- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:VAIAS

Vaisala (HLSE:VAIAS): Exploring Current Valuation and Market Views After Recent Modest Gains

Reviewed by Simply Wall St

Vaisala Oyj (HLSE:VAIAS) has drawn attention lately as investors review its recent performance and consider longer-term trends. Shares have delivered a small gain for the past month, prompting some to take a closer look at what is driving sentiment.

See our latest analysis for Vaisala Oyj.

Vaisala Oyj’s recent 1-month share price return of 3.91% hints at momentum possibly returning, even as its year-to-date movement remains a touch soft. Over the last year, total shareholder returns have edged up, continuing a solid multi-year trend and suggesting investors see stable growth potential.

If you’re curious to see what else could be capturing market attention lately, it is a great moment to broaden your investing scope and discover fast growing stocks with high insider ownership

With shares trading about 12% below estimated intrinsic value and 15% below analyst targets, investors are left to consider whether Vaisala Oyj represents a genuine buying opportunity or if the market is already anticipating future growth.

Most Popular Narrative: 13.7% Undervalued

The narrative’s fair value for Vaisala Oyj implies meaningful upside from the last close, signaling that the market may be overlooking longer-term structural drivers. This sets up an intriguing debate about which financial catalysts truly matter most for the current valuation.

Accelerating global attention and investment in climate change mitigation, and increasing regulatory demands for accurate environmental data, continue to drive structural, long-term demand across Vaisala's core business lines. This suggests underlying market expansion and potential for revenue growth as current cyclical weakness in renewables and the public sector recovers.

Want to know what’s powering the boldest price calls? This narrative stands on aggressive growth in recurring digital revenues, a future margin jump, and a premium profit multiple. Curious what kind of upside those forecasts could mean? See what makes these expectations so bullish and which numbers could flip the story.

Result: Fair Value of €53.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in renewables or prolonged public sector spending cuts could challenge the current growth thesis and put pressure on Vaisala’s earnings outlook.

Find out about the key risks to this Vaisala Oyj narrative.

Another View: What Do Market Multiples Say?

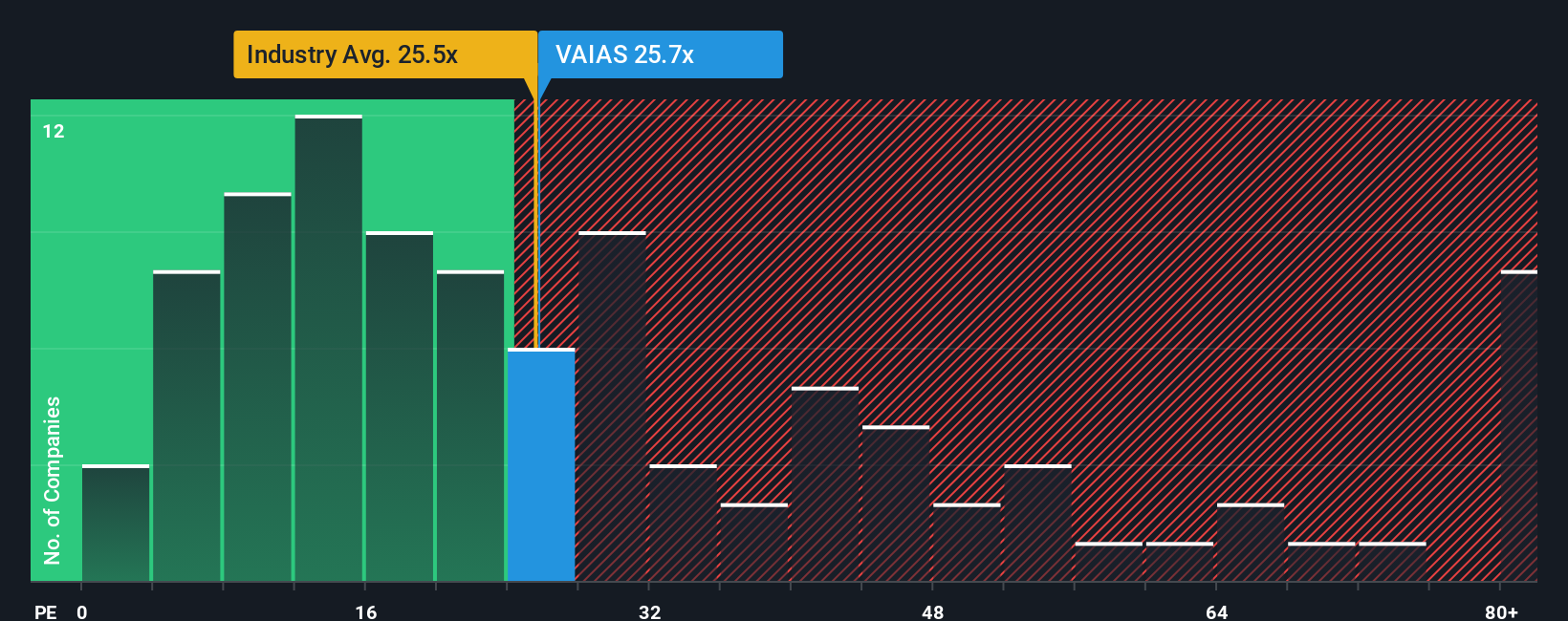

Taking a different approach and looking at price-to-earnings, Vaisala Oyj trades at 26.5x, noticeably above the European Electronic industry average of 25.5x, and the peer average of just 20.9x. The fair ratio, based on market fundamentals, sits even lower at 18.9x. This signals investors are currently paying a premium, raising questions about whether the optimism is justified or if some downside risk remains.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vaisala Oyj Narrative

If you have a different perspective or want to dive into the numbers yourself, you can build a personal view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vaisala Oyj.

Looking for more investment ideas?

Why limit yourself to just one opportunity? Supercharge your investing strategy by tapping into unique sectors and trends with these powerful stock lists. There is always a new angle to grab before everyone else does.

- Spot income opportunities and boost your payout potential by checking out these 17 dividend stocks with yields > 3% that continue to deliver strong yields.

- Ride the wave of artificial intelligence innovations by examining these 27 AI penny stocks shaping tomorrow’s tech and automation landscape.

- Position yourself early in the next technological leap by evaluating these 27 quantum computing stocks changing the game in data, security, and computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VAIAS

Vaisala Oyj

Provides weather, environmental, and industrial measurement solutions and services for weather-related and industrial markets.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives