- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

Could Exail Technologies’ (ENXTPA:EXA) Index Inclusion Hint at a Shift in Its Investor Appeal?

Reviewed by Sasha Jovanovic

- Exail Technologies was recently added to the Euronext 150 Index, joining a select group of companies tracked by this influential benchmark.

- This inclusion may enhance Exail Technologies’ visibility in the investment community, particularly among institutional investors who often track major indices.

- We’ll explore how the company’s entry into the Euronext 150 Index could shape its investment narrative and appeal to a broader investor base.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Exail Technologies' Investment Narrative?

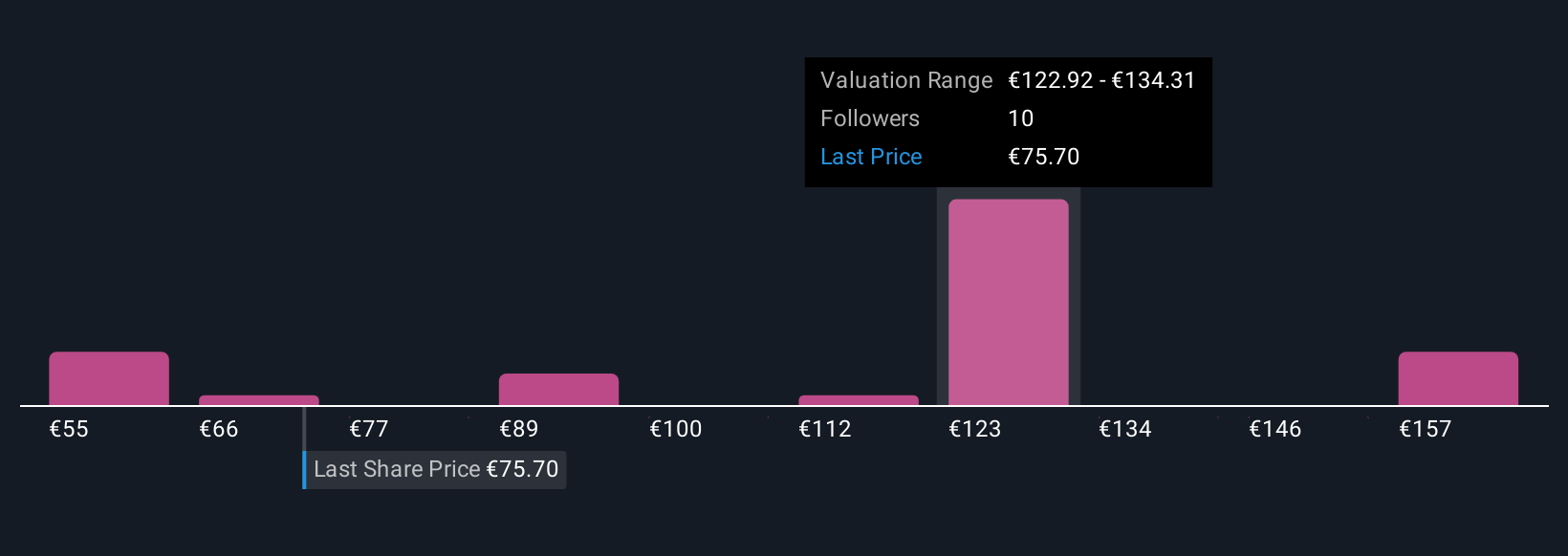

To own Exail Technologies, you’d need confidence in its ability to harness long-term momentum from contract wins, strong product innovation, and emerging leadership in autonomous drone technology, especially with fresh recognition as part of the Euronext 150 Index. Entry to a major benchmark may increase the company’s profile among larger funds, and could boost liquidity and short-term demand. Yet the share’s wide volatility, along with slower revenue growth versus historic highs and profitability only just returning, means the risks from valuation and execution remain pronounced. Prior analysis highlighted concern about board independence and coverage of interest payments. If ongoing visibility from index inclusions materializes as meaningful new investor support, that could shift the catalysts toward market acceptance and multiple expansion. For now, the impact looks promising but likely incremental based on recent price trends.

However, there are concerns around board independence that investors should understand in detail.

Exail Technologies' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 9 other fair value estimates on Exail Technologies - why the stock might be worth 31% less than the current price!

Build Your Own Exail Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exail Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Exail Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exail Technologies' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives