It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Ober SA (EPA:ALOBR) share price slid 26% over twelve months. That's disappointing when you consider the market returned 20%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 20% in three years. It's down 1.6% in the last seven days.

View our latest analysis for Ober

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Ober share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

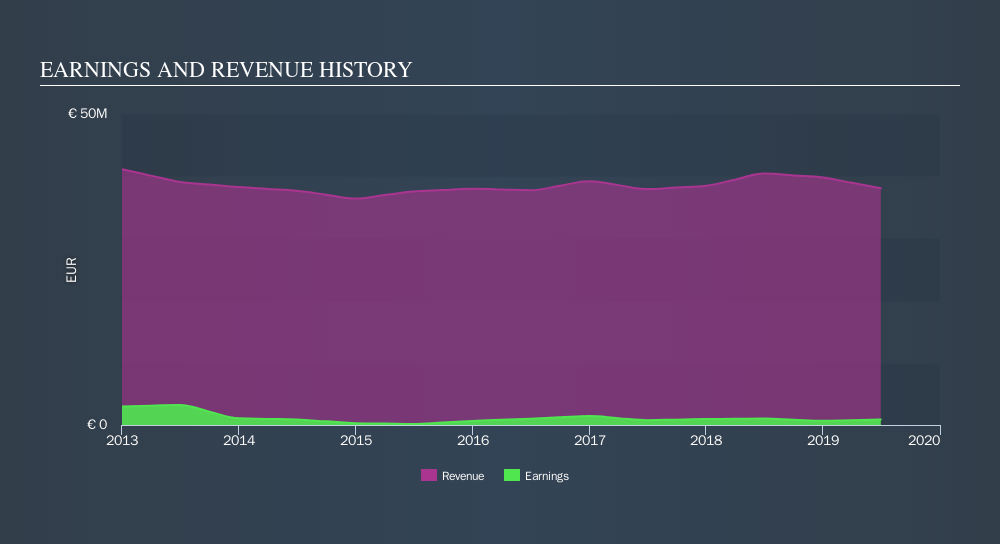

Ober's dividend seems healthy to us, so we doubt that the yield is a concern for the market. In fact, it seems more likely that the revenue fall of 5.8% in the last year is the worry. So it seems likely that the weak revenue is making the market more cautious about the stock.

The graphic below depicts how revenue has changed over time.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Ober, it has a TSR of -22% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Investors in Ober had a tough year, with a total loss of 22% (including dividends) , against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Ober you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

We will like Ober better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ALOBR

Ober

Ober SA provides decorative and technical surfaces for interior fittings in France.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives