Is BNP Paribas a Bargain After a 14.4% Drop Despite Strong Yearly Gains?

Reviewed by Bailey Pemberton

- Wondering if BNP Paribas is really offering value right now? You are not alone; a lot of investors are digging into what the numbers actually mean for the stock.

- Despite a recent dip of 2.1% this week and a 14.4% slide over the past month, BNP Paribas is still up an impressive 13.2% year-to-date and 17.1% over the last year, hinting at resilience and underlying growth potential.

- Recent headlines about the European banking sector have brought fresh attention to major players like BNP Paribas, especially as shifting economic conditions and regulatory changes have stirred up both optimism and uncertainty. News around the company’s expanding international operations and fintech initiatives has also caught the eye of market watchers.

- For those looking for a quick metric, BNP Paribas scores a 6/6 on our basic valuation checks, putting it at the top of the range. We are going to explore not just the usual ratios, but also a more holistic way to think about valuation by the end of this article.

Find out why BNP Paribas's 17.1% return over the last year is lagging behind its peers.

Approach 1: BNP Paribas Excess Returns Analysis

The Excess Returns valuation model assesses a company based on how efficiently it generates profits from its invested capital, after accounting for the required return demanded by shareholders. This approach pays close attention to the return on equity and the quality of future earnings, rather than just headline growth rates or cash flows.

For BNP Paribas, the numbers provide a revealing snapshot. The current Book Value stands at €111.07 per share. The anticipated stable Book Value is projected at €115.32 per share. Looking at earnings, the stable Earnings Per Share (EPS) is estimated at €11.99 per share, based on weighted future return on equity projections from 13 analysts. The company’s average Return on Equity is 10.40%, which is solid for a major European bank. However, the estimated Cost of Equity is €13.95 per share. This means the calculated Excess Return is slightly negative at €-1.96 per share. These figures suggest the bank is making good use of its equity base, but just below the threshold that investors might like to see for true outperformance. All book value and EPS estimates are sourced from consensus analyst estimates.

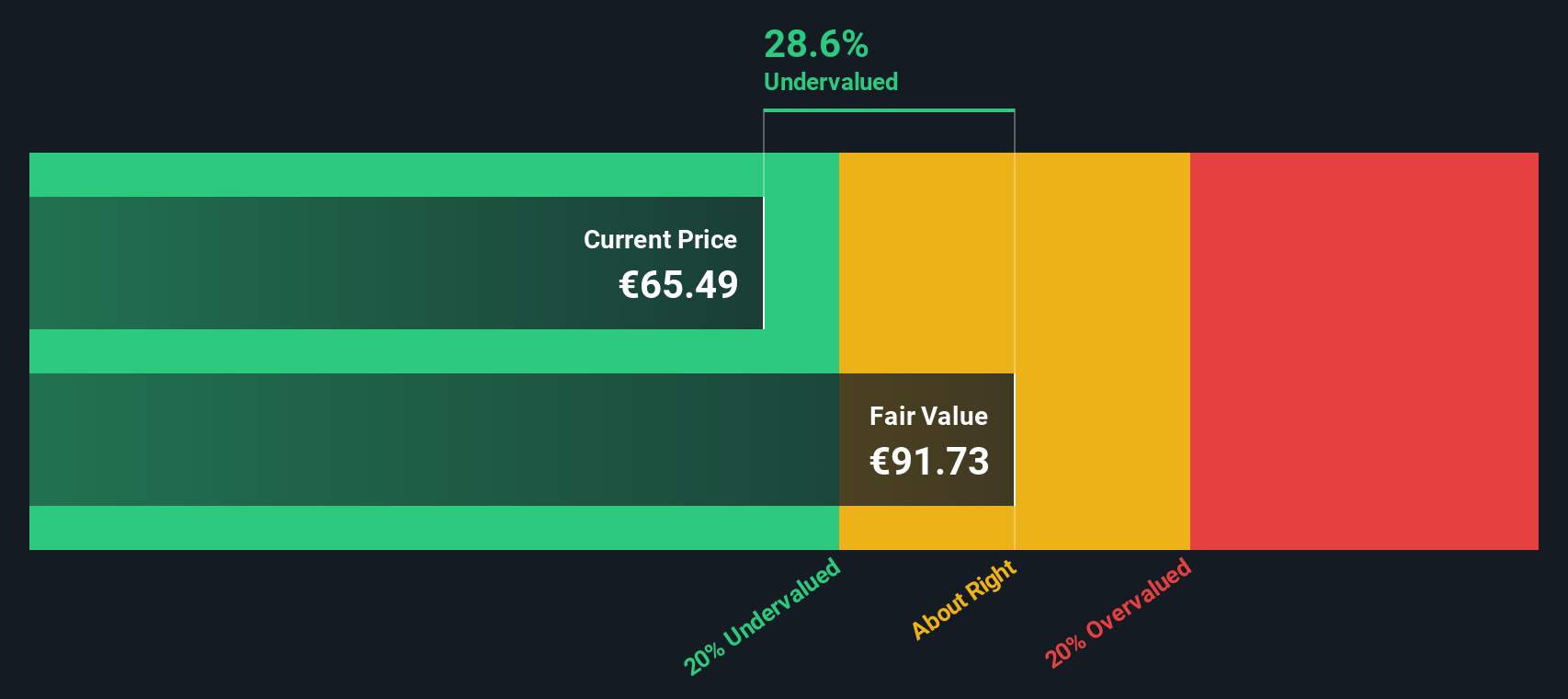

The model calculates an intrinsic value that is 30.2% above the current share price. This suggests the stock is currently undervalued according to these metrics.

Result: UNDERVALUED

Our Excess Returns analysis suggests BNP Paribas is undervalued by 30.2%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: BNP Paribas Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for established, profitable companies like BNP Paribas. This ratio is popular because it gives investors a quick sense of how much they are paying for each euro of earnings. It is especially useful when a company is consistently profitable.

When evaluating PE ratios, it is important to consider growth prospects and risk. Companies with strong future earnings growth or lower perceived risk tend to command higher PE ratios. On the other hand, slower growth or higher risk usually means investors are willing to pay less for the same amount of earnings.

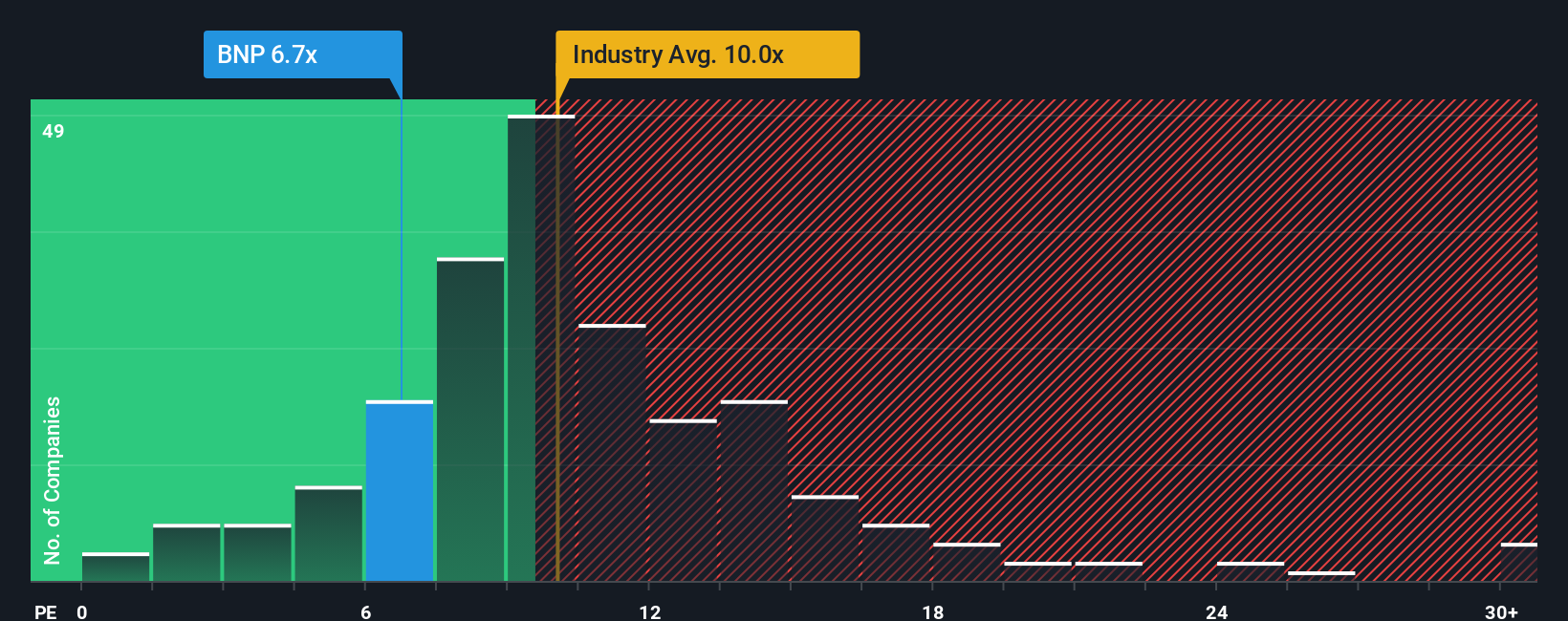

BNP Paribas is currently trading at a PE ratio of 6.89x. This is well below both the average for its European banking industry peers (11.78x) and the broader banking industry average of 10.11x. Simply Wall St’s proprietary Fair Ratio for BNP Paribas is calculated at 8.67x. This reflects not just peer benchmarks but also important company-specific factors such as expected earnings growth, profit margins, market conditions, and risk profile. The Fair Ratio provides a more tailored view than comparing only to peers because it incorporates nuanced differences between companies, such as the scale of the bank, the sustainability of earnings, and how the company navigates sector risks.

Since BNP Paribas’s actual PE ratio of 6.89x is below the Fair Ratio of 8.67x, the stock currently looks undervalued based on this key multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BNP Paribas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives: an approach that empowers you to create your own story behind BNP Paribas’s numbers, based on your personal expectations for its future revenue, earnings and margins.

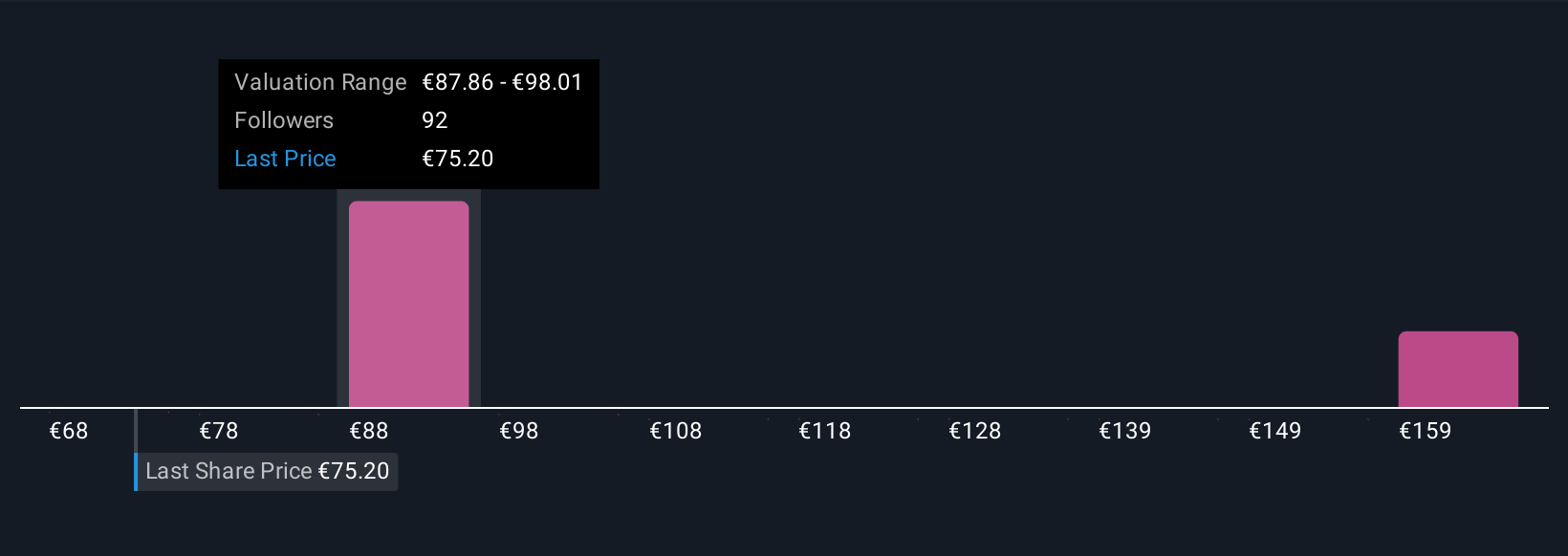

A Narrative is essentially your investment viewpoint, connecting what’s happening in the business to a forecast of its fundamentals, and then to a “fair value” you believe is justified. Narratives make it easy to translate your view of market opportunities, risks, and execution into actionable investment ideas. You can explore and build Narratives easily using Simply Wall St’s Community page, where millions of investors share and update their perspectives.

Narratives help you decide when to buy or sell by showing the difference between a company’s Fair Value (based on your or others’ assumptions) and its current price. And because Narratives update dynamically as new information or news comes in, they always reflect the latest outlook.

For BNP Paribas, one investor’s Narrative might forecast robust expansion in digital wealth management and set a fair value around €100 per share. Another, more cautious view might focus on regulatory pressures and assign a value closer to €77. Your Narrative makes all the difference in your decision making.

Do you think there's more to the story for BNP Paribas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives