- France

- /

- Auto Components

- /

- ENXTPA:ALDEL

Returns At Delfingen Industry (EPA:ALDEL) Appear To Be Weighed Down

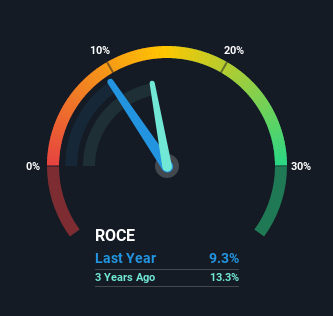

What trends should we look for it we want to identify stocks that can multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Delfingen Industry (EPA:ALDEL) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Delfingen Industry, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.093 = €21m ÷ (€330m - €106m) (Based on the trailing twelve months to December 2020).

Thus, Delfingen Industry has an ROCE of 9.3%. On its own, that's a low figure but it's around the 8.3% average generated by the Auto Components industry.

View our latest analysis for Delfingen Industry

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Delfingen Industry, check out these free graphs here.

What Does the ROCE Trend For Delfingen Industry Tell Us?

In terms of Delfingen Industry's historical ROCE trend, it doesn't exactly demand attention. The company has consistently earned 9.3% for the last five years, and the capital employed within the business has risen 114% in that time. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

The Key Takeaway

As we've seen above, Delfingen Industry's returns on capital haven't increased but it is reinvesting in the business. Yet to long term shareholders the stock has gifted them an incredible 152% return in the last five years, so the market appears to be rosy about its future. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

Delfingen Industry does come with some risks though, we found 3 warning signs in our investment analysis, and 2 of those are significant...

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading Delfingen Industry or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALDEL

Delfingen Société Anonyme

Provides protection and routing systems for electrical networks and on-board fluid transfer solutions to industrial and automotive sectors worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success