Slammed 81% McPhy Energy S.A. (EPA:ALMCP) Screens Well Here But There Might Be A Catch

McPhy Energy S.A. (EPA:ALMCP) shareholders that were waiting for something to happen have been dealt a blow with a 81% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 98% share price decline.

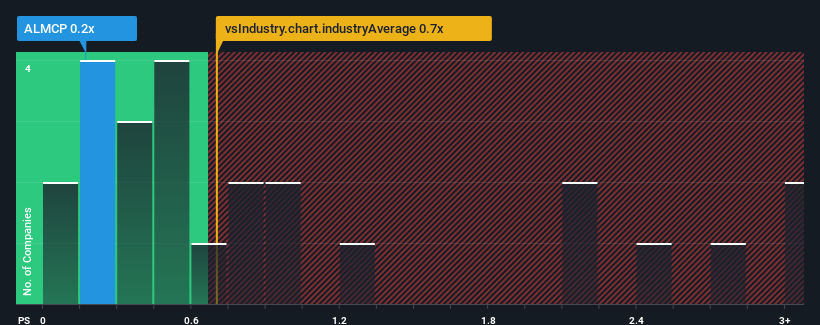

Following the heavy fall in price, when close to half the companies operating in France's Machinery industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider McPhy Energy as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 4 warning signs investors should be aware of before investing in McPhy Energy. Read for free now.View our latest analysis for McPhy Energy

What Does McPhy Energy's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, McPhy Energy's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on McPhy Energy.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as McPhy Energy's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 30%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 57% per year over the next three years. With the industry only predicted to deliver 5.7% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that McPhy Energy's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does McPhy Energy's P/S Mean For Investors?

McPhy Energy's recently weak share price has pulled its P/S back below other Machinery companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems McPhy Energy currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for McPhy Energy (3 can't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALMCP

McPhy Energy

Provides hydrogen production and distribution equipment for hydrogen energy, hydrogen mobility, and industrial hydrogen markets.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives