- France

- /

- Auto Components

- /

- ENXTPA:ML

Does Michelin’s Greener Manufacturing Push Signal a New Opportunity After Shares Drop 13.9% in 2025?

Reviewed by Bailey Pemberton

- Wondering if Compagnie Générale des Établissements Michelin Société en commandite par actions stock is a genuine bargain or just priced fairly? You are not alone. With market opinions all over the place, a deeper dive is well worth it.

- The past year has seen the share price dip by 7.3%, with a steeper drop of 13.9% year-to-date. This could mean new opportunities or changing risks.

- Recent headlines about Michelin have highlighted strategic partnerships and sustainability initiatives, both of which contribute to broader market sentiment and may explain some of the stock’s price movements lately. For instance, news of Michelin’s commitment to greener manufacturing and expanding collaborations in the tire industry have provided useful context around investor expectations.

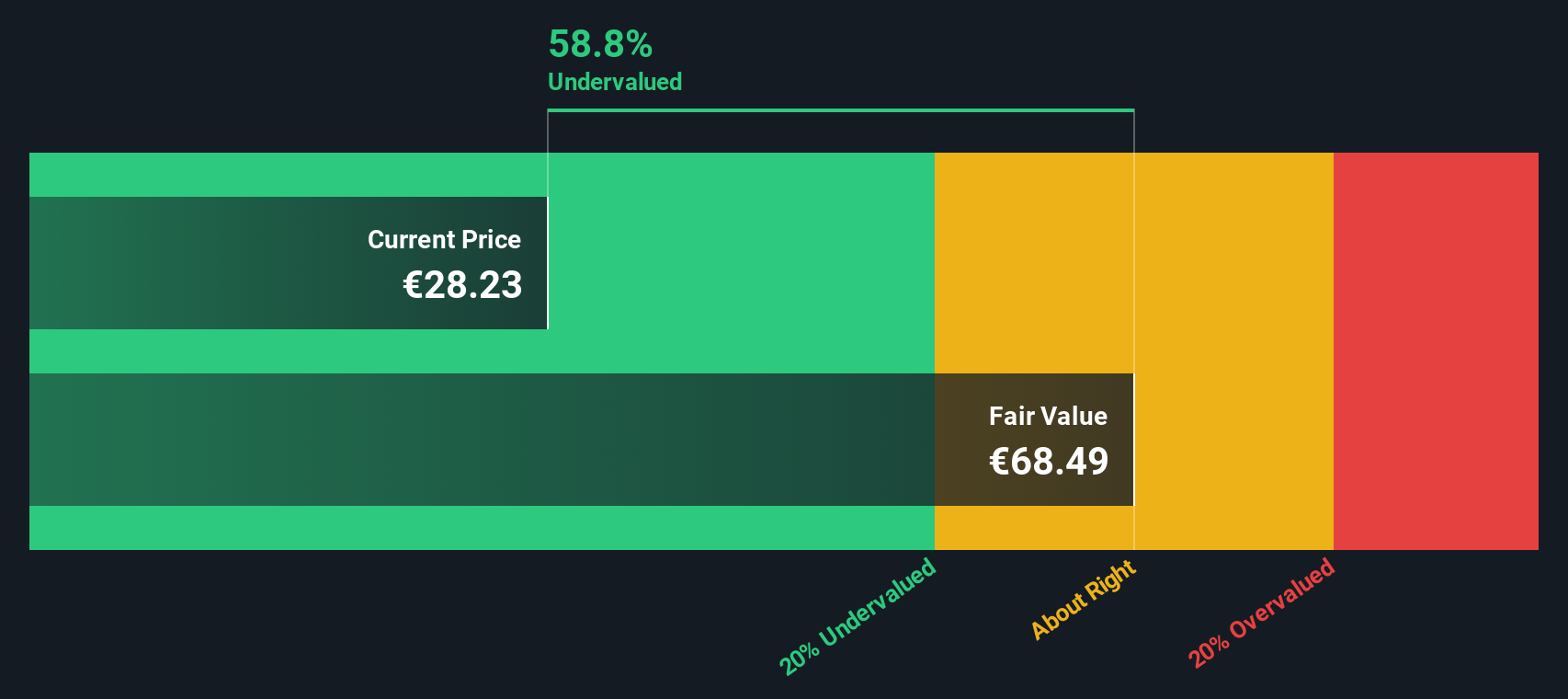

- Based on our six-point valuation check, Michelin’s value score sits at 4 out of 6. This indicates the stock is undervalued in a majority of areas. Let’s unpack the common methods analysts use to value companies like Michelin, and stick around as we reveal a smarter way to assess fair value at the end.

Approach 1: Compagnie Générale des Établissements Michelin Société en commandite par actions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to today’s value. This approach takes into account both analyst estimates and longer-term forecasts.

For Compagnie Générale des Établissements Michelin Société en commandite par actions, the most recent Free Cash Flow was €1.36 billion. Analysts forecast strong growth, projecting Free Cash Flow to rise to €3.24 billion by 2029. While detailed estimates are only available for the next five years, Simply Wall St extrapolates into the following decade. Their analysis shows steady growth based on the two-stage model.

Based on these projections, the DCF model returns an intrinsic value of €72.90 per share. With the DCF model indicating a 62.0% discount relative to the current share price, the stock is notably undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Compagnie Générale des Établissements Michelin Société en commandite par actions is undervalued by 62.0%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Compagnie Générale des Établissements Michelin Société en commandite par actions Price vs Earnings

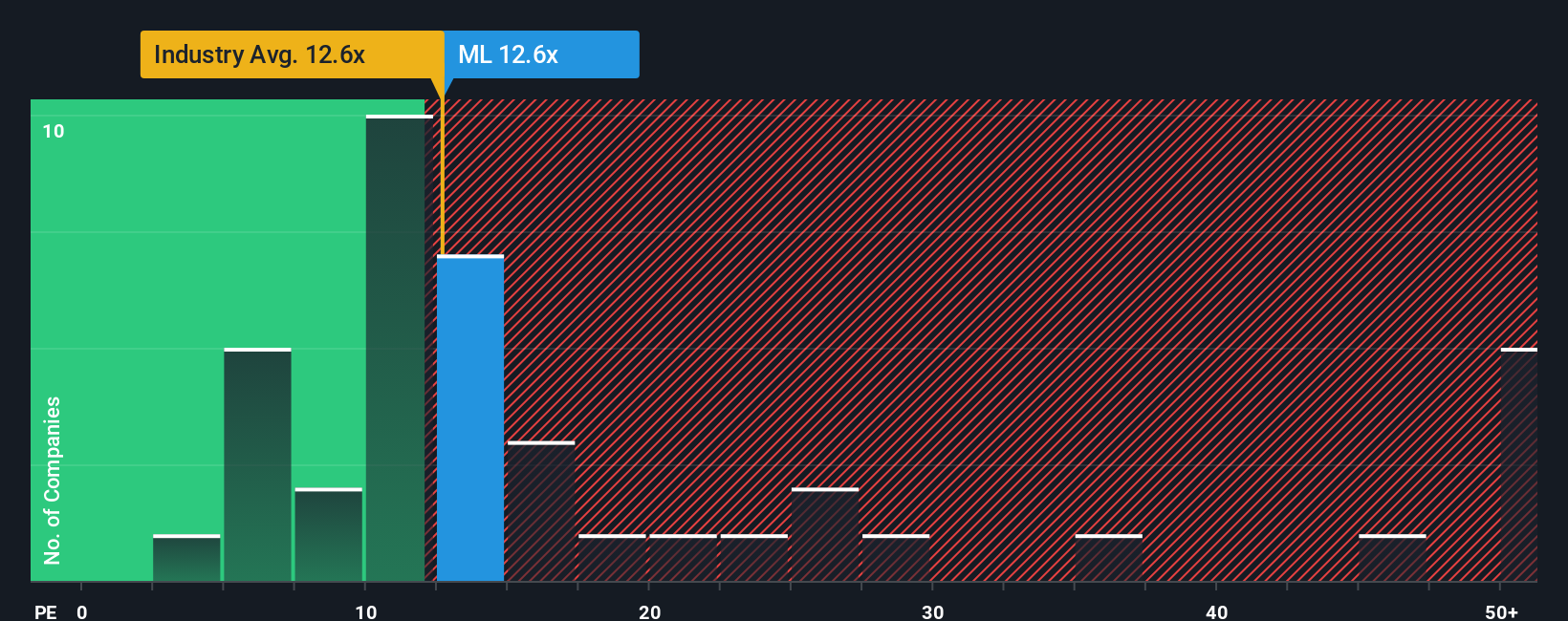

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Compagnie Générale des Établissements Michelin Société en commandite par actions because it provides a direct comparison between a company's share price and its earnings per share. It is a quick way to gauge how much investors are paying for each euro of earnings, making it particularly relevant for established businesses that generate steady profits.

Growth expectations and risk levels play a big role in shaping what counts as a “normal” or “fair” PE ratio. Companies with higher growth potential or lower perceived risk typically command higher PE multiples. More mature firms or those facing greater uncertainties usually trade at lower ratios.

Currently, Michelin’s PE ratio sits at 12.4x, which is notably lower than both the auto components industry average of 21.3x and the selected peer group’s 17.5x. This lower PE might suggest the stock is inexpensive, but context is key.

Simply Wall St’s proprietary Fair Ratio takes things further. This approach calculates what a fair PE multiple should be for Michelin, factoring in its earnings growth, profit margins, industry dynamics, company size, and unique risks. This is more reliable than just comparing against industry averages or peers, since it incorporates company-specific fundamentals that can significantly affect a fair value estimate.

In Michelin’s case, the Fair Ratio is 11.4x, which is very close to the company’s current PE ratio of 12.4x. The slim difference suggests the stock is trading at about what you would expect given its characteristics.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Compagnie Générale des Établissements Michelin Société en commandite par actions Narrative

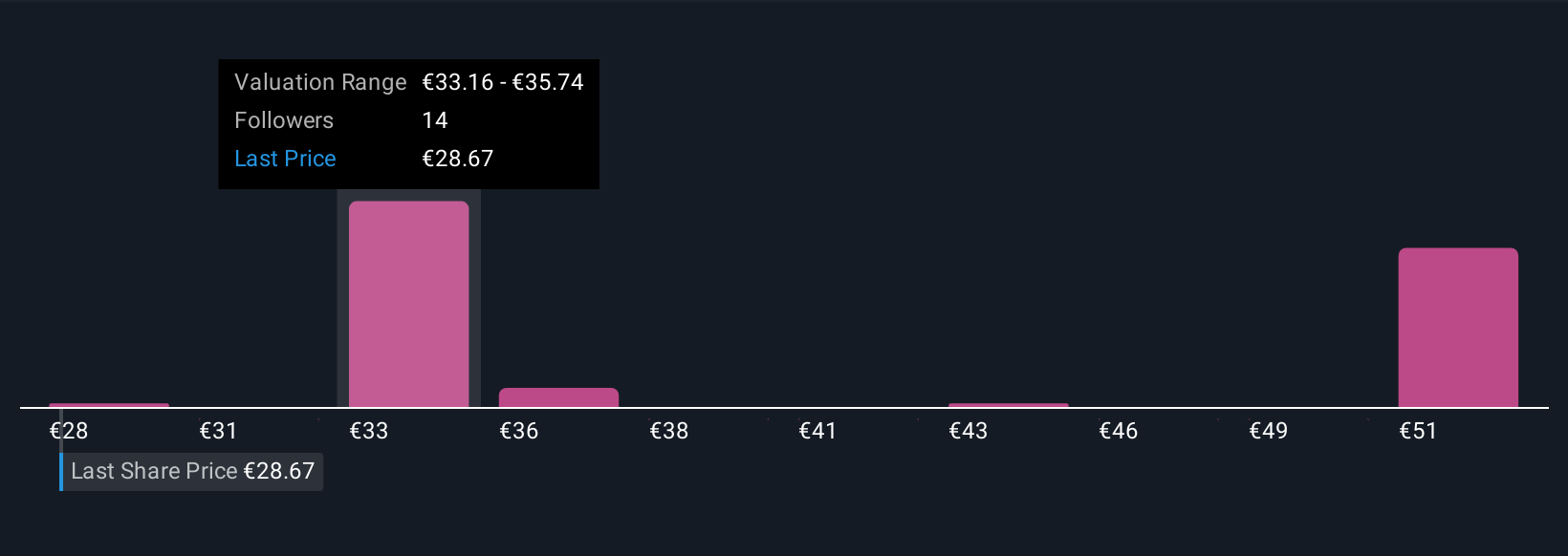

Earlier, we hinted at a more dynamic approach to valuation, so let’s talk about Narratives. A Narrative is a simple, accessible way for you to express your own perspective on a company, weaving together its story, such as recent restructuring, new products, or market risks, with quantitative expectations like future revenue, earnings, and profit margins. Narratives bridge the gap between a company’s business outlook and the numbers, helping you generate a personalized fair value and compare it to the current price to guide your buy or sell decisions.

Simply Wall St has made Narratives available right in the Community page, where millions of investors can build and share their investment stories as news breaks or earnings are announced. Unlike static ratios, Narratives update automatically when the latest financials or headlines land, keeping your thesis relevant over time.

For Compagnie Générale des Établissements Michelin Société en commandite par actions, one Narrative might emphasize innovation in EV and eco-friendly tires driving strong growth, while another may focus on margin risks from global competition or price volatility. These different perspectives help explain why bullish investors see a fair value near €43.0 per share and more cautious ones estimate just €28.0, so you can weigh all sides as you form your own view.

Do you think there's more to the story for Compagnie Générale des Établissements Michelin Société en commandite par actions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives