Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Valeo SA (EPA:FR) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Valeo

How Much Debt Does Valeo Carry?

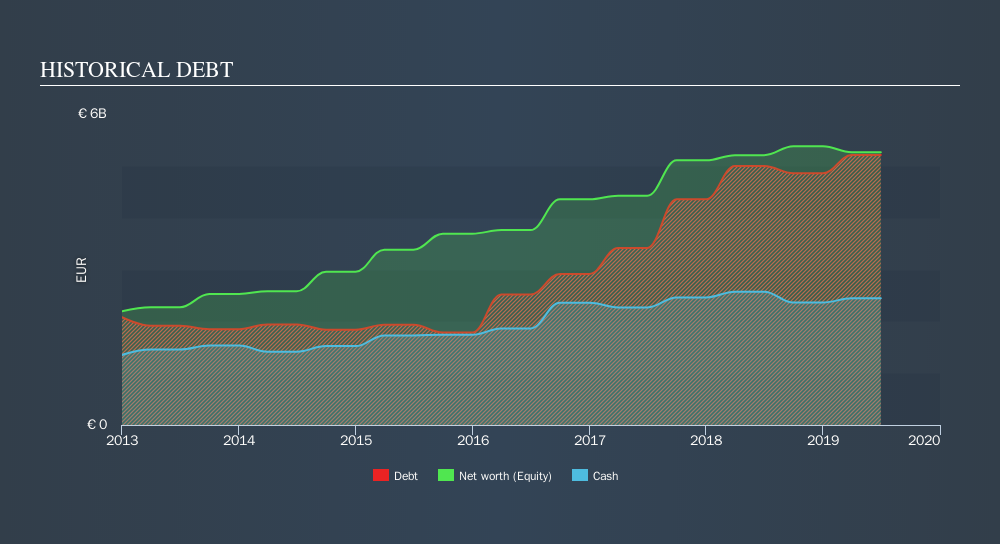

As you can see below, at the end of June 2019, Valeo had €5.21b of debt, up from €5.00b a year ago. Click the image for more detail. However, because it has a cash reserve of €2.44b, its net debt is less, at about €2.76b.

A Look At Valeo's Liabilities

The latest balance sheet data shows that Valeo had liabilities of €8.03b due within a year, and liabilities of €6.16b falling due after that. Offsetting this, it had €2.44b in cash and €2.99b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €8.76b.

Given this deficit is actually higher than the company's market capitalization of €7.19b, we think shareholders really should watch Valeo's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that Valeo's moderate net debt to EBITDA ratio ( being 1.5), indicates prudence when it comes to debt. And its strong interest cover of 13.9 times, makes us even more comfortable. In fact Valeo's saving grace is its low debt levels, because its EBIT has tanked 35% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Valeo can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Valeo's free cash flow amounted to 23% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Valeo's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Overall, it seems to us that Valeo's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Valeo's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives