- France

- /

- Auto Components

- /

- ENXTPA:OPM

Compagnie Plastic Omnium SE (EPA:POM) Screens Well But There Might Be A Catch

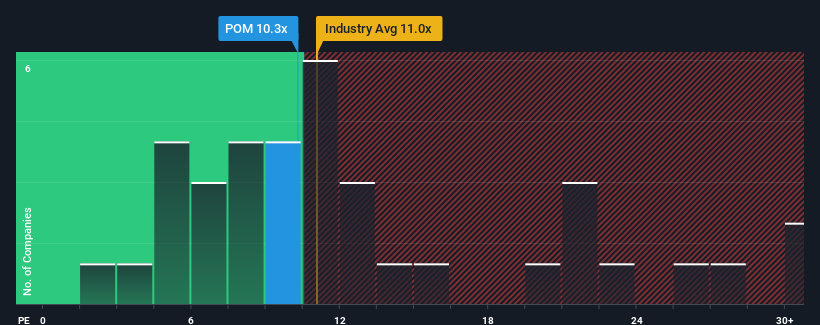

When close to half the companies in France have price-to-earnings ratios (or "P/E's") above 16x, you may consider Compagnie Plastic Omnium SE (EPA:POM) as an attractive investment with its 10.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Compagnie Plastic Omnium certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Compagnie Plastic Omnium

How Is Compagnie Plastic Omnium's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Compagnie Plastic Omnium's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 86% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the nine analysts watching the company. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Compagnie Plastic Omnium's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Compagnie Plastic Omnium currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Compagnie Plastic Omnium.

If you're unsure about the strength of Compagnie Plastic Omnium's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives