- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Is Airbus Stock Worth a Fresh Look After Its Recent Surge in Aircraft Orders?

Reviewed by Bailey Pemberton

- Curious if Airbus stock is priced right for your portfolio? Here is what you need to know before making your next move.

- After a stellar 50.9% climb over the past year and a 26.0% gain year-to-date, Airbus has cooled off a bit in recent weeks. The stock dipped 1.2% over seven days and 3.2% in the past month.

- Recent headlines have highlighted Airbus's ongoing winning streak with new aircraft orders and growing airline partnerships. This has fueled optimism about the company's growth prospects. At the same time, industry talk around supply chain pressures and shifting global travel trends has kept investors' eyes on every development.

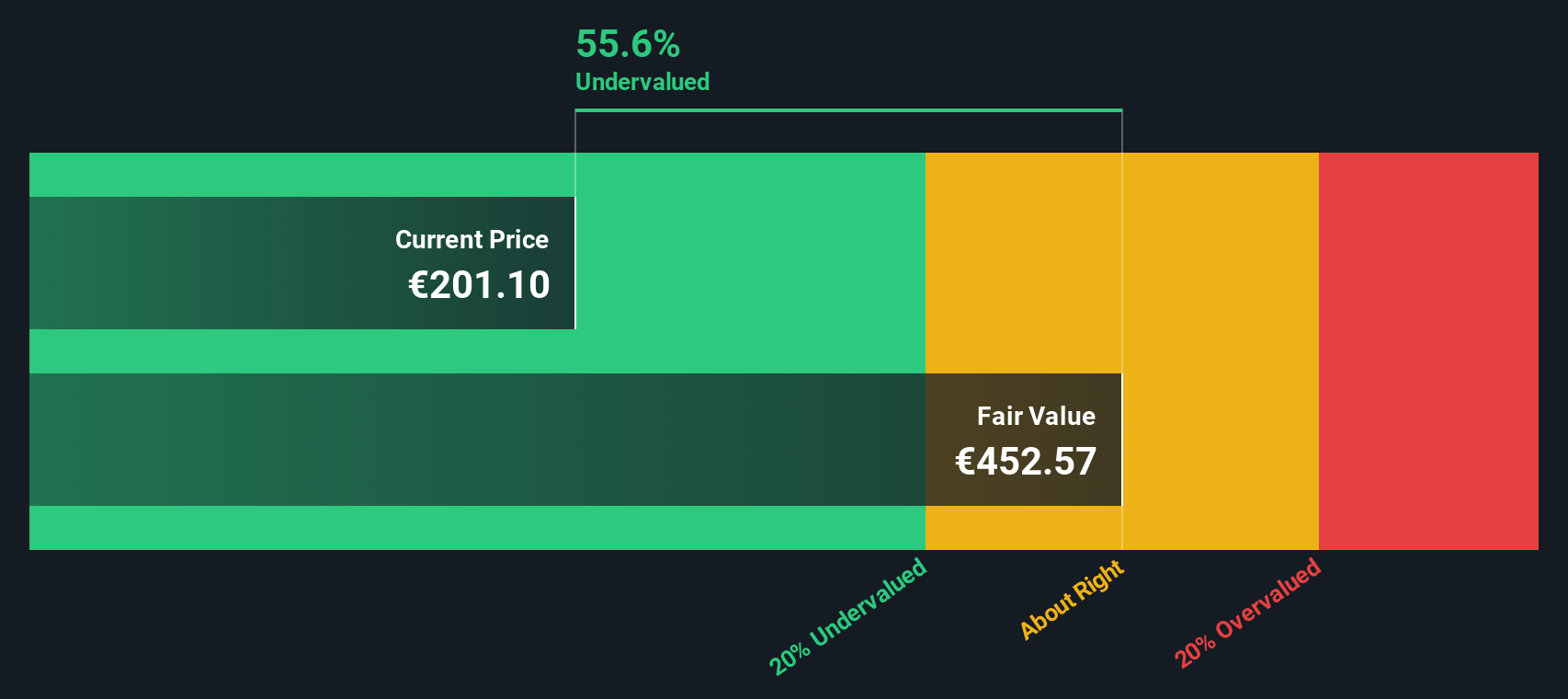

- With a valuation score of 5 out of 6, it is clear that Airbus stands out when it comes to being undervalued versus key benchmarks. Next, we look at different ways to value the company, and an even smarter approach is revealed by the end of this article.

Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach for valuing companies, especially those with consistent cash flows. It forecasts a company's future free cash flows based on analyst estimates and company performance. These projected cash flows are then discounted back to today's value to estimate the business's intrinsic worth.

For Airbus, the current Free Cash Flow stands at approximately €3.8 Billion. Analysts project robust growth in the years ahead, with Free Cash Flow expected to reach about €9.4 Billion by 2029. While analyst estimates build the foundation for the next five years, longer-term figures are extrapolated using conservative growth rates.

Based on these forecasts, the DCF model estimates Airbus’s intrinsic value at roughly €330.69 per share. Compared to its recent market price, this represents a 39.0% discount, suggesting that the stock is significantly undervalued at current levels.

In summary, the DCF model highlights a compelling undervaluation and implies Airbus could offer strong long-term value for investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbus is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Airbus Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular tool for valuing profitable companies like Airbus because it directly connects a company’s market value with its actual earnings. Investors often look to the PE ratio to gauge whether a stock’s price accurately reflects its earnings potential.

A "normal" or fair PE ratio is shaped by key factors such as earnings growth prospects and business risks. Fast-growing companies generally command a higher PE, while firms facing uncertainty or slower expansion tend to trade at lower ratios.

Currently, Airbus trades at a PE ratio of 31.44x. This is below the average for its Aerospace & Defense industry, which stands at 45.54x, and slightly under its peer group average of 33.44x.

Simply Wall St’s “Fair Ratio” for Airbus is 34.93x. The Fair Ratio goes beyond simple averages by factoring in Airbus’s earnings growth outlook, profit margins, market risks, and industry dynamics to pinpoint a multiple that more precisely matches the company’s reality. This personalized metric is more insightful than broad peer or industry comparisons because it considers Airbus’s unique position and trajectory.

When comparing Airbus’s current PE of 31.44x with the Fair Ratio of 34.93x, the stock appears to be trading modestly below what would be expected given its fundamentals, indicating it may be undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a dynamic, easy-to-use tool that lets you combine your own view of Airbus’s story, such as your expectations for its future revenue, earnings, and margins, with the numbers that drive fair value calculations.

Instead of just looking at ratios or static forecasts, Narratives help you link the company’s business realities and industry trends to financial forecasts and ultimately to a personalized fair value. Hosted on Simply Wall St’s Community page, Narratives are used by millions of investors to track their investment logic, compare fair values to the current market price, and decide whether it might be time to buy or sell.

What makes Narratives especially powerful is their ability to update in real time when new news, quarterly results, or analyst updates become available. This helps you avoid outdated assumptions and always keep your view current.

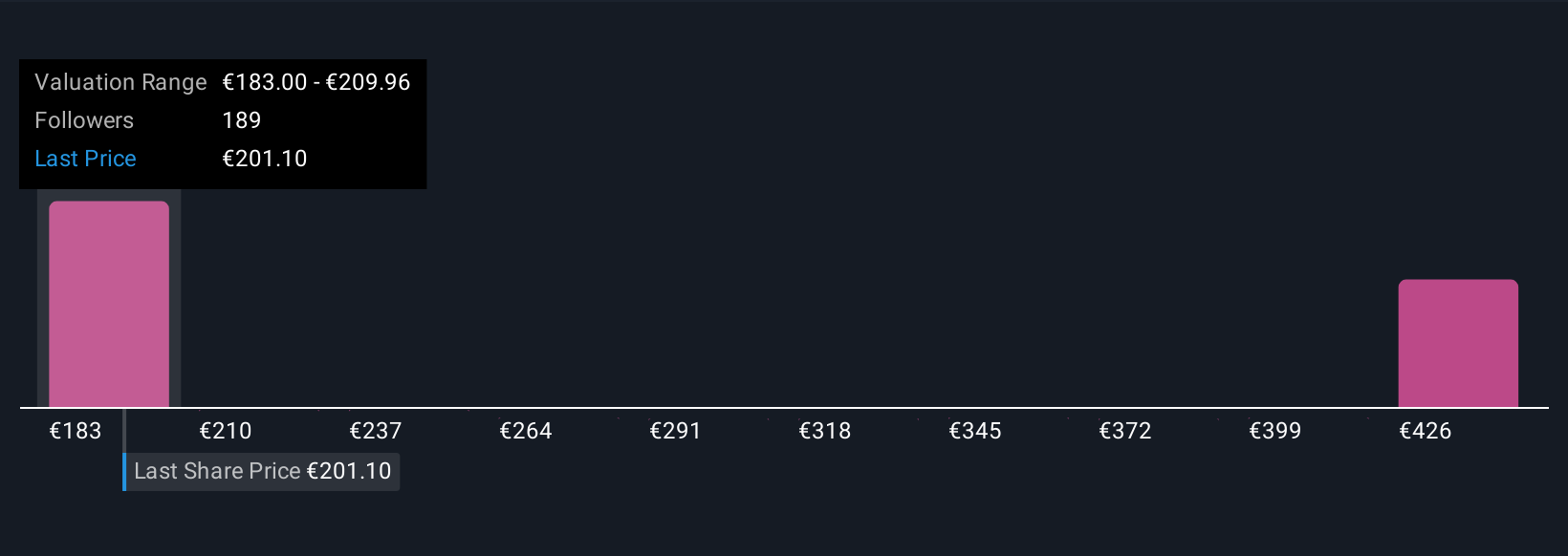

For example, among Airbus investors now, the most optimistic Narrative sees a price target of €244, fueled by strong global demand and margin improvements, while the most cautious Narrative sits at €140, citing supply chain and production risks. This shows how different stories can lead to different estimates and decisions.

Do you think there's more to the story for Airbus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success