- France

- /

- Auto Components

- /

- ENXTPA:FRVIA

Further weakness as Forvia (EPA:FRVIA) drops 3.3% this week, taking five-year losses to 53%

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Forvia SE (EPA:FRVIA) share price is a whole 60% lower. That's not a lot of fun for true believers. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Forvia

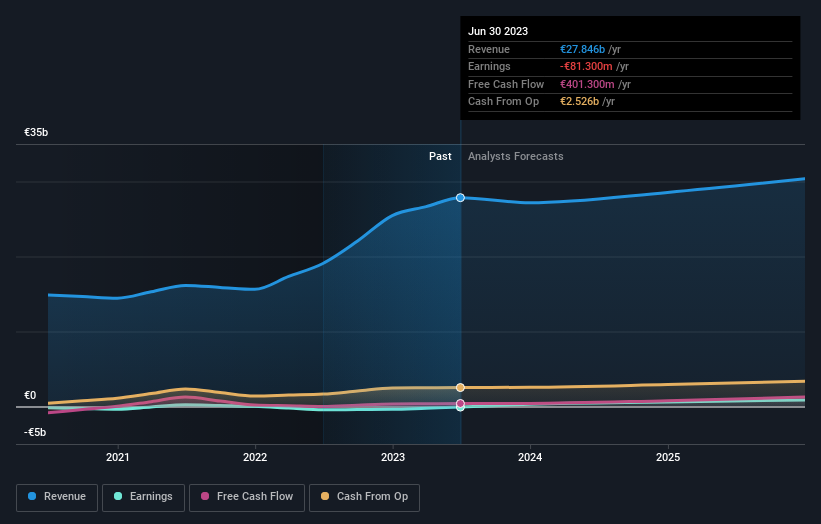

Because Forvia made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Forvia saw its revenue increase by 8.8% per year. That's a pretty good rate for a long time period. The share price return isn't so respectable with an annual loss of 10% over the period. It seems probably that the business has failed to live up to initial expectations. A pessimistic market can create opportunities.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Forvia is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Forvia in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Forvia's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Forvia's TSR of was a loss of 53% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Forvia shareholders have received a total shareholder return of 55% over the last year. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Forvia better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Forvia .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FRVIA

Forvia

Manufactures and sells automotive technology solutions in France, Germany, other European countries, the Americas, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives