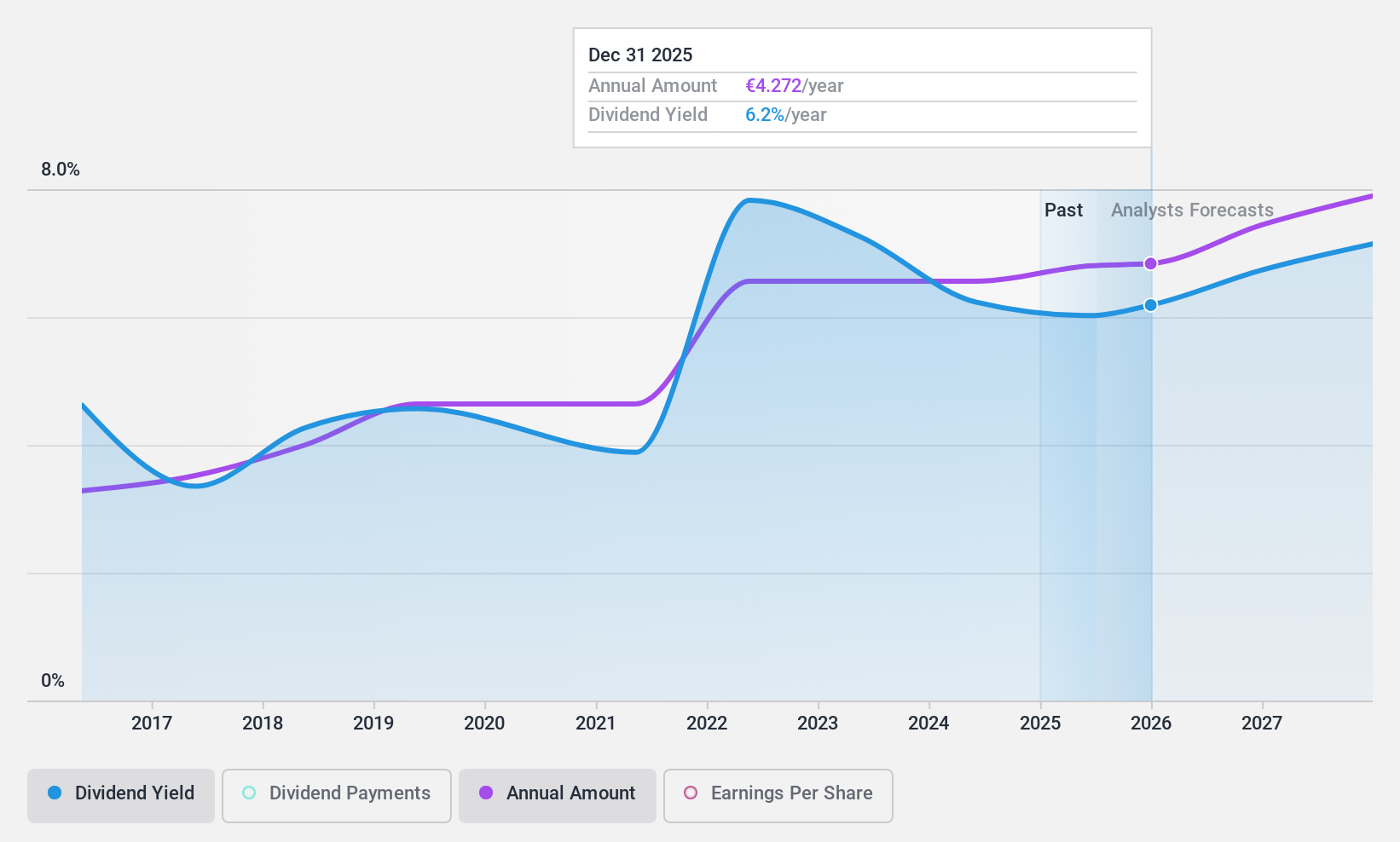

Dividend Yield: 6.2%

Amundi S.A. recently affirmed a dividend of €4.10 per share, marking a consistent payout amidst a backdrop of increasing revenues and net income, as evidenced by its first-quarter earnings report showing growth from the previous year. Although Amundi's dividend yield ranks well in the French market, its history of dividend payments over the past eight years shows volatility, casting some uncertainty on future stability. Nonetheless, both earnings and cash flow adequately cover current dividends, with recent financial performance suggesting modest ongoing earnings growth.

- Take a closer look at Amundi's potential here in our dividend report.

- Our valuation report unveils the possibility Amundi's shares may be trading at a discount.

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in various sectors including construction, property and urban development, civil engineering, metallic construction, roadwork, energy systems, and concessions both in France and internationally with a market cap of approximately €8.59 billion.

Operations: Eiffage SA's revenue is primarily generated through its Infrastructures (€8.43 billion), Energy Systems (€5.99 billion), Construction (€4.29 billion), and Concessions (€3.90 billion) segments.

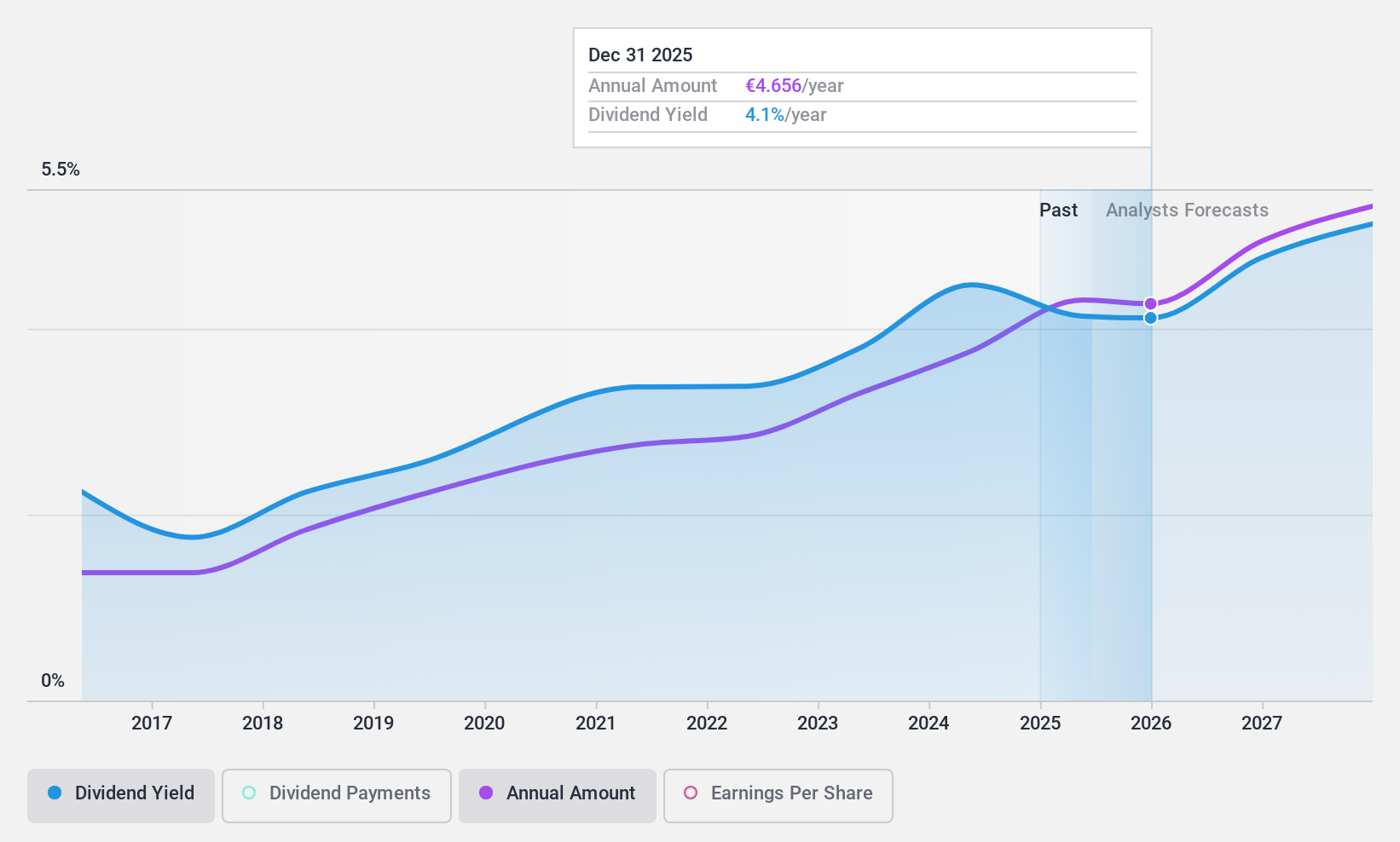

Dividend Yield: 4.5%

Eiffage, while maintaining a low cash payout ratio of 15.6%, ensures its dividends are well-supported by both earnings and cash flows, with respective payout ratios of 38.5% and 15.6%. Despite a dividend yield of 4.49%, which is below the top quartile in France at 5.35%, Eiffage has shown a commitment to growing dividends, evidenced by an increase over the past decade. However, this growth has been marked by volatility in payments throughout the same period. Recent strategic alliances, such as with Google Cloud to enhance operational efficiency through AI, underline efforts to bolster future capabilities but also reflect ongoing challenges like high debt levels that could impact financial flexibility.

- Click to explore a detailed breakdown of our findings in Eiffage's dividend report.

- In light of our recent valuation report, it seems possible that Eiffage is trading behind its estimated value.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA operates in banking and financial services for private investors, businesses, institutions, and professionals both in Monaco and globally, with a market cap of approximately €0.62 billion.

Operations: CFM Indosuez Wealth Management SA generates its revenue primarily through its wealth management segment, which accounted for €196.38 million.

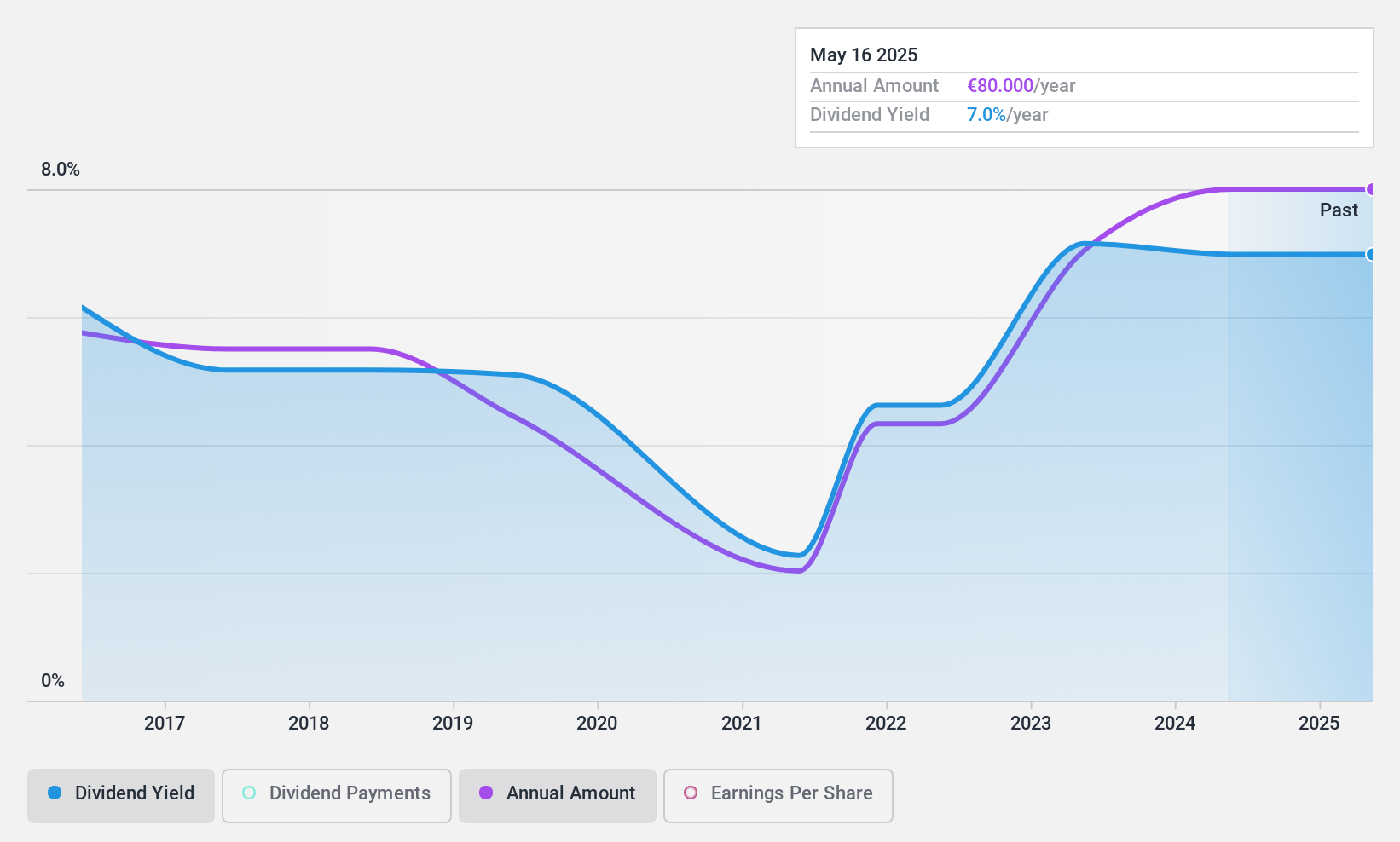

Dividend Yield: 7.4%

CFM Indosuez Wealth Management has demonstrated a mixed dividend history with a high yield of 7.41%, placing it in the top 25% in France, yet its dividends have shown volatility and unreliability over the past decade. Despite this, earnings growth was robust at 40.1% last year, and with a payout ratio of 70.8%, dividends are currently supported by earnings. The company's price-to-earnings ratio at €10.2 is attractive compared to the French market average of €15.6, suggesting potential value despite past dividend inconsistencies.

- Dive into the specifics of CFM Indosuez Wealth Management here with our thorough dividend report.

- The valuation report we've compiled suggests that CFM Indosuez Wealth Management's current price could be inflated.

Summing It All Up

- Delve into our full catalog of 37 Top Euronext Paris Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLCFM

CFM Indosuez Wealth Management

Engages in the provision of banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally.

Solid track record with excellent balance sheet and pays a dividend.