- Finland

- /

- Telecom Services and Carriers

- /

- HLSE:ELISA

Elisa (HLSE:ELISA) Margin Dip Reignites Debate Over Profitability Narrative

Reviewed by Simply Wall St

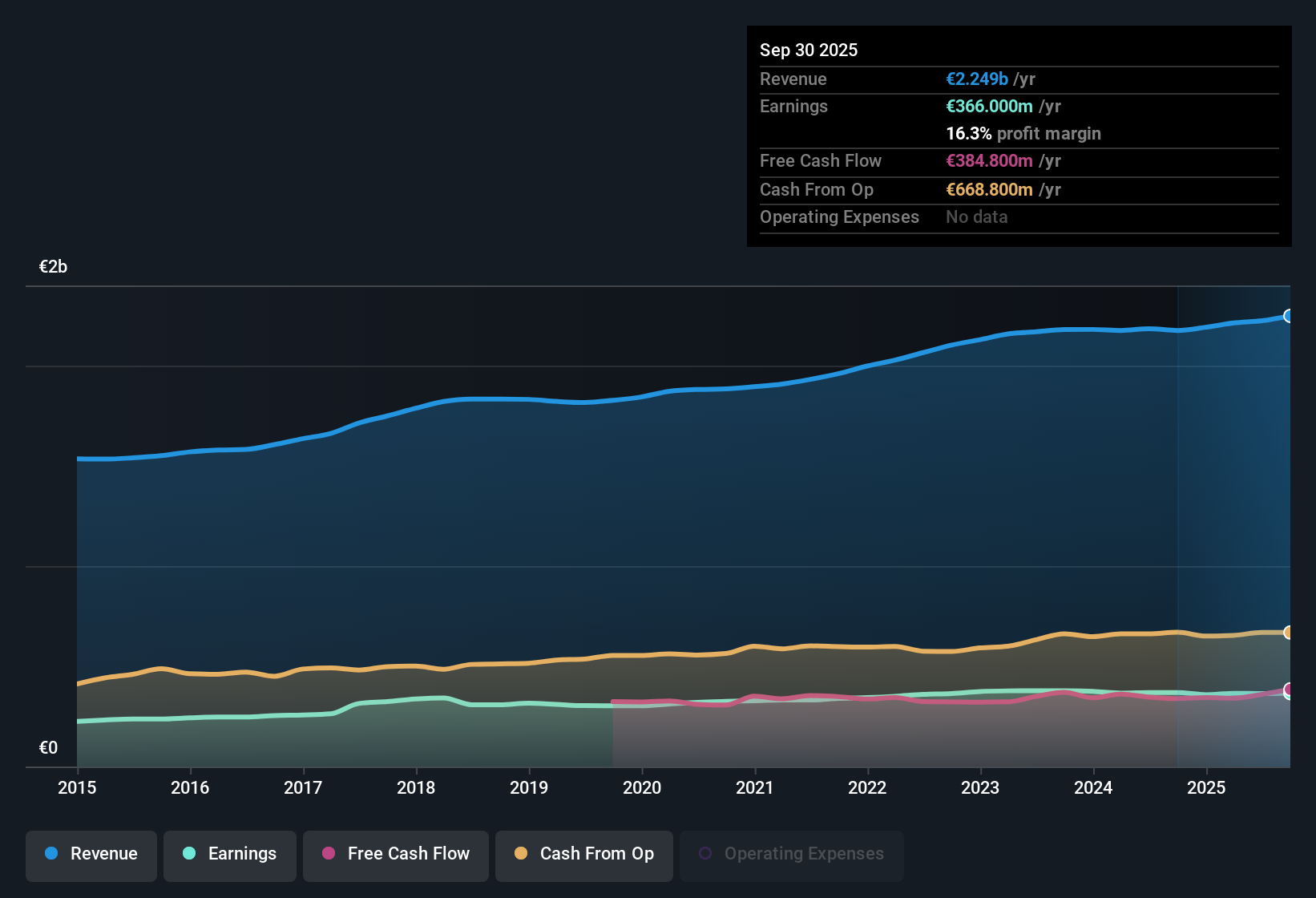

Elisa Oyj (HLSE:ELISA) reported net profit margins of 16.4%, down from last year’s 16.9%, as earnings experienced negative growth over the past year following a five-year average growth rate of 2.6% annually. Earnings are forecast to rebound, growing at 4.86% per year, while revenue is expected to rise 2.5% per year, trailing the Finnish market’s 4% pace. With the share price trading at €40.12, below the estimated fair value of €72.10, investors are weighing ongoing profit and revenue growth against emerging concerns over margins and dividend sustainability.

See our full analysis for Elisa Oyj.The next section explores how these results compare to the story investors tell about Elisa. Let’s see which narratives are confirmed and which face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Dip from 16.9% to 16.4%

- Net profit margins narrowed from 16.9% to 16.4% over the past year, underscoring a modest pullback in profitability despite annualized five-year earnings growth of 2.6%.

- The prevailing market view highlights that, while recent margin pressure reflects sector-wide pricing competition, Elisa’s steady approach to 5G and digital expansion is seen as cushioning against further profit slippage.

- Sector peers across the Nordics are facing similar high capital outlays as they invest in network upgrades.

- Investors look to Elisa’s operational stability during this period, with stable margins serving as a bellwether for defensive strength in a competitive climate.

Trading Below DCF Fair Value

- The current share price of €40.12 stands significantly under the DCF fair value estimate of €72.10, putting Elisa at a notable valuation discount.

- Market analysis notes that this discount heavily supports the case for good value, especially given Elisa’s high-quality earnings. At the same time, it signals that investors may be waiting for stronger near-term growth before rerating the stock.

- Elisa’s shares are priced well below the Finnish market’s revenue growth leaders. This reflects cautious optimism about its long-term cash flow strength.

- Despite lower short-term growth expectations compared to the sector, reliable cash generation and dividends draw income-focused investors.

Dividend Sustainability Under Watch

- Key risks highlighted by the company include uncertainty around the sustainability of its dividend, a concern that complicates its reputation as a blue-chip income stock.

- The prevailing market view recognizes that while Elisa’s commitment to payouts is a core attraction, recent earnings weakness and slightly compressed margins prompt questions about its future ability to maintain current dividend levels.

- Ongoing sector pressure on profitability may limit near-term flexibility to grow the dividend.

- The balance between stable cash flow and the risk of a payout adjustment remains a primary consideration for both new and existing shareholders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Elisa Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Elisa’s squeezed profit margins and looming questions over dividend sustainability highlight uncertainty for investors seeking reliable income and consistent returns.

If dependable payouts and financial resilience matter to you, consider these 1979 dividend stocks with yields > 3% to discover companies that offer stronger and more secure dividend prospects right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elisa Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ELISA

Elisa Oyj

Provides telecommunications, information and communication technology (ICT), and online services in Finland, rest of Europe, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives