Is BNP Paribas a Bargain After 13% Pullback and Digital Banking Expansion?

Reviewed by Bailey Pemberton

- Wondering whether BNP Paribas is trading at a bargain or an overhyped price? You're in the right place, especially if you like unearthing value where others might overlook it.

- The stock has shown impressive long-term growth, gaining 132.1% over 5 years and 20.6% in the past year. There was a recent pullback of 13.3% over the past month.

- Context for these moves comes from major headlines such as BNP Paribas' strategic push into sustainable finance and its increased focus on digital banking services, which have caught investors’ attention. Shifts in the European financial sector and changing interest rates have also played a part, sparking both optimism and caution among shareholders.

- When we run the numbers, BNP Paribas scores a 6 out of 6 on our valuation checks for undervaluation. We will break down the traditional ways to value the company in just a moment, but keep reading to see the even bigger picture at the end of the article.

Find out why BNP Paribas's 20.6% return over the last year is lagging behind its peers.

Approach 1: BNP Paribas Excess Returns Analysis

The Excess Returns Model evaluates whether a company is creating value by earning returns on its equity that exceed its cost of equity. For BNP Paribas, this method helps estimate the intrinsic worth of the stock based on how efficiently the bank is deploying shareholder capital, compared to what investors would typically require as compensation for risk.

Key metrics from analysts’ forecasts include a Book Value of €111.07 per share, with a Stable EPS projected at €11.77 per share. These estimates are underpinned by a weighted average future Return on Equity of 10.26% from 14 analysts. The cost of equity is calculated at €14.11 per share, meaning the excess return is actually negative at €-2.35 per share. Stable Book Value is forecast to reach €114.72 per share, backed by consensus estimates from nine analysts. This signals that, while BNP Paribas continues to grow its book value and produce substantial earnings, it is not currently covering its required cost of capital.

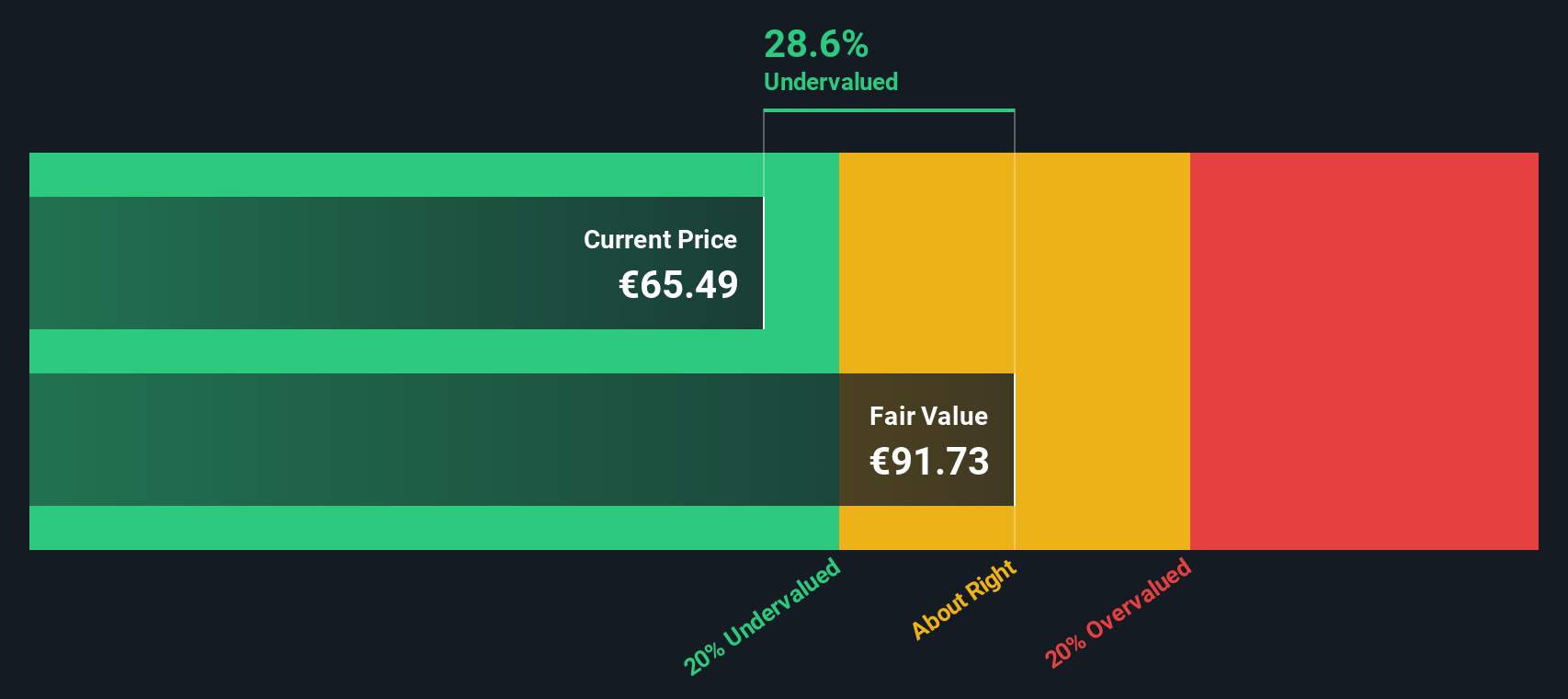

The Excess Returns Model currently estimates the intrinsic value of BNP Paribas stock as being 28.6% above the market price, indicating undervaluation. This suggests there may be an opportunity for value-seeking investors, provided that future returns on equity remain stable or improve.

Result: UNDERVALUED

Our Excess Returns analysis suggests BNP Paribas is undervalued by 28.6%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: BNP Paribas Price vs Earnings

For profitable companies like BNP Paribas, the Price-to-Earnings (PE) ratio is one of the most useful valuation metrics. It provides a quick snapshot of how much investors are willing to pay today for each euro of current earnings. This makes it a favored benchmark for banks and other mature businesses with consistent profits.

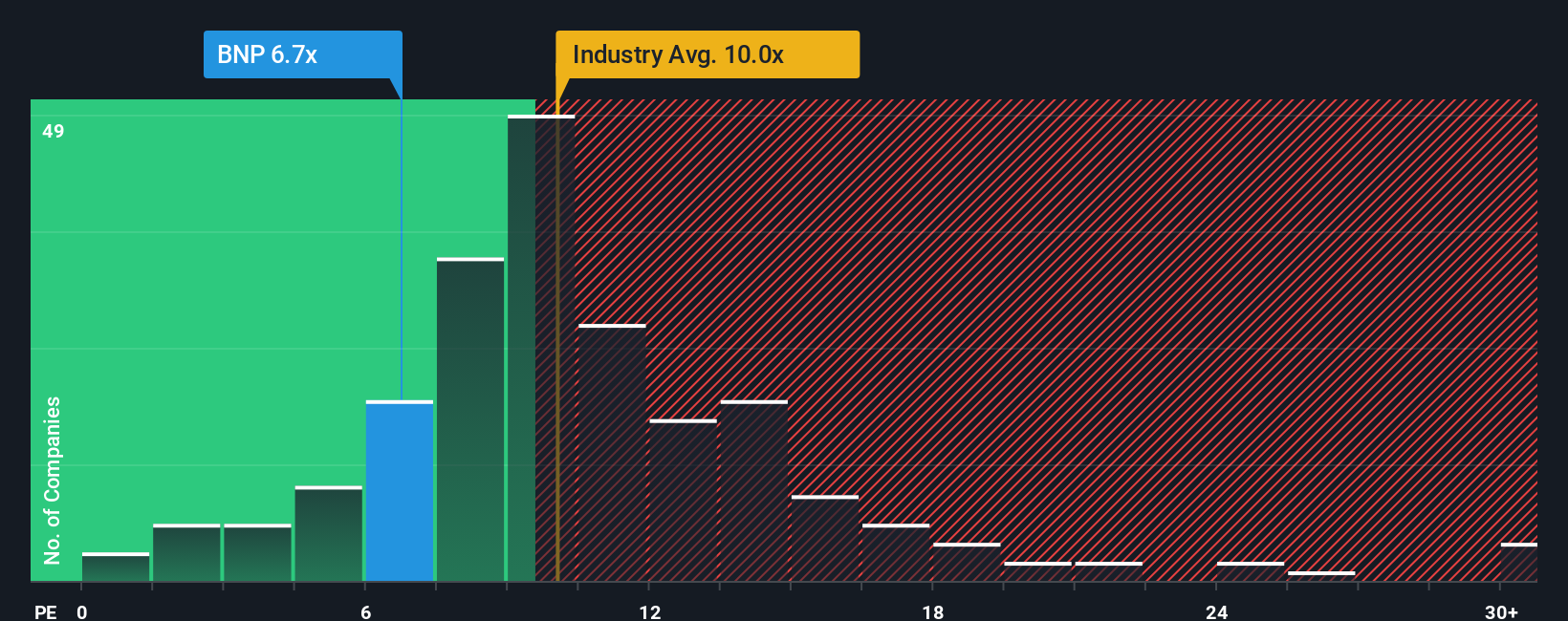

What counts as a "normal" or "fair" PE ratio is influenced by expectations for growth and risk. Higher-growth, lower-risk stocks tend to command higher PE multiples, while companies facing headwinds often trade at a discount. Comparing BNP Paribas' current PE of 6.73x to the average for the European banks industry, which sits at 10.18x, and to its main peers at 11.83x, it is clear that BNP Paribas is trading at a notable discount to both benchmarks.

However, rather than relying solely on crude comparisons, Simply Wall St's Fair Ratio of 7.63x offers a more comprehensive benchmark. This proprietary metric takes into account not just BNP Paribas' growth estimates, profit margins, and market cap, but also factors in industry dynamics and specific risks the company faces. Because it adjusts for more than just averages, it provides a much clearer real-world sense of what the market could rationally pay for BNP Paribas right now.

With the current PE ratio almost a full point below the Fair Ratio, BNP Paribas looks undervalued using this approach, signaling potential upside if the fundamentals hold steady.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BNP Paribas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company, an accessible tool that allows you to tie together your outlook on BNP Paribas' future (like projected revenue, earnings, or margins) into a single, actionable financial forecast and fair value.

Unlike traditional valuation methods that rely just on the numbers, Narratives link your specific perspective or thesis about BNP Paribas with the actual financial modeling and market valuation, providing context for your expectations. On Simply Wall St's Community page, millions of investors regularly create Narratives to easily compare their own fair value estimates with the current share price and decide whether to buy, hold, or sell.

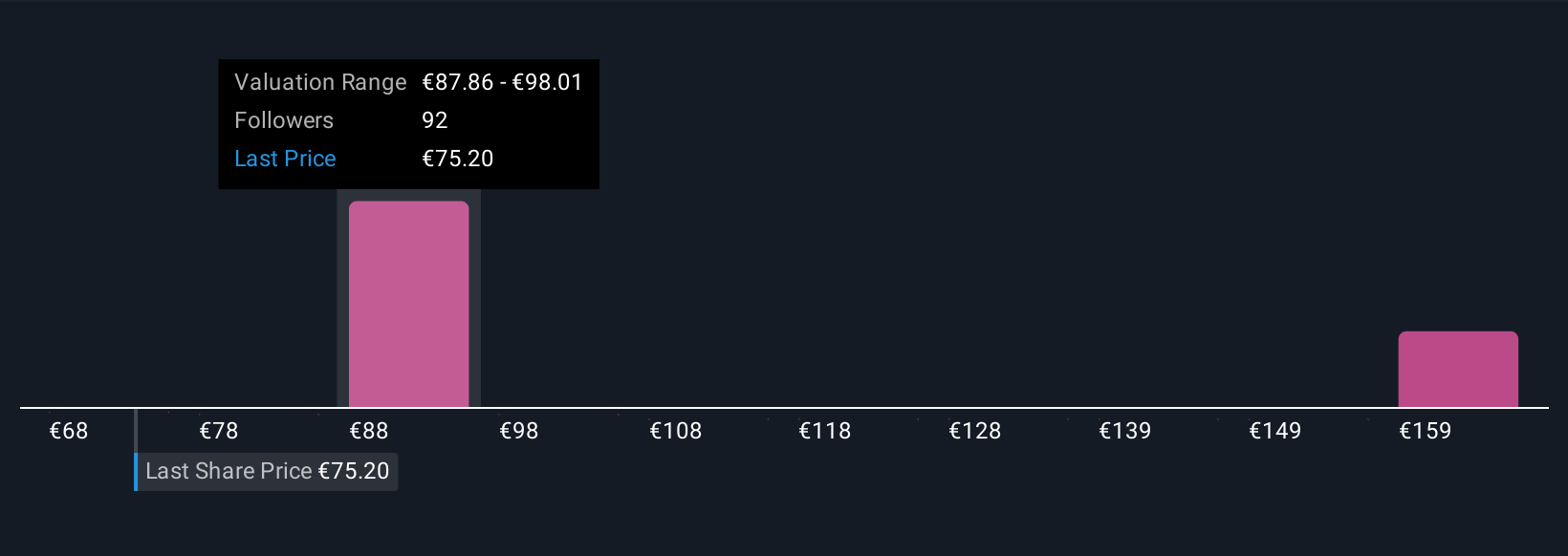

Narratives are dynamic. Any time new information, earnings reports, or news hits the market, the fair value and outlook are automatically updated so your investment case always stays relevant. For example, the widest analyst Narratives for BNP Paribas show a high target of €100.0 for very bullish cases built around rapid client acquisition and digital expansion, while the most cautious see fair value as low as €77.4, reflecting worries about regulatory and margin headwinds. Narratives empower you to quickly see how different expectations lead to different decisions, helping you make smarter moves with confidence.

Do you think there's more to the story for BNP Paribas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives