- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia Oyj (HLSE:NOKIA) Is Up 9.9% After Nvidia’s $1 Billion AI Investment and 5G-6G Partnership Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late October 2025, Nvidia announced a US$1 billion equity investment in Nokia for a 2.9% stake, launching a partnership to integrate Nvidia's AI technology with Nokia’s 5G and 6G network infrastructure and accelerate development of AI-native mobile networks. This collaboration signals a pivotal expansion for both firms, connecting AI and telecommunications to create next-generation wireless services and infrastructure.

- Nokia’s ability to leverage Nvidia’s AI capabilities for advanced network deployments could reshape its positioning in the global telecom and AI network markets.

- We'll explore what Nvidia’s major investment and AI collaboration could mean for Nokia’s growth outlook and evolving industry position.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nokia Oyj Investment Narrative Recap

To be a Nokia shareholder right now, you need to believe the company can translate its deep technological partnerships and investments, such as Nvidia’s US$1 billion equity stake, into meaningful leadership in AI-native networks and next-gen connectivity. While Nvidia’s move immediately addresses Nokia’s underpenetration in key AI and data center markets, execution risk in Mobile Networks and the margin impact from competitive pressures remain front and center for the stock’s short-term catalyst and risk profile.

The recently announced deployment of Ecuador’s first commercial 5G network, powered by Nokia, closely ties to this AI collaboration by reinforcing Nokia’s foothold in emerging digital markets while showcasing its network technology in real-world environments that may benefit from upcoming AI-enabled enhancements.

On the flip side, investors need to watch for the persistent headwinds from Nokia’s Mobile Networks segment, particularly if...

Read the full narrative on Nokia Oyj (it's free!)

Nokia Oyj's narrative projects €21.0 billion in revenue and €1.7 billion in earnings by 2028. This requires 3.0% yearly revenue growth and an earnings increase of €791 million from current earnings of €909.0 million.

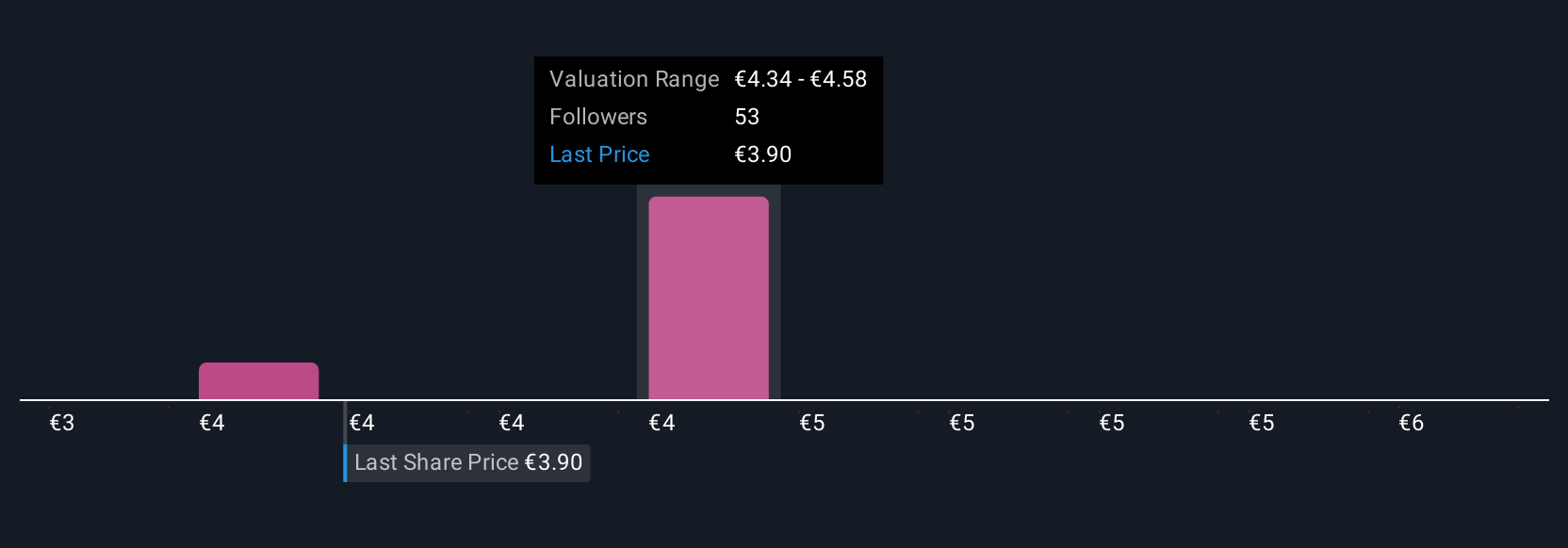

Uncover how Nokia Oyj's forecasts yield a €4.53 fair value, a 23% downside to its current price.

Exploring Other Perspectives

Six recent fair value estimates from the Simply Wall St Community span €1.99 to €5.75 per share, covering a broad spectrum of investor forecasts. As momentum from Nokia’s global partnerships fuels optimism, market participants widely differ on valuation, reflecting the importance of understanding multiple viewpoints before making any investment decision.

Explore 6 other fair value estimates on Nokia Oyj - why the stock might be worth less than half the current price!

Build Your Own Nokia Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nokia Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nokia Oyj's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives