- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus (ENXTPA:AIR) Expands A350 Orders and Increases Dividend Payout Target

Reviewed by Simply Wall St

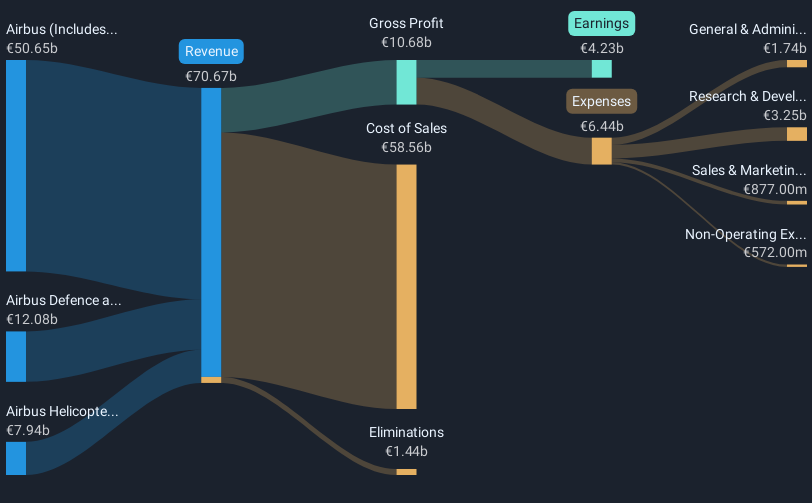

Airbus (ENXTPA:AIR) recently announced its plans to increase shareholder returns by adjusting its dividend payout strategy and securing a significant order from STARLUX Airlines for additional A350-1000 aircraft. Concurrently, the company has formed a partnership with McGill University to advance research and innovation in aerospace. Despite these developments, Airbus's share price remained flat over the past month, aligning with broader market trends. These initiatives, however, suggest a robust strategic focus on growth and sustainability, potentially adding long-term value even as immediate market movements remain tempered.

Buy, Hold or Sell Airbus? View our complete analysis and fair value estimate and you decide.

The recent developments at Airbus, including its adjusted dividend payout strategy and aircraft order from STARLUX Airlines, have further emphasized its commitment to growth and sustainability. These measures could potentially enhance future revenue and earnings, particularly as they involve expansion in key sectors like commercial aircraft. Looking at Airbus's performance over the past five years, the company's total shareholder return, including share price appreciation and dividends, was an impressive 177%. This demonstrates consistent value generation for shareholders over a prolonged period.

Over the past year, however, Airbus's performance with a share price decline of 0.6% did not keep pace with the French Aerospace & Defense industry's 27% growth. Despite the immediate flat share price movement following the recent announcements, analysts have set a consensus price target of €182.17, indicating a potential upside. The share price, presently at €147.14, reflects a significant discount to this target, suggesting room for growth based on expected revenue and earnings forecasts. As Airbus continues to focus on strategic partnerships and resolving supply chain challenges, these initiatives could support its projected revenue growth of 9.7% annually and position it favorably against industry shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives