- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

Improved Revenues Required Before Figeac Aero Société Anonyme (EPA:FGA) Stock's 29% Jump Looks Justified

Despite an already strong run, Figeac Aero Société Anonyme (EPA:FGA) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 34%.

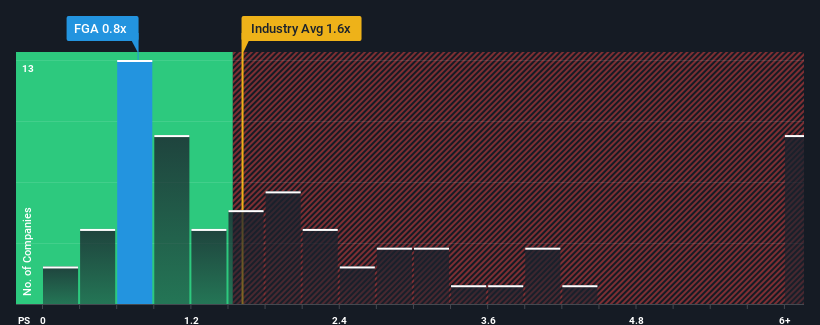

Even after such a large jump in price, Figeac Aero Société Anonyme's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Aerospace & Defense industry in France, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Figeac Aero Société Anonyme

How Figeac Aero Société Anonyme Has Been Performing

With revenue growth that's superior to most other companies of late, Figeac Aero Société Anonyme has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Figeac Aero Société Anonyme.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Figeac Aero Société Anonyme's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Pleasingly, revenue has also lifted 83% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 8.0% during the coming year according to the three analysts following the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Figeac Aero Société Anonyme's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite Figeac Aero Société Anonyme's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Figeac Aero Société Anonyme's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Figeac Aero Société Anonyme with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential with acceptable track record.

Market Insights

Community Narratives